Hyperliquid’s HYPE token pushed past Stellar’s XLM in market cap, then drew new attention after a TradingView chart showed a titillating rebound off $20.50. This capability that, the level of curiosity shifted as to whether HYPE can withhold the reclaimed vary pork up after the instant recovery.

Hyperliquid tops Stellar by market cap as HYPE trades end to $22

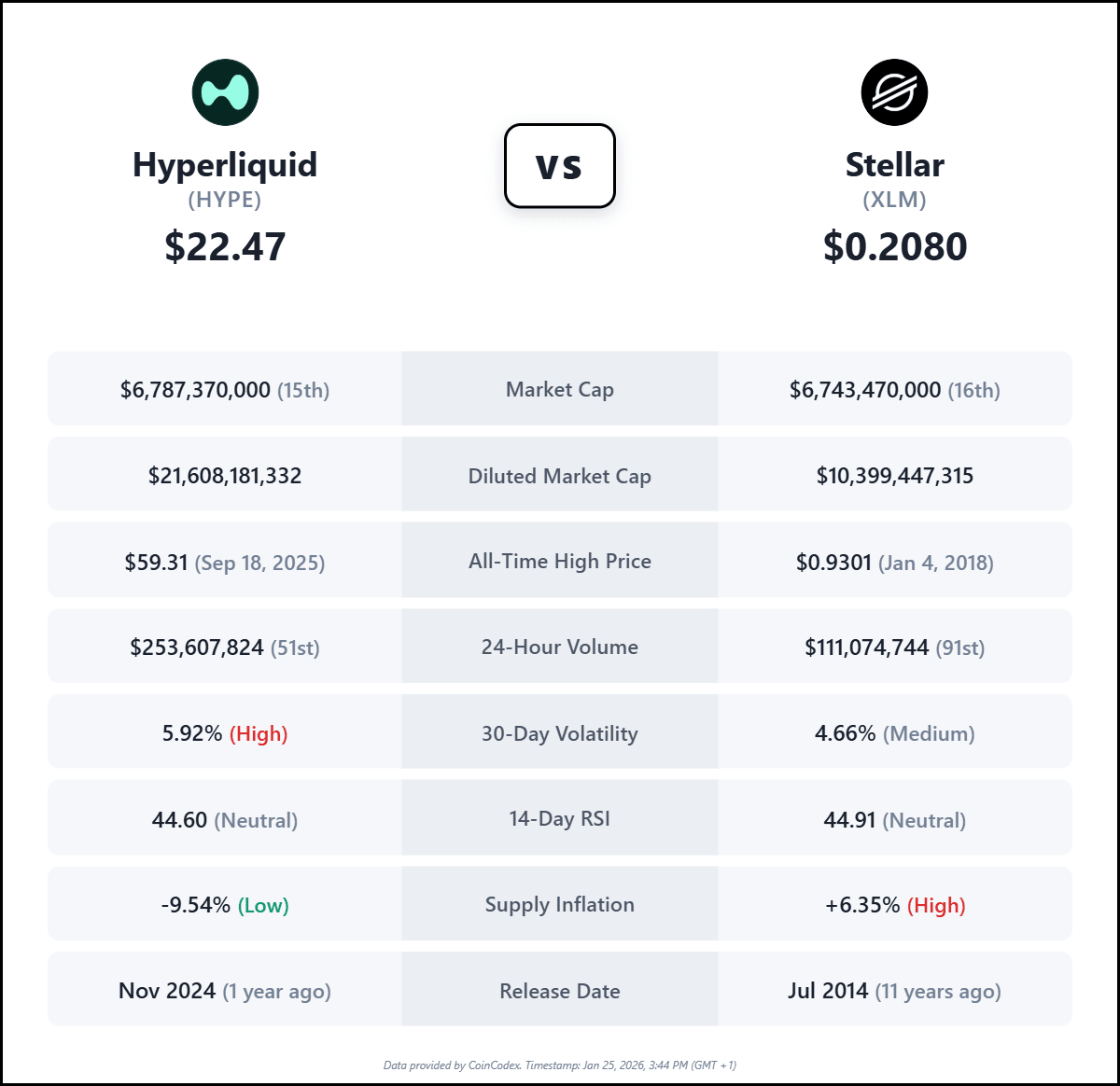

Hyperliquid’s HYPE token pushed its market capitalization to about $6.9 billion, transferring it ahead of Stellar’s roughly $6.78 billion on CoinCodex’s rankings.

After the market cap crossover, HYPE traded spherical $22.5 and posted about $125 million in 24 hour procuring and selling volume. The token’s circulating supply stood end to 302.07 million, whereas complete and max supply had been each listed at 961.67 million, leaving the fully diluted valuation end to $21.8 billion.

Asset Card Comparison: Hyperliquid vs Stellar. Offer: CoinCodex

Within the meantime, Stellar traded end to $0.208 with a 24 hour volume spherical $79.8 million, conserving its valuation end in the help of no topic the ranking poke. CoinCodex listed Stellar’s circulating supply at about 32.42 billion XLM, with a max supply end to 50.0 billion.

Hyperliquid chart post flags vary reclaim after $20.50 low

Hyperliquid’s HYPE token drew new technical attention after an X person, OliverSuccess_, shared a TradingView chart exhibiting tag rebounding help above a prior pork up band. The chart reveals HYPEUSDT end to $23.30 after a selloff that put a visual low at $20.50, then flipped into a instant recovery.

HYPEUSDT Perpetual Differ Reclaim Chart. Offer: OliverSuccess on X

The chart frames the pass as a return into a outlined consolidation zone. It marks a vary low through the low $22 put and a vary high end to the upper $28 put, with tag spending weeks chopping interior that box earlier than the breakdown and snapback. After the rebound, the chart’s drawn course suggests a pullback in direction of the vary low could presumably act as the next resolution level earlier than any strive in direction of the pause of the vary.

OliverSuccess_ labeled the downswing as a 3 day bullish divergence, implying momentum weakened whereas tag printed a decrease low. In his behold, that divergence blended with the reclaim strengthens the case that sellers lost administration end to the lows, even supposing the chart composed reveals uneven candles within the vary.