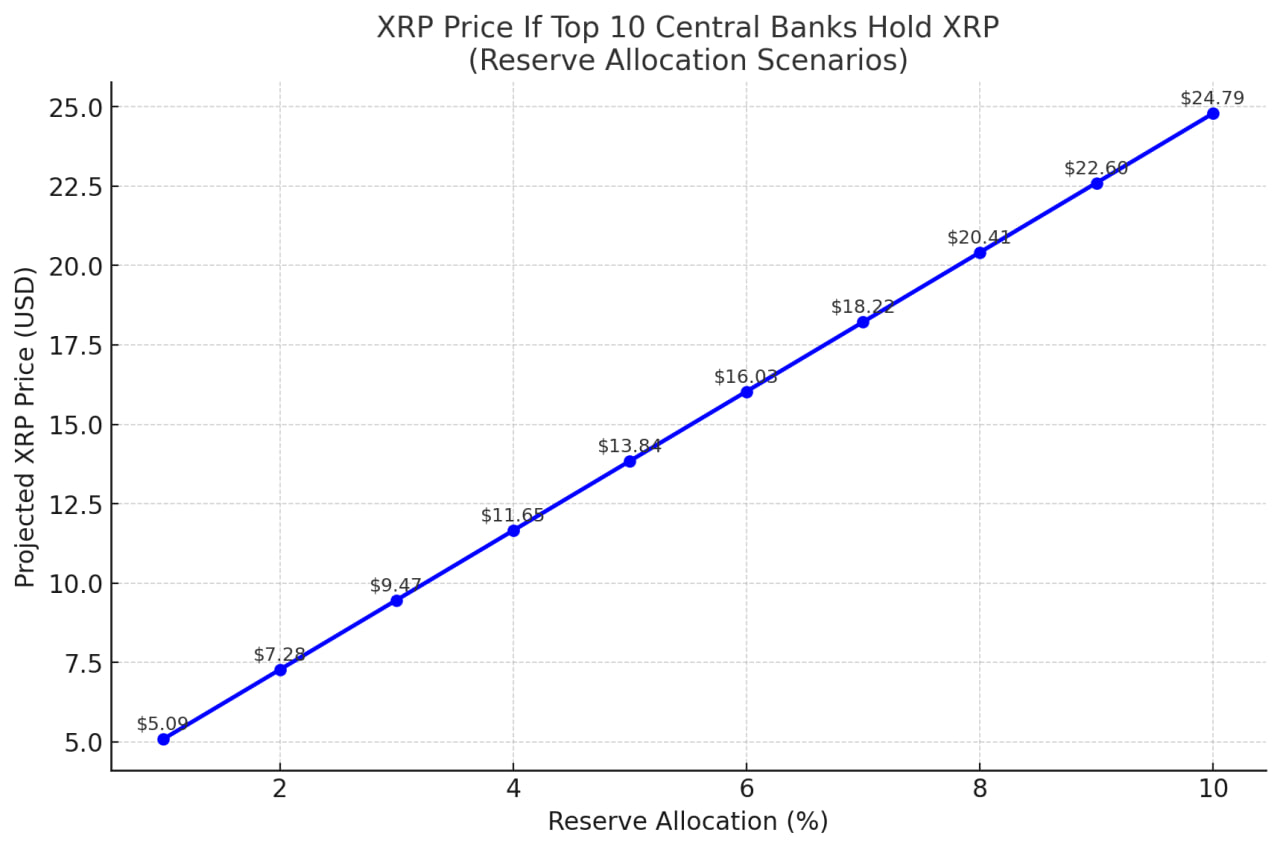

A original evaluation explores the seemingly XRP attach if the area’s high 10 central banks allocate a portion of their mixed $13 trillion in reserves to the coin.

The outcomes demonstrate that even a modest level of adoption at this scale could maybe additionally propel XRP to original heights.

XRP’s Recent Market Location

Particularly, XRP is within the point out time trading at around $2.81, with a circulating present of roughly 59.4 billion tokens. This affords it a market cap of about $172.3 billion, making it certainly one of many most exciting digital belongings in circulation. Despite this nice valuation, the entry of central banks could maybe additionally utterly reshape XRP’s trajectory.

Extended Outlook at 10%

Having a see beyond modest allocations, a 10% commitment from central financial institution reserves, roughly $1.3 trillion, could maybe additionally elevate XRP’s market cap to $1.47 trillion. On this scenario, XRP attach could maybe additionally climb to around $22.58 per coin, as regards to eight times its novel attach.

Nonetheless, it is fundamental to demonstrate that these figures are according to overall market cap arithmetic, assuming that central financial institution inflows would translate straight into increased valuation.

Genuinely, such huge buying stress from establishments of this dimension would seemingly set aside a multiplier execute, doubtlessly utilizing XRP’s attach successfully beyond these projections.

Even a $1 billion executive allocation could maybe additionally trigger necessary market reactions, making inflows of $130 billion to $1.3 trillion arrangement more impactful than the raw numbers could maybe additionally counsel.

Put in tips the market frenzy that will seemingly observe an announcement that the U.S. executive is buying $1 billion worth of XRP.

But Is There Any Probability These Governments Will Protect XRP?

The concept of governments keeping XRP is compelling, namely amid a world push for crypto innovation and adoption at the governmental level, which has reached unheard of momentum this 300 and sixty five days.

The U.S. executive has signed into law a bill on stablecoins, marking a ancient milestone for crypto legitimacy. Furthermore, the executive is working toward establishing a national crypto reserve that could maybe additionally delay to 1 million BTC, alongside with a diversified crypto stockpile including XRP, Ethereum, Cardano, and Solana.

Nonetheless, the U.S. has now not expressed readiness to aquire any cryptocurrency beyond Bitcoin.

In countries fancy Russia and China, most discussions around crypto non-public taking into account Bitcoin and stablecoins, customarily considered as instruments to promote their native currencies.

Relating to Bitcoin, institutional FOMO stays excessive. Governments that within the point out time preserve BTC demonstrate no signs of selling. Particularly, countries much like the U.S., China, the U.K., Ukraine, Bhutan, El Salvador, and 4 others collectively preserve 517,298 BTC—worth over $56.76 billion.

In essence, the novel institutional focal point is overwhelmingly on Bitcoin, whereas altcoins fancy XRP remain within the background.

Takeaway

This evaluation highlights the perhaps outsized affect of institutional adoption on XRP, namely at the most realistic seemingly level. Nonetheless, the scenario of governments allocating between $130 billion and $1.3 trillion into XRP stays highly speculative.

Because it stands, Bitcoin is the more seemingly candidate for such trim-scale executive adoption.