Few years in contemporary memory admire been as just appropriate for Bitcoin (BTC) as 2024. The enviornment’s premier cryptocurrency no longer handiest saw the approval of the main-ever U.S. situation BTC replace-traded funds (ETFs) however has moreover been surging within the crypto market.

In actual fact, Bitcoin mark rose 40.11% one year-to-date (YTD) from roughly $44,000 to its press time mark of $61,937.

Restful, one Bitcoin-linked stock has managed to outperform the field’s predominant cryptocurrency with its yearly bellow – Michael Saylor’s MicroStrategy (NASDAQ: MSTR) – despite current fears that the approval of BTC ETFs would dampen its correlation with the coin.

Now, with a Bitcoin surge to $100,000 acting very likely on the eve of the extremely-anticipated halving tournament – an tournament that historically ended in BTC worth rising tenfold, and usually even a hundredfold – Finbold determined to test out and figure out how excessive MSTR could well high-tail underneath such situations.

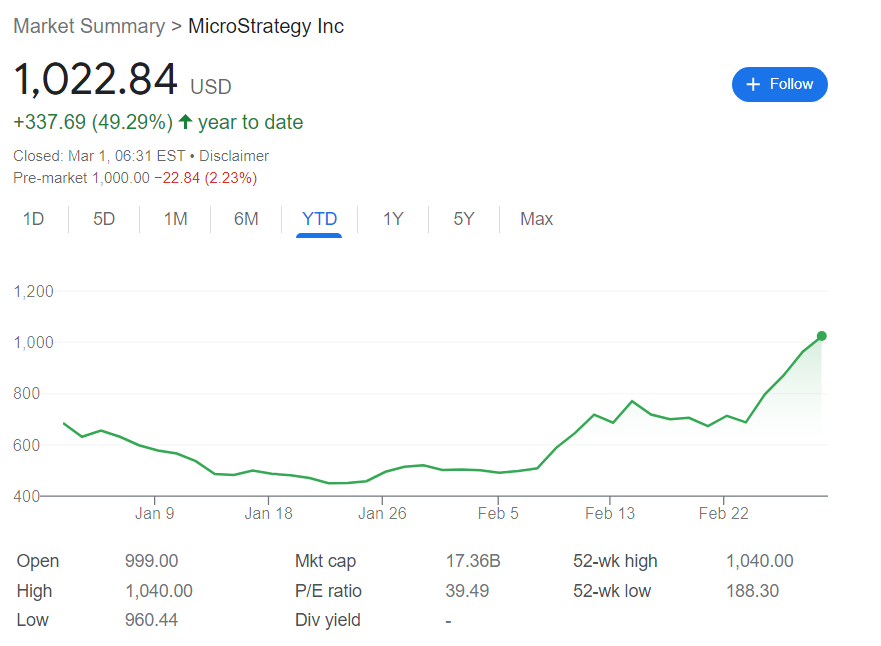

MSTR stock mark chart

To estimate how excessive MicroStrategy could well high-tail ought to Bitcoin proceed surging, we first admire to perceive how well-known it has already risen when compared to the cryptocurrency.

Perchance surprisingly – severely provided that MSTR shares plunged 20% within the main forty eight hours after the ETF approvals – Michael Saylor’s company for trudge outperformed Bitcoin in 2024.

In the same time physique that saw BTC upward push 40.11%, MicroStrategy surged 49.29% – from roughly $685 at the open of the one year to $1,022.84 at the stock market’s conclude on February 29.

In keeping with this, we know that in 2024, MSTR shares rose roughly 1.23% for every 1% expand in Bitcoin worth.

How well-known could well MSTR stock surge if BTC reaches $100,000?

To attain $100,000, Bitcoin would admire to expand in mark by yet one more 61.58% and climb besides-known as $38.063.

While this kind of surge could seem implausibly astronomical initially gaze, it is worth remembering that, within the final 5 days on my own, BTC rose besides-known as $10,000. This implies that the coin would need no longer up to 4 more such bull runs – or 19 additional days at the original average mountain climbing price – to attain the aim mark.

Given MicroStrategy’s little outpacing of Bitcoin – and assuming the ratio stays stage within the foreseeable future – MSTR stock is vulnerable to upward push 75.67% by the point BTC mark reaches $100,000 – and receive itself closer than ever to its aged all-time highs above $3,000 at roughly $1,796.82.

Purchase shares now with eToro – trusted and developed investment platform

Disclaimer: The protest material on this scheme ought to no longer be thought of investment recommendation. Investing is speculative. When investing, your capital is in chance.