The crypto market is exhibiting signs of development, with the overall market cap no longer too long in the past surpassing $3 trillion. This recovery suggests increasing self perception amongst investors.

Alternatively, the grim truth is that perfect as many tokens listed this year like additionally died because of an absence of sustainable issue systems.

Mission Capitalists To The Blame?

The Mission Capitalists are in actuality killing the crypto place as they opt to fund new and rising crypto merchandise perfect for the sake of making profits off of them. While this will also no longer seem staunch now flawed, it impacts the commerce’s long-timeframe viability. David Phelps of JokerRace explained how VCs operate in crypto:

“Most frequently, VC money comes from the tip for a couple of years whereas companies work to salvage it from the bottom long timeframe… but in crypto, that hasn’t came about. Corporations like taken money from the tip, conventional it to mint a token at VC-level valuations, then worked to bolster token rate—with their very dangle tokens (sic),” Phelps tweeted.

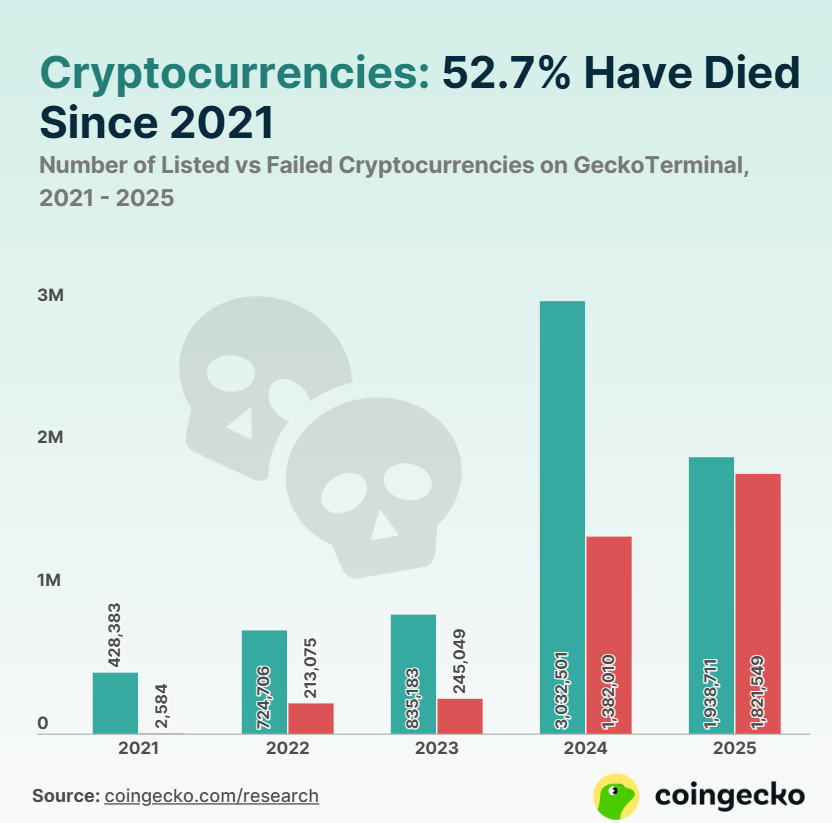

Alternatively, with market circumstances worsening, VCs began pulling support, and crypto projects are feeling the repercussions. A latest Coingecko be taught report published that over 1.82 million cryptocurrencies failed in 2025 on my own, whereas roughly 1.93 million had been efficiently listed. This marks a important elevate from 2024, when simplest 1.38 million tokens failed, and it’s alarming on condition that 2025 is simplest midway through.

The rising series of screw ups highlights a shift in vision all the scheme throughout the commerce. What began as a financial revolution has morphed into of enterprise for lickety-split profits. This shift has compromised the true cause of cryptocurrency.

In an interview with BeInCrypto, Hank Huang, CEO at Kronos Analysis, mentioned how crypto projects can differentiate themselves from scams and steal a stronger stand:

“Starting with a smaller market cap captures investors’ attention, exhibiting that rate and market cap aren’t artificially inflated. By focusing on achievable yet thrilling milestones, constructing strategic partnerships, and providing a clear roadmap, self perception is built. With the DAO model in place, the community is empowered to invent key decisions, whether it’s picking between product pattern or deciding which utility use case to prioritize. This model fosters right engagement and additionally reveals that we’re constructing together, constructing long-timeframe cost through collective input and collaboration,” Huang mentioned.

Finding A Potential Through

One of the foremost causes for token and mission screw ups is an absence of focal point on income. Many VC-driven projects operate on free money, providing free services till the funds creep out. This creates an environment where investors are hesitant to pay for similar services, even though the decisions are more sustainable.

The attach a question to arises: How can crypto companies pivot to assemble commerce items grounded in right cost and particular person-driven income as a replacement of relying on token rate manipulation and VC-driven hype? Per Huang, the acknowledge lies with the companies themselves:

“Crypto projects ought to originate with a smaller, more manageable market cap, avoiding the inflated valuations driven by non permanent hype. The focus must shift from token rate incentives to right income items, through expenses, services, or particular person-driven issue. With a clear, likely roadmap, projects can manufacture slowly but for the long timeframe, avoiding over-promising and below-turning in, and as a replacement, constructing sustainable cost for years, no longer months,” Huang suggested BeInCrypto.

Merely attach, it is a important time for the crypto market to realign with its fashioned cause: constructing financial independence. This shift is important to forestall the crypto market from collapsing into a plump-blown disaster.