November marks two years for the reason that FTX alternate went bankrupt. Since then, most valuable crypto exchanges accept seen their Bitcoin reserves develop.

FTX’s incapability to preserve ample reserves to fulfill person requests exposed extreme flaws in its controls. It additionally highlighted the necessity for increased transparency and reliable reserve reporting amongst all crypto exchanges.

Observers accept grown keenly responsive to the dangers that exchanges face after they lack ample reserves. In the occasion that they are able to’t meet withdrawal requests, it undermines person self assurance and places them prone to shedding funds. Asserting ample reserves is serious for liquidity and account for execution, namely throughout unstable durations.

In light of this pattern, CryptoQuant shared with crypto.news a peek on the convey of alternate proof-of-reserves (PoR).

Desk of Contents

How has crypto changed post-FTX?

FTX‘s crumple in November 2022 used to be one amongst crucial and dramatic events in the crypto industry’s historic previous. This incident undermined investor self assurance and triggered profound adjustments in the crypto market’s construction and functioning.

At the time, the worth of Bitcoin (BTC) and other most valuable cryptocurrencies fell, reflecting apprehension and distrust of institutional players available in the market. Many merchants began to doubt the security and stability of crypto and, as a result, decided to switch away the market entirely.

Consideration in direction of security points grew to become mighty extra pressing. Many crypto exchanges and initiatives accept begun implementing current measures to provide protection to users’ funds, including two-facet authentication, monitoring methods, and examining transactions for suspicious exercise.

Original security standards accept emerged, apart from to solutions to stop the loss of funds in case of hacks or fraudulent actions. Amongst others, the PoR accepted has emerged — a mechanism cryptocurrency exchanges expend to publicly show that they accept ample assets in reserve to conceal all person balances.

“PoR fosters trust and transparency, because it lets in users to substantiate that one more has no longer over-leveraged or mismanaged their assets, which has become namely needed following high-profile alternate collapses in the industry.”

CryptoQuant

Vital exchanges document Bitcoin outflow

Amongst the most valuable exchanges with the most infamous Bitcoin reserves, finest Coinbase does no longer post PoR experiences. Consultants point out that the opposite most valuable exchanges periodically provide such experiences with varying levels of transparency.

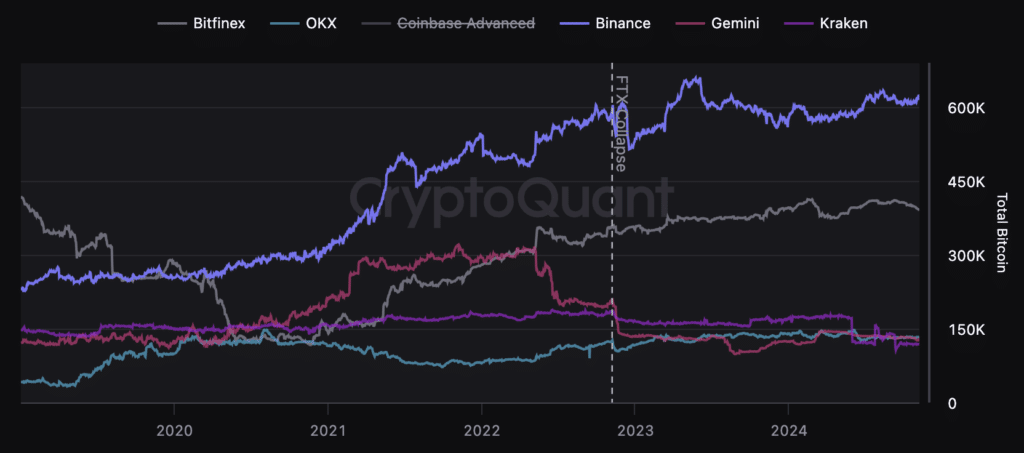

Binance’s reserve increased by 28,000 BTC, or 5%, reaching 611,000, no topic the strain from the U.S. authorities in 2023. Amongst the most valuable exchanges, Binance additionally reveals the most minor reserve decrease over your entire length, no longer exceeding 16%.

Three key exchanges serve 75% of all Bitcoins held by exchanges. These are Coinbase Stepped forward, with 830,000 BTC, Binance with 615,000, and Bitfinex, which has 395,000 Bitcoins.

Collectively, the reserves of these platforms attain 1.836 million BTC, which is 9.3% of the total quantity of Bitcoins in circulation. The final 17 exchanges serve a total of 684,000 BTC.

Reserves touchdown

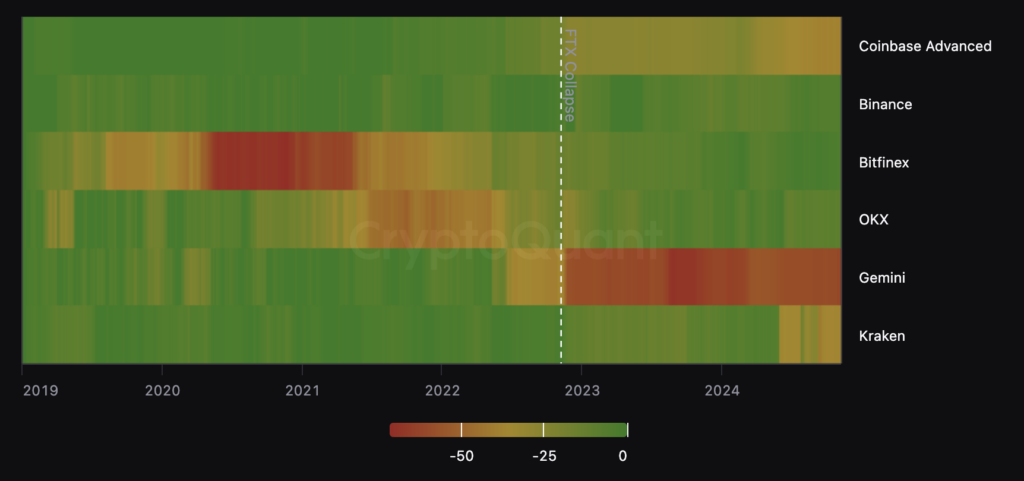

At point out, Binance, Bitfinex, and OKX tell miniature decreases in reserves. At the identical time, Binance appears to be the actual alternate that has no longer experienced valuable drawdowns in its historic previous.

Analyzing alternate reserves basically based entirely on monitoring their adjustments lets in us to assess their potential to fulfill person calls for over time.

Necessary declines may per chance presumably well tell that users are vastly withdrawing their funds, indicating a decrease in trust or monetary issues.

An crucial decline in Binance’s reserves used to be 15%, which occurred in December 2022, shortly after the FTX shatter. At the time, Binance faced appreciable criticism and distrust over its reserve document.

On the opposite hand, Binance’s reserves accept recovered and are currently down finest 7%. Other valuable exchanges accept additionally seen tiny declines, with Bitfinex down 5% and OKX down 11%.

While industry leaders like Binance and Bitfinex accept managed to shore up their reserves for the reason that FTX shatter, the problem is unruffled traumatic. The failure of some most valuable players like Coinbase to post PoR experiences means that the avenue to tubby transparency is unruffled far off. However the newest reserve dynamics tell a wish to enhance and originate bigger users’ trust.

The professional, in a comment to crypto.news, emphasized that the financial misfortune of FTX underscored the necessity for crypto exchanges to point out that they accept ample reserves.

“This occasion led to a shift where users desire exchanges that tell proof of their assets on-chain. This pushed the industry to adopt PoR practices, serving to rebuild trust and confirm that exchanges can support up their users’ funds.”

Cut Pitto, head of promoting at CryptoQuant