The Deribit-listed bitcoin BTC$102,019.12 choices market is revealing increasing warning among traders, with some prepping for a whisk to $80,000, as space prices explain indicators of weak spot.

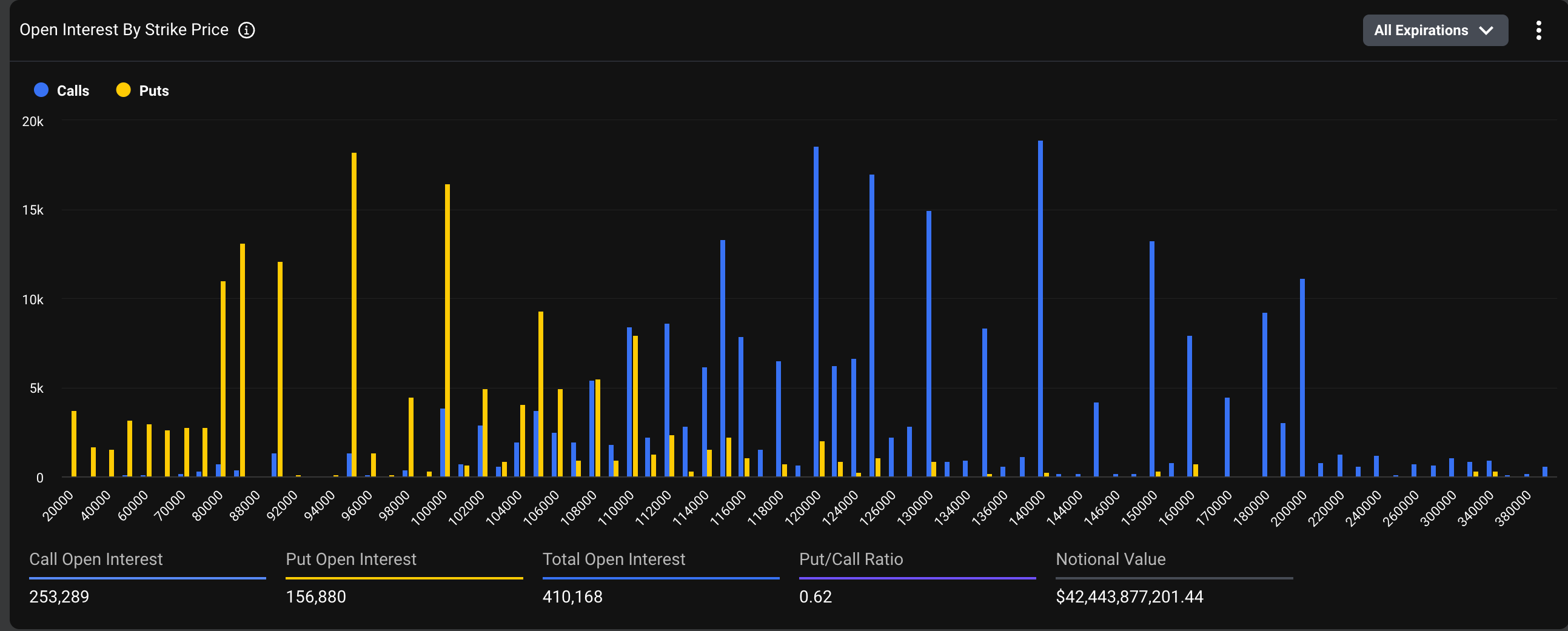

Notional begin ardour in BTC choices, or the greenback worth of the active contracts, stays elevated above $40 billion on Deribit, with project concentrated in November and December strikes when it comes to $110,000. Alternatively, at the the same time, demand for the $80,000 strike has increased, a impress that traders are searching ahead to a persisted sell-off in BTC.

“A well-known surge in achieve choices positioned diagram the $80,000 designate indicators traders are an increasing number of hedging towards a deeper whisk,” Deribit talked about. Deribit, the arena’s largest crypto choices exchange, accounts for over 80% of the global choices project.

Alternatives are widely outdated to hedge space/futures market publicity and speculate on set aside direction, volatility and time. A achieve possibility presents the purchaser the appropriate, but no longer the responsibility, to sell the underlying asset at a predetermined set aside on or sooner than a specified future date. A achieve represents an insurance towards set aside drops, while a name represents a bullish bet.

The $80,000 achieve is of project that the space set aside will decline below that level by the probability’s expiration date.

As of writing, the $80,000 achieve possibility on Deribit has begin ardour (OI) exceeding $1 billion, while the $90,000 achieve stands diagram $1.9 billion, practically matching the combined begin ardour of the licensed $120,000 and $140,000 name choices.

Indicate that no longer lower than piece of the OI in these higher strike calls stems from overwriting, or shorting towards lengthy space bets, moderately than outright bullish bets. BTC holders immediate higher strike calls to generate extra yield on top of their coin stash.

Down 18%

Bitcoin’s set aside has dropped by over 18% since reaching a anecdote excessive of more than $126,000, roughly four weeks ago. At one level this week, prices briefly fell below $100,000.

The sell-off comes as macro pressures, namely the most recent hawkish commentary by Fed’s Chair Jerome Powell, accept weakened demand for space ETFs.

“Macro pressure filtered straight into crypto thru four consecutive intervals of roughly $1.3 billion in accept outflows from U.S. space Bitcoin ETFs, a reversal that turned one of 2025’s strongest tailwinds correct into a diagram-term headwind,” Singapore-based mostly mostly QCP Capital, talked about in a market update Wednesday.

“The softer space demand collided with forced deleveraging, with more than $1 billion in lengthy liquidations at the lows,” the agency added.

Ecoinometrics warned in a most recent anecdote that the closer bitcoin’s set aside stays to the $100,000 level, the increased the threat of a recommendations loop emerging, the set aside set aside weak spot triggers outflows from bitcoin ETFs, which in flip locations extra downward pressure on the space set aside.

As of writing, bitcoin changed fingers at $103,200, representing a 1.9% salvage over the final 24 hours.