Bitcoin, the pioneering cryptocurrency, continues to captivate traders and traders with its cyclical ticket actions and unparalleled market dominance. As of January 2025, Bitcoin has shown fundamental upward momentum, suggesting that it could well maybe maybe also very well be poised for further beneficial properties within the coming month. In this Bitcoin ticket analysis, we are able to mediate about the chart’s technical structure, key stages of reinforce and resistance, and the symptoms driving market sentiment to acknowledge the pressing quiz: how high can Bitcoin’s ticket rise within the next 30 days?

Is Bitcoin Label Breaking By strategy of Resistance Stages?

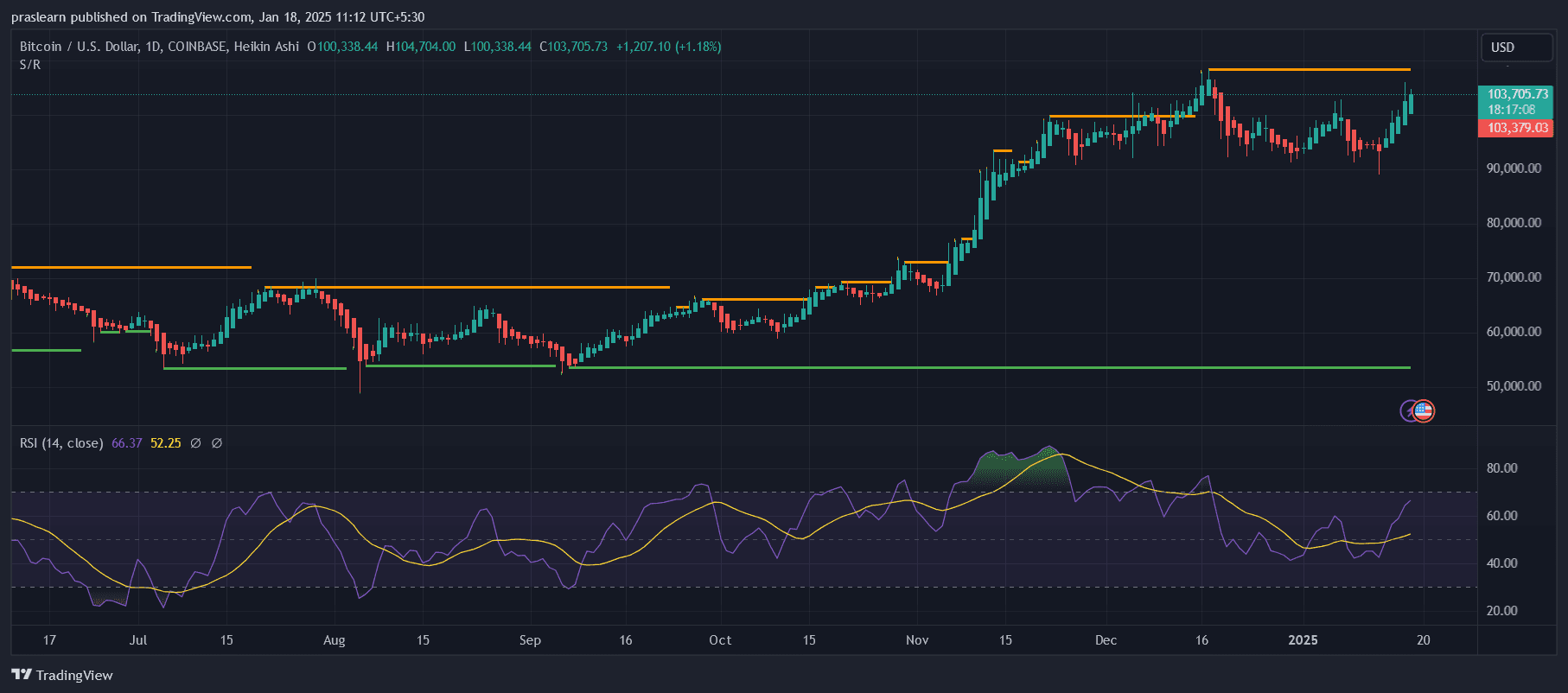

The chart reveals that Bitcoin is currently trading plot $103,705, animated a extreme resistance zone established within the previous few months. The orange horizontal traces within the chart put historical resistance stages, the build old rallies bear either stalled or reversed. Bitcoin’s fresh bullish momentum, evidenced by consecutive green Heikin Ashi candles, suggests real procuring force.

A breakout above the unusual resistance around $104,000 could maybe presumably also put a accelerate to better targets, because the next fundamental resistance stages appear like around $110,000 and $115,000. The volume and candlestick patterns over the following few days shall be extreme in figuring out whether or no longer this breakout is sustainable or a spurious put.

What Role Does the RSI Indicator Play?

The Relative Strength Index (RSI), shown on the bottom of the chart, is currently at 66.37, indicating real bullish momentum but no longer but coming into the overbought territory (above 70). This implies that there is aloof room for ticket appreciation sooner than the market becomes overextended. Historically, Bitcoin ticket has shown the opportunity of appealing upward moves when the RSI crosses the 70 degree, driven by FOMO (anguish of lacking out) amongst traders.

If the RSI trends better and breaches 70, it could well maybe maybe also signify an acceleration in procuring exercise, potentially pushing Bitcoin toward the $115,000 put. On the opposite hand, traders could maybe presumably also aloof remain cautious of a probably bearish divergence, the build the RSI begins to decline whereas prices continue to rise, as this most often precedes a correction.

How Predominant Are the Most up-to-the-minute Enhance Stages?

The golf green horizontal traces on the chart put extreme reinforce stages around $90,000, which acted as a unsuitable for Bitcoin ticket fresh rally. This reinforce zone is a must-bear for affirming bullish sentiment; a breakdown under it could well maybe maybe also divulge the unusual uptrend and impart Bitcoin to further plot back risks.

Given the strength of the unusual uptrend and the proximity of the 50-day transferring real looking (no longer shown within the chart), it is miles unlikely that Bitcoin will revisit this degree within the next 30 days unless confronted with a huge macroeconomic or market-issue shock.

What Can We Quiz of From Market Sentiment and Fundamentals?

Beyond the chart, market sentiment plays a huge role in figuring out Bitcoin’s ticket trajectory. Most up-to-the-minute macroeconomic trends, equivalent to reduced inflationary pressures and increased institutional adoption, bear created a favorable backdrop for Bitcoin. Furthermore, the upcoming Bitcoin halving match, which reduces mining rewards, is seemingly fueling bullish hypothesis. This confluence of technical and classic elements supports the case for persevered upside in Bitcoin’s ticket.

Conclusion

Consistent with the chart’s technical analysis, Bitcoin appears to be like to be well-positioned for further beneficial properties within the next 30 days. A breakout above $104,000 could maybe presumably also propel prices toward the $110,000 to $115,000 vary, supported by real RSI momentum and bullish market sentiment. On the opposite hand, traders could maybe presumably also aloof carefully video display the RSI and volume dynamics to verify the sustainability of the uptrend. While plot back risks remain minimal within the plot term, affirming the $90,000 reinforce degree shall be compulsory for preserving Bitcoin’s bullish outlook.