Chainlink (LINK) has quietly remodeled from a DeFi oracle provider into one in every of basically the most critical pieces of infrastructure within the blockchain economic system. With the commence of the Chainlink Reserve and the growth of Price Abstraction, LINK now has a constructed-in ask engine fueled by conducting adoption and onchain provider usage. At the identical time, its label action is heating up, with LINK breaking above $20 and pushing toward the predominant $25 resistance. The worthy ask now would perchance perhaps presumably be whether or now not these fundamentals and technical signals can lift LINK to the next milestone at $30.

Why the Chainlink Reserve Matters?

The Chainlink Reserve is designed to funnel both onchain and offchain income straight into LINK, supporting long-term say. Right here is made that chances are you’ll perhaps presumably imagine by Price Abstraction, a machine that allows enterprises and customers to pay in their hottest tokens or stablecoins, which would perchance perhaps presumably neatly be then automatically converted to LINK. With offchain conducting income now flowing into the Reserve, Chainlink has successfully constructed a ask engine that continuously absorbs LINK present.

This give a boost to positions Chainlink another way from varied networks that depend simplest on transaction charges. By tying conducting adoption and tokenization infrastructure straight to LINK accumulation, the Reserve acts as both a stabilizer and a say driver for the token.

Chainlink Imprint Prediction: LINK Imprint Action

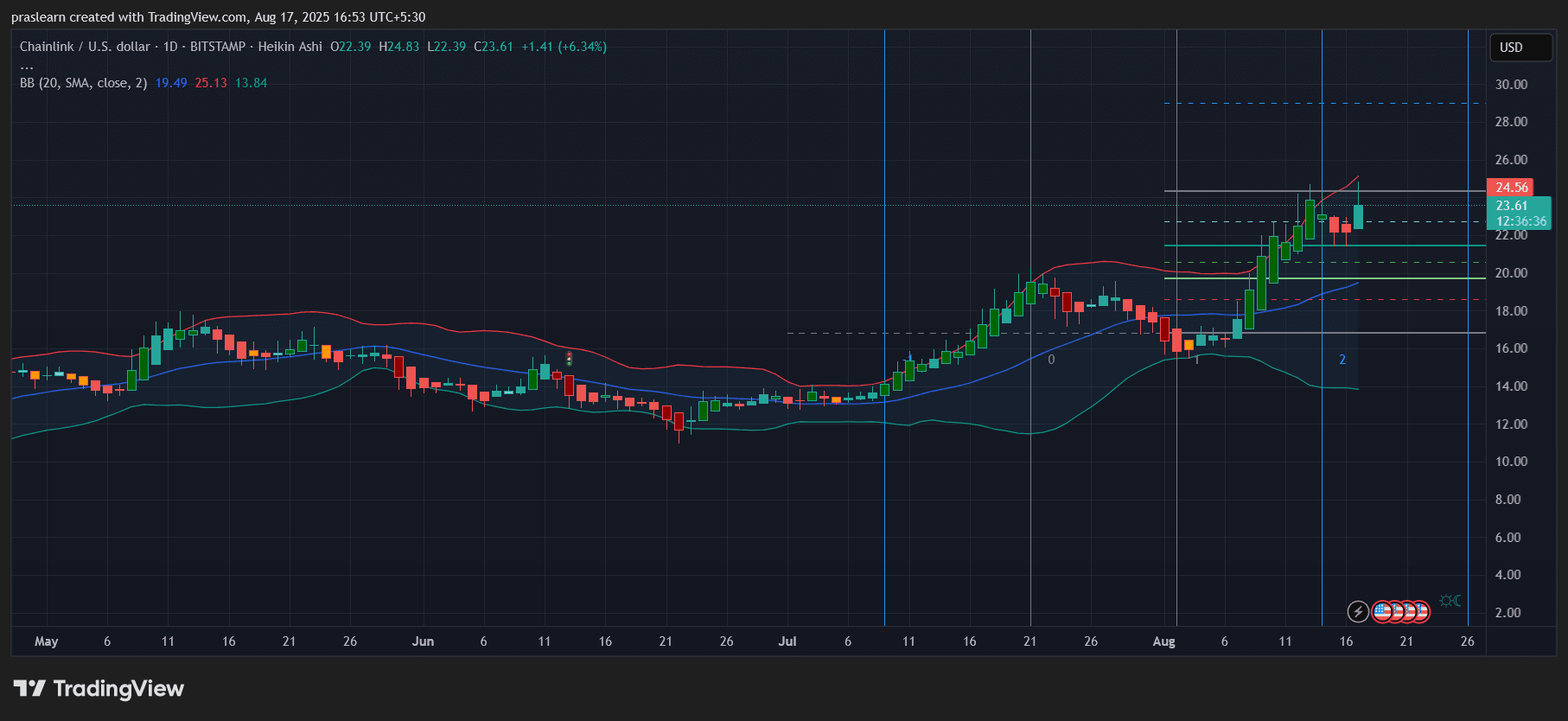

Taking a detect on the day-to-day chart, LINK is procuring and selling at $23.61, up 6.34% on the day. A accurate rally from early August pushed label during the psychological $20 barrier, marking a particular breakout from its prior consolidation.

The Bollinger Bands (BB) philosophize widening volatility, with label hugging the upper band end to $25.13, signaling bullish momentum but also instant-term overextension. Essentially the most up-to-date wick rejection at $24.83 suggests profit-taking end to resistance.

Key phases to stare:

- Instant enhance: $22.00 (mid-fluctuate consolidation zone)

- Serious enhance: $19.50 (20-day SMA, bottom of BB fluctuate)

- Resistance zone: $25.50–26.00 (upper band and Fib extension)

- Breakout target: $30.00 (foremost psychological and Fib projection)

As long as LINK holds above $22, momentum favors bulls. A end above $25 would likely space the stage for a bustle toward $28–30.

Chainlink’s Expanding Role Previous Oracles

Chainlink is now not proper about label feeds. With over 2,000 oracles powering 60+ blockchains and securing $80B+ in price, Chainlink is now an institutional-grade infrastructure layer. Its Unhealthy-Chain Interoperability Protocol (CCIP), automation instruments, and compliance-ready aspects give it a varied web page online to energy tokenized sources—a market projected within the trillions.

The place competitors supply fragmented products and services, Chainlink delivers a modular, unified platform. This constructed-in ecosystem makes it more uncomplicated for enterprises to undertake blockchain choices at scale while maintaining compliance and privateness intact. The gain enact: sustained ask for LINK.

Chainlink Imprint Prediction: What to Request of Next for LINK Imprint?

The LINK rally is backed by both fundamentals and technicals:

- Bullish case: If adoption momentum and Reserve-pushed ask persist, LINK would perchance perhaps presumably push toward $28–30 within the approaching weeks.

- Neutral case: Consolidation between $22–25 while traders wait for clearer signals.

- Bearish threat: A breakdown below $19.50 would perchance perhaps presumably pull LINK support into the mid-kids, though fundamentals develop this deliver of affairs less likely within the instant term.

With Price Abstraction tying conducting income straight to LINK ask, the token has a structural advantage in comparison with varied altcoins. The following decisive breakout above $25 will be critical for confirming a brand accumulated leg greater.

LINK’s fundamentals during the Chainlink Reserve are stronger than ever, while the chart signals momentum toward $30 if resistance breaks. Traders ought to peaceful stare the $22 enhance and $25 resistance carefully for the next worthy circulation.