If the US formally joins the Israel–Iran battle, Bitcoin and the broader crypto market could per chance well scrutinize curious brief-time length losses.

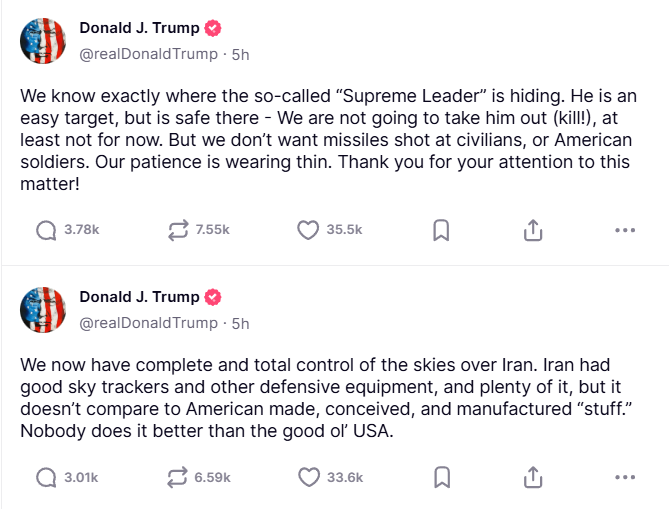

Per President Trump’s contemporary posts and geopolitical rumors, the US could per chance well impact a chance to enter this battle. Market analysts question anxiousness-off sentiment to dominate world assets, pulling liquidity a long way flung from volatile sectors love cryptocurrencies.

Bitcoin Faces Quick Downside if US Enters the Battle

Bitcoin, within the meanwhile buying and selling shut to $104,500, could per chance well drop 10–20% in a matter of days, based fully on patterns from outdated geopolitical shocks.

Within the early stages of spacious-scale conflicts, consumers in total cruise to aged safe havens—comparable to US Treasuries, the dollar, and gold.

Crypto, no matter some claims of being a hedge, has consistently behaved love a high-anxiousness asset all the diagram thru such episodes.

As an instance, all the diagram thru the Russia–Ukraine battle in 2022, Bitcoin dropped over 12% within every week of the initial invasion. It later recovered partly however tracked equity markets closely at some level of the escalation.

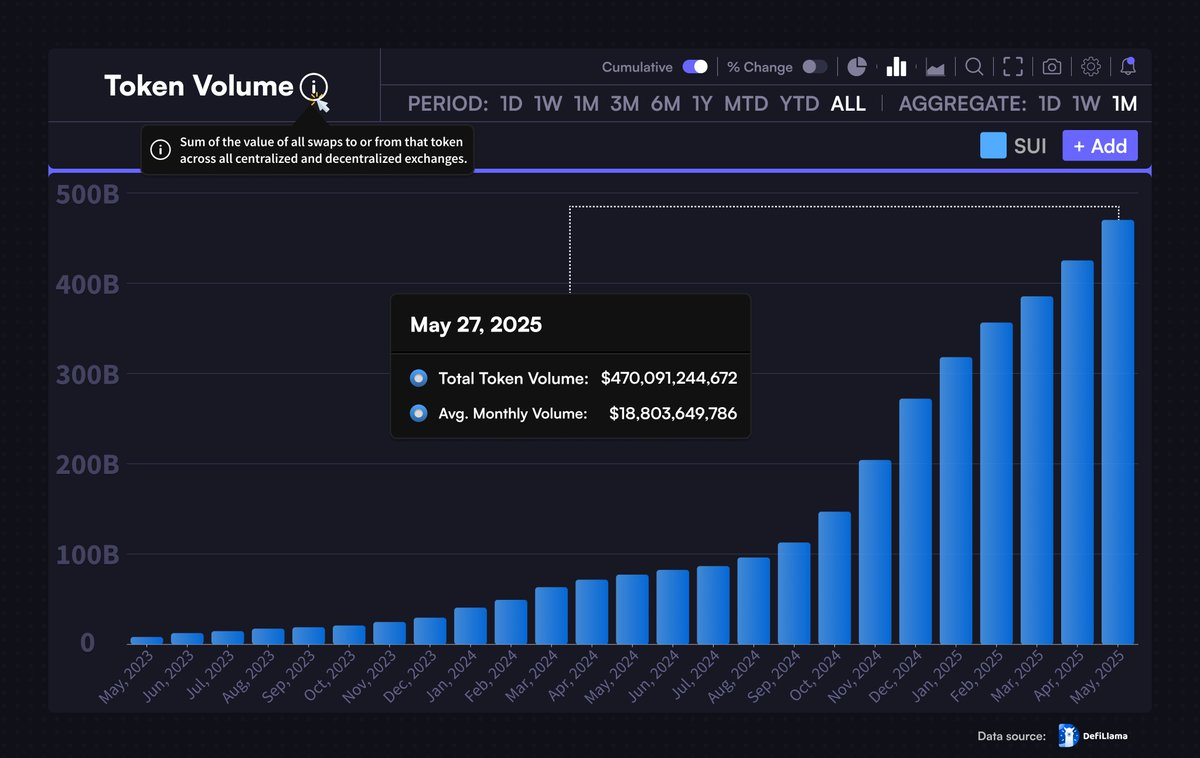

On-chain activity usually displays this anxiousness aversion. Leverage tends to tumble, exchange inflows rise, and buying and selling volumes drop all the diagram thru lessons of geopolitical stress.

These metrics signal investor flight and de-risking.

Macro Catalysts Will Compound Crypto Market Volatility

If US navy action in Iran results in a mighty broader regional battle, it’ll also moreover spike oil costs and inflation expectations. That can stress the Federal Reserve to extend rate cuts or even take be aware of tightening again.

Higher vitality costs could per chance well drive consumer inflation encourage above the Fed’s 2% target, especially with WTI rude already showing sensitivity to headlines from the Middle East.

War-pushed offer shocks would likely disrupt shipping and impact larger enter charges globally.

In that scenario, the Fed would face a elaborate exchange-off between financial stability and inflation adjust. A prolonged hawkish stance would drive up actual yields and suppress crypto valuations.

US Treasury yields, already shut to 4.4% on the 10-twelve months repeat, could per chance well rise additional if battle spending expands fiscal deficits. The US national debt has surpassed $36 trillion, elevating long-time length debt service dangers.

Within the meantime, the US Greenback Index (DXY), now hovering spherical 98.3, could per chance well give a boost to additional as world consumers watch dollar-denominated security.

A rising dollar has historically been bearish for Bitcoin and altcoins, specifically in rising markets where capital outflows put together dollar surges.

Crypto markets also are at chance of suffer when aged equity volatility spikes.

The VIX, a benchmark apprehension gauge, usually climbs all the diagram thru battle or disaster lessons—additional tightening anxiousness budgets and triggering margin calls across crypto exchanges.

Longer-Period of time Direction Depends upon on War Length and Fed Response

If the US intervention is transient and results in a mercurial ceasefire, markets could per chance well rebound. Bitcoin has historically recovered within 4–6 weeks after the initial shock, as considered in previous battle-linked downturns.

Then again, if the battle drags on or expands locally, crypto could per chance well face an extended length of volatility, declining liquidity, and suppressed costs.

Investor flee for food for speculative assets would likely dwell low till geopolitical clarity returns.

That said, chronic inflation from battle-linked disruptions could per chance well revive the narrative of Bitcoin as an extended-time length hedge in opposition to fiat debasement.

Nonetheless this bullish case competes straight with tighter financial policy, which limits upside in anxiousness-on assets.

Institutional inflows could per chance well end or decline under such prerequisites. CME futures positioning, stablecoin offer, and L2 on-chain flows could per chance be crucial indicators of sentiment shift within the weeks forward.

Key levels to visual display unit contain Bitcoin’s $100,000 psychological toughen and Ethereum’s $2,000 zone.

If damaged, technical selling could per chance well trip downward stress across all foremost tokens.

What to Stare Now

Patrons could per chance well soundless closely track:

- Oil ticket actions and forward contracts.

- Fed statements on inflation and rate policy.

- Treasury public sale results and bond yield spreads.

- Alternate outflows and leverage utilization in crypto.

- VIX and world anxiousness indicators.

If the US joins the battle, Bitcoin’s brief-time length future is usually dictated by macro prerequisites—no longer crypto fundamentals.

Traders could per chance well soundless put together for volatility, set apart hedged, and visual display unit geopolitical trends in actual time.