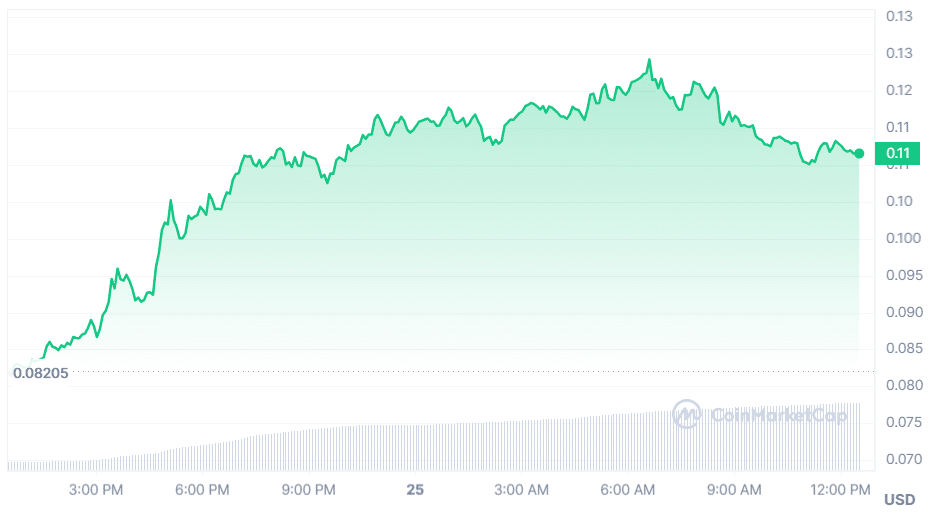

IDEX, the native token of the hybrid decentralized trade (DEX) and market-making protocol of the same name, has elevated 33% over the last 24 hours as it files a surge in investor curiosity.

The crypto asset, on the total leveraged for gasoline charges and liquidity provision on the Idex trade, had witnessed a in general bearish model over the last two weeks, losing 30% from $0.0920 on March 13 to a low of $0.0642 on March 20 as the broader market fell.

On the opposite hand, this observe walk straight away preceded a restoration push that has now considered the token reclaim a 10-month-excessive. IDEX observed the begin of its factual fortunes over the weekend, spiking to a excessive of $0.0904 on March 23 sooner than retracing on the again of stern resistance.

It’s good to well possibly additionally like: Top cryptocurrencies to gaze this week: DOGE, MATIC, XEC

The asset’s bullish momentum extended to the next day to come, allowing it to surge to $0.1191 on March 23, as it breached the $0.1 psychological observe threshold for the first time since May possibly 2023. IDEX closed March 23 with a courageous Forty eight.24% get, marking its biggest intraday get in 23 months.

Despite a subsequent 4.Forty eight% decline this morning, the asset has retained quite a lot of the gains recorded over the weekend. Market files signifies IDEX is up 33% within the closing 24 hours, making it one in every of the discontinue-performing crypto resources inner this length.

Particularly, principal aspects are scant on the that it is most likely you’ll well possibly possibly deem field off of the present surge, however files suggests it will honest stem from rising search files from following a upward thrust in curiosity. IDEX’s volume has spiked 636% to $171.9 million over the last 24 hours, with Binance commanding 66% of the international volume.

Google Trends files also signifies that searches for IDEX contain skyrocketed since March 23, with curiosity over time rising from 23 to 92 as of 14:00 UTC on March 24. Interest has dropped since then, however stays reasonably greater as compared to the seven-day average.

Very much, IDEX’s derivatives volume has also elevated by 1,364% within the closing 24 hours to $784.fifty three million on the reporting time, with Open Interest (OI) rising 508% to $35.67 million, primarily based solely on Coinglass files. The asset currently trades for $0.1111, having a search files from to again above the $0.11 territory no matter the existing bearish motion.

Read more: Avalanche Foundation launches Memecoin Speed, injecting $1m into ecosystem