European crypto alternate-traded products (ETPs) gain skilled a first-rate influx of investments within the 2d half of 2024, showcasing the rising self assurance in Bitcoin and various digital sources among the many voice’s retail investors.

BeInCrypto spoke with Jellyverse Co-Founder Ben Rauch and Blocksquare CEO Denis Petrovcic to designate whether or no longer this increased expect of for ETPs is right here to remain or if it’s a brief response to favorable market stipulations.

Rising ETP Popularity in Europe

As crypto adoption and recognition proceed to upward thrust globally, ETPs akin to alternate-traded funds (ETFs) and alternate-traded notes (ETNs) gain emerged as major funding autos for European investors seeking publicity to this various asset class.

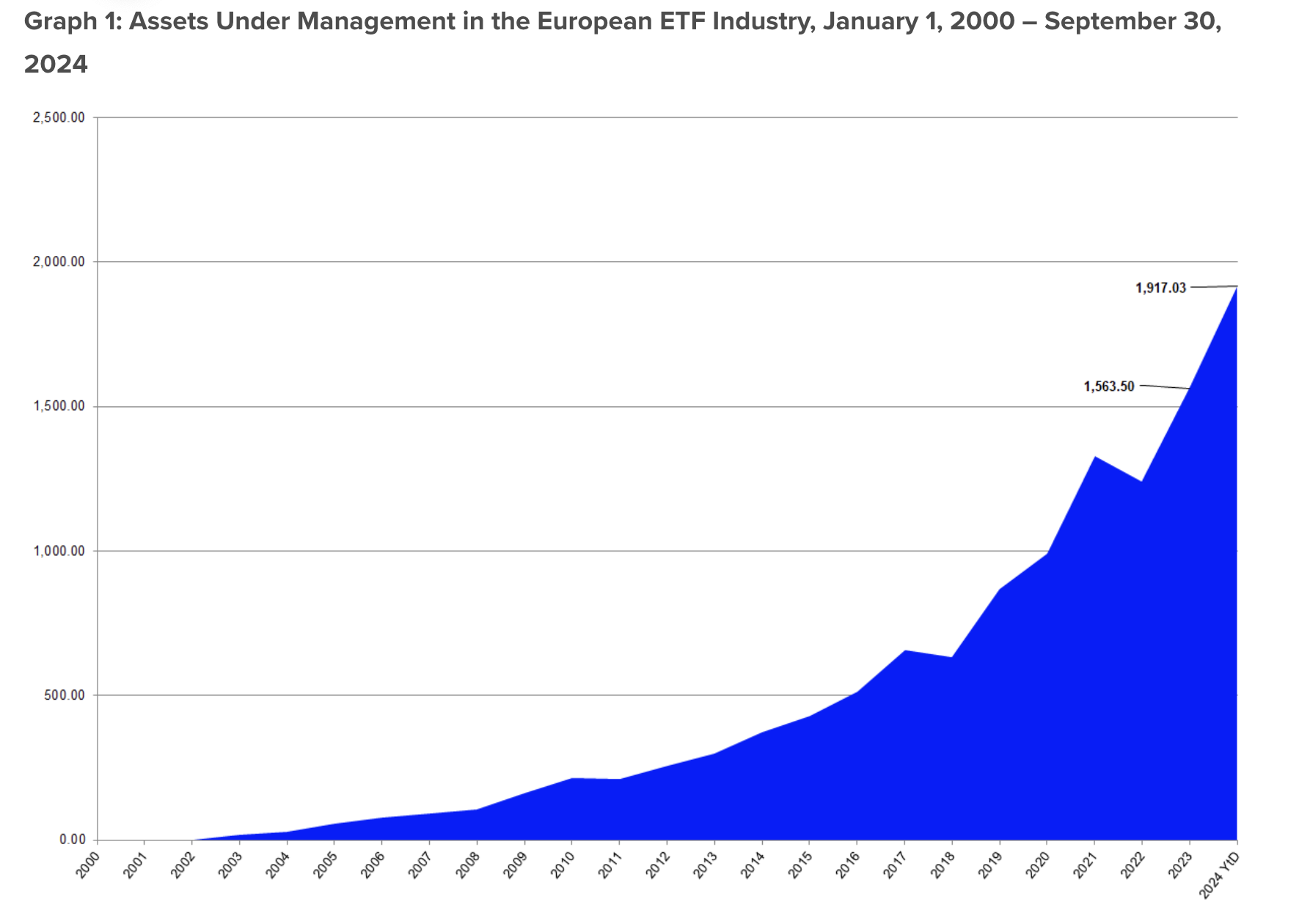

The European ETF alternate, in direct, saw sizable growth in 2024. The alternate skilled an estimated procure inflow recordsdata of €167.2 billion by the terminate of the third quarter, per data from Lipper Alpha. This volume continues to attain unparalleled phases this day.

“Over the last phrase 365 days, investor sentiment has shifted vastly toward mainstream adoption. Bitcoin is no longer any longer considered as a harmful or ‘shady’ funding for simplest criminals or tech enthusiasts. As an different, we glance rising hobby from investors worldwide, and this pattern is in all probability to plod up even extra in 2025,” Rauch told BeInCrypto.

ETPs are publicly traded securities that offer investors a convenient and cost-effective technique to amplify their portfolios. Crypto ETPs entice many investors on memoir of they permit them to interact with crypto sources with out having yell ownership over them.

“Crypto ETPs present a seamless and controlled pathway to invent publicity to digital sources with out the complexities of custody, security, and technical management. They match with out complications inside of passe portfolio structures, offering comfort and compliance for institutional investors,” said Petrovcic.

They moreover bridge the gap between passe and decentralized finance.

ETPs as a Plan of Diversifying Investor Portfolios

Weak investors relish in thoughts Bitcoin ETPs an entry level to the broader digital asset market.

“They are with out complications accessible to institutional investors, and some institutions are already expressing hobby in allocating a fraction of their treasury to crypto,” added Rauch.

Excessive-profile corporations esteem Microstrategy, Marathon Digital, Tesla, and Block already defend Bitcoin of their treasuries.

MicroStrategy, to illustrate, for the time being owns over 2% of Bitcoin’s present, the utilize of debt and equity to amass 423,650 BTC value $41.5 billion. By making the cryptocurrency the first reserve asset in its treasury, MicroStrategy has cemented Bitcoin’s voice in corporate finance.

Moreover, this aggressive Bitcoin accumulation blueprint has paid off financially for the firm. Within the previous yr, MSTR’s stock impress has surged over 480%. The stock used to be moreover added to the well-known Nasdaq-100 index in December. As a consequence, several various crypto corporations gain been attempting to be aware in MicroStrategy’s footsteps.

On December 13, Revolt Platforms, a number one Bitcoin mining and digital infrastructure firm, acquired 5,117 BTC for $510 million, increasing its total holdings to 16,728 BTC.

Finest two days sooner than, Marathon Digital Holdings spent $1.1 billion to procure 11,774 Bitcoin. It now holds 40,435 Bitcoin, valued at $3.9 billion.

Blockstream, a number one firm in blockchain know-how, has moreover been often accumulating Bitcoin and runs a Bitcoin treasury.

Publicity to Cryptocurrencies Previous Bitcoin

Interactions with Bitcoin ETPs inevitably introduce investors to various forms of cryptocurrencies.

“ETP services are increasing their offerings to comprise multi-asset products, integrating trusty-world sources alongside cryptocurrencies. Improvements in custodial technologies and staking mechanisms are moreover making these products extra attention-grabbing and receive,” said Petrovcic.

According to Rauch, various crypto sources aside from Bitcoin will shortly drive ETP adoption in Europe.

“Though Bitcoin stays the first driver, I expect of various crypto initiatives to relieve vastly as properly—especially these identified by governments or major alternate gamers for their tidy contract capabilities. If these initiatives are chosen for super-scale adoption, they could presumably look good growth,” he said.

Industry gamers pay extra consideration to various tokenized sources thru this generalized publicity.

“Bitcoin’s 2024 rally has clearly sparked renewed hobby in crypto-connected funding autos. Institutional portfolios are an increasing selection of integrating tokenized sources alongside cryptocurrencies, motivated by the need for diversification and the effectivity equipped by tokenization. True-world sources esteem tokenized trusty property are changing into key complementary choices, attention-grabbing to those seeking each growth and steadiness of their investments,” Petrovcic told BeInCrypto.

Petrovcic believes these tokenized sources are the trusty drivers within the encourage of ETP growth across Europe.

“The surge in European crypto ETP inflows highlights rising self assurance in digital sources and the infrastructure supporting them. For my portion, I gain it displays a broader pattern of investors recognizing the value of tokenization, no longer factual for cryptocurrencies but moreover for tangible RWA sources, as portion of a diversified funding blueprint,” he added.

The rising hobby in tokenized sources in European crypto ETP inflows displays a broader shift in opposition to diversified funding systems.

Europe’s Unified Technique to Crypto Rules

Relating to regulatory readability, ETPs gain considered extra success in Europe than various areas.

Europe emerged as a pacesetter within the crypto ETP market, beginning with the open of the sphere’s first Bitcoin ETP by XBT Provider on Nasdaq Stockholm in 2015. This early entry emphasized the need for transparency and compliance, paving the system for a regulated bridge between passe finance and the crypto market.

Listing crypto ETPs on major European exchanges esteem Deutsche Börse Xetra, SIX Swiss Alternate, and Euronext offers investors with receive and streamlined entry to the cryptocurrency market, increasing trust and facilitating broader adoption.

On December 30, the European Union authorised the Markets in Crypto-Sources (MiCA) regulation, establishing uniform requirements across EU member states. This standardized methodology enhanced user security by ensuring that all crypto asset issuers and restore services adhere to the the same guidelines and regulations.

The MiCA approval as a consequence affords extra regulatory easy assignment for ETP issuers and investors.

“Europe has made principal strides in clarifying regulations for crypto-sources, offering a much bigger degree of easy assignment for ETP issuers and investors. By applying these guidelines at some level of the EU, MiCA creates a extra predictable atmosphere for every issuers and investors,” said Rauch.

As a consequence, Europe represents a key market for crypto ETFs, with a total asset size of $3.67 billion and representing 8.8% of the worldwide crypto ETF market, per CoinGecko compare.

Since MiCA’s implementation, several crypto corporations gain moreover began to receive working licenses across Europe.

Balancing Rules With Innovation

Though the European crypto community well-known the approval of the MiCA framework, wariness exists over the dangers with excessive investor security.

Whereas the focus on transparency and investor security is vital for the prolonged-term growth and sustainability of the crypto ETP market, it will maybe presumably moreover gain unintended consequences, doubtlessly slowing down the tempo of innovation inside of this sector, per Rauch.

Placing a steadiness between regulatory thoroughness and innovation needs to be on the center of ETP-connected laws.

“There’s repeatedly a risk that excessive regulation could presumably moreover stifle innovation. Legislatures must stroll a blinding line between retaining investors and retaining the alternate competitive—especially one which’s identified for relocating if stipulations change into outrageous. I gain that establishing major requirements and guidelines for custody, risk disclosure, and business operations ought to quiet suffice on the beginning, permitting companies to thrive with out too many barriers. Since crypto is a world market powered by extremely skilled people, making it overly burdensome will merely drive them to various jurisdictions,” Rauch said.

To take care of far from a bid where the steadiness is tipped, regulators and alternate gamers need streamlined dialog between each various.

“I gain that a collaborative methodology between regulators and the alternate can strike the lovely steadiness. Regulators ought to quiet focal level on fostering transparency and promoting training, alongside decided guidelines for issuers. This methodology would compose certain innovation in ETPs continues whereas safeguarding retail investors from pointless risks,” added Petrovcic.

Finding the lovely equilibrium will be principal for the ongoing growth of the European crypto ETP market.

ETPs and Associated Dangers

Despite Europe’s proactive methodology to crypto regulations to safeguard investor pursuits, the crypto market’s inherent volatility exposes ETP investors to cost instability.

“Since crypto ETPs are extremely risky sources, they aren’t upright for every investor and customarily require an adjustment length to tackle piquant impress swings. This volatility can lead to impulsive funding choices and doubtlessly super losses. Though the regulatory framework is rather sturdy, quiet market entrants ought to quiet quiet fail or compose melancholy choices, inserting customer funds at risk,” Rauch told BeInCrypto.

To that, Petrovcic added:

“Misunderstanding the persona of these products can lead to overexposure, especially at some level of market downturns.”

He moreover argues that certain risk management practices ought to quiet be implemented to mitigate the adversarial affect of market instability and ensure the soundness of ETPs at some level of classes of volatility.

“Guaranteeing liquidity and effective risk management systems at some level of classes of volatility is serious to declaring investor self assurance in these products. Stability measures most frequently comprise important custodial choices, clear pricing mechanisms, and regulatory oversight. This methodology would compose certain innovation in ETPs continues whereas safeguarding retail investors from pointless risks,” he said.

Assuaging these risks will extra drive investor self assurance and a broader ETP adoption.

How the US Would maybe well Form Europe’s ETP Market

Now that many market people expect of the incoming Trump administration to compose a extra crypto-pleasant atmosphere within the US, this will in all probability moreover encourage Europe to take care of its voice as a number one participant in ETPs.

“Historically, Europe has moved extra slowly when embracing quiet innovations. If the US implements supportive crypto policies, we could presumably moreover look a first-rate shift in market focal level to the US, particularly for products esteem ETPs and ETFs, which gain already played a key feature in changing overall investor sentiment,” Rauch said.

Within the previous few years, the US has struggled to manufacture a decided regulatory framework for the cryptocurrency alternate.

In January 2024, the SEC authorised 11 voice Bitcoin ETFs for the first time within the US. Four months later, the SEC moreover greenlit voice Ethereum ETFs.

On the opposite hand, the approval came after several years of fight sooner than the SEC identified the two cryptocurrencies as non-securities. Now, inside of a yr, several various crypto-based mostly ETFs, akin to XRP and Solana, are pending approval from the regulator.

If the SEC below Trump-appointed Chair Paul Atkins proves to be extra proactive, this will in all probability moreover moreover incentivize Europe to ascertain its regulatory methodology to ETPs.

“Skilled-crypto policies within the US could presumably moreover intensify competition, prompting Europe to refine its regulatory framework to take care of leadership. This could relieve the worldwide market for tokenized sources, including cryptocurrencies and trusty-world sources, utilizing innovation and adoption on each aspects of the Atlantic,” said Petrovcic.

As ETPs invent momentum, striking the lovely steadiness between innovation and investor security will change into a pressing effort for international locations and institutions.