- Hyperliquid resumes gains after three days of losses, concentrated on $40.00 after rebounding from $35.00 toughen.

- HYPE’s DeFi TVL reached a median of $1.77 billion on Friday, marking an 80% amplify over the past three months.

- Hyperliquid is on the verge of a technical breakout, concentrated on 24% amplify to its all-time high.

Hyperliquid (HYPE) breaks a poke of three consecutive days of losses on Friday, up nearly 3% to change at around $36.82 on the time of writing. The high-performance Layer-1 blockchain token is attempting a style reversal, following a 23% decline from its all-time high of $Forty five.71 reached on June 16. Lend a hand tested at $35.34 has paved the manner for the hot push in direction of the excessive resistance at $40.00 and, doubtlessly, the all-time high.

Hyperliquid DeFi TVL increase signals investor self belief

Hobby in Hyperliquid has gradually elevated over the past three months, buoyed by the HYPE’s mark rally to all-time highs. Per DeFiLlama, the Decentralized Finance (DeFi) Total Worth Locked (TVL), which represents the entire worth of all money held in shipshape contracts linked to protocols on the chain, stood at around $1.77 billion on Friday.

The uptrend over the past three months, since April 1, has led to an 80% amplify within the TVL from roughly $353 million. This means that user self belief and trust within the token and the ecosystem are growing, evidenced by the surge in deposits and staking.

Hyperliquid DeFi TVL files | Supply: DeFiLlama

A elevated TVL resolve reflects ample liquidity within the protocol’s DeFi platforms, encompassing lending, borrowing, and shopping and selling. In total, Hyperliquid boasts a particular sentiment backed by token holders and platform adoption.

At the equivalent time, a elevated TVL quantity predisposes HYPE to rate increases amid lowered sell-aspect strain because customers lock their holdings in shipshape contracts.

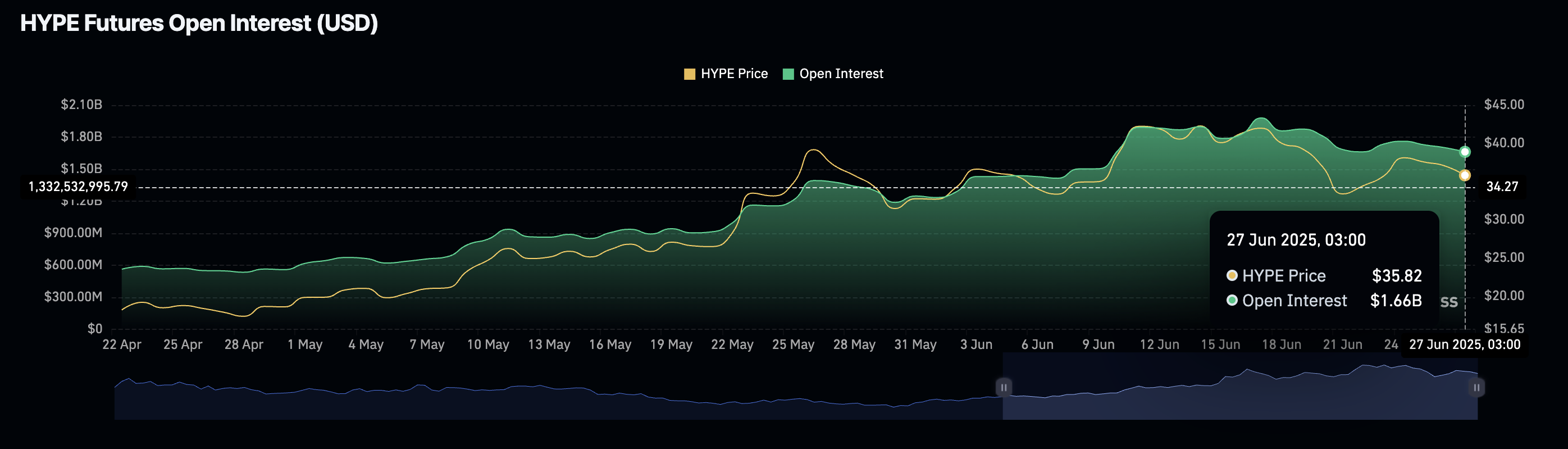

Nonetheless, patrons would possibly deserve to temper their expectations based on the downward style in HYPE futures contracts’ Commence Hobby (OI). CoinGlass files shows that OI averaged $1.66 billion on Friday after peaking at around $1.98 billion on June 17.

Commence Hobby refers back to the US Buck (USD) of all futures and alternatives contracts which luxuriate in but to be settled or closed. A persistent decline signifies that traders are dropping curiosity in HYPE and can no longer be going to be making a guess on mark increases within the brief term.

Hyperliquid Commence Hobby files | Supply: CoinGlass

If quantity drops in tandem, shopping and selling activity will stupid down, presumably limiting bullish momentum and leaving Hyperliquid weak to a decline.

Technical outlook: Hyperliquid makes an try restoration, but bearish signals persist

Hyperliquid’s mark is printing a inexperienced candle on Friday after securing technical toughen at around $35.34. A breakout in direction of the $40.00 key hurdle will likely apply if bulls upward push above a confluence resistance at around $37.14, where the 100-length Exponential Transferring Average (EMA) and the 50-length EMA converge with the upper boundary of the descending channel on the 4-hour chart.

The Relative Energy Index (RSI) hovers a little bit above the midline, indicating fine bullish momentum. Traders must mute video display the marketplace for persevered circulation in direction of overbought territory to assess the strength of the uptrend.

HYPE/USD 4-hour chart

Aloof, the Transferring Average Convergence Divergence (MACD) indicator sustains a sell model that became once flashed on Thursday, which would possibly dilute bullish momentum.