Institutional merchants are being drawn to Bitcoin mining corporations for their synthetic intelligence (AI) doable, nevertheless they’ll raze up reaping surprising advantages from cryptocurrency bull markets.

“If we are genuine about our $200K Bitcoin ticket forecast, merchants will reach for AI and might perchance perchance well raze up taking half within the Bitcoin bull markets, with out asking for it,” a Bernstein file launched Monday states, because it encapsulates a twin alternative that institutional merchants might perchance perchance well no longer grasp anticipated.

This surprising synergy between AI infrastructure and cryptocurrency mining is attracting attention from institutional merchants who gaze past the extinct boundaries of these applied sciences.

Consistent with Bernstein, Bitcoin miners are uniquely positioned on this save attributable to their tall vitality sources and strategic locations.

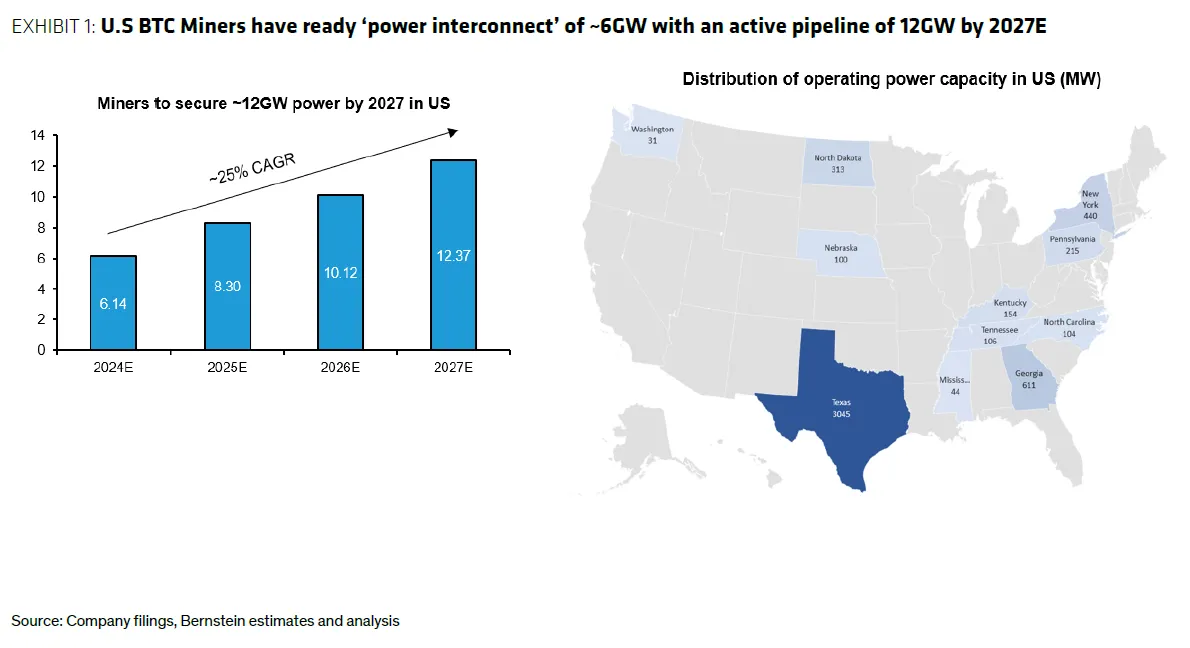

“Together Bitcoin miners grasp entry to 4GW of vitality right now, with operational interconnect going to 6GW by raze of 2024,” the file notes, underlining the diverse infrastructure these corporations grasp at their disposal.

Making a case for the re-ranking of Bitcoin miners, Bernstein analysts write that they’ve an identical vitality portfolios, on the opposite hand, exchange at a cut price to legacy info centers. ~$4mn per MW to ~$30-50mn/MW, on the opposite hand, miners also form a allotment of income per MW – $0.6mn per MW vs. $4.7mn per MW.

“As Bitcoin miners produce on their AI info heart campuses, we imagine this hole in both income and buying and selling multiples will slim,” Bernstein states.

Consistent with Bernstein’s diagnosis, Bitcoin miners grasp a valuable edge when it comes to vitality infrastructure.

These operations at the second grasp entry to 4GW of vitality, with projections suggesting this might perchance perchance well reach 12GW by 2027.

This big vitality capacity, coupled with miners’ skills in working high-density operations at 70-80KW per rack, aligns with the annoying vitality requirements of AI computing.

Unlike extinct info centers, Bitcoin miners grasp strategically built their operations around “stranded vitality” sources, recurrently in unconventional locations where land and vitality are abundant.

This methodology has ended in the pattern of sprawling websites, some spanning a couple of of acres, with vitality capacities ranging from 100MW to 1GW.

As an illustration, TeraWulf’s (WULF) Lake Mariner location in Western Contemporary York boasts a doable 500MW hydropower capacity, total with gargantuan water sources for cooling—a really great ingredient for both cryptocurrency mining and AI operations.

Bernstein extra states that Bitcoin miners’ skills extends past mere entry to vitality and that their profitability hinges on sophisticated vitality rate administration, along side hedging recommendations in wholesale buying and selling markets and collaborative relationships with utilities and grid operators.

This skills might perchance perchance well display priceless in managing the energy-intensive requires of AI computing.

Edited by Stacy Elliott.