XRP stays one of many most talked-about digital resources within the crypto market, with rising hypothesis round its future trace most likely.

Traders amassing 1,000 to 10,000 XRP on the present time would be positioning themselves for necessary gains if predominant catalysts materialize.

Two key narratives would possibly well perhaps force XRP’s trace to unprecedented heights. The first is its most likely inclusion in a U.S. digital asset reserve, whereas the assorted is the approval of an XRP alternate-traded fund (ETF).

Every scenarios possess expansive-scale institutional adoption, which can field off exponential trace appreciation.

XRP as a US Reserve Asset—A Debt Resolution?

One in every of the most ambitious speculations round XRP is its most likely adoption as allotment of a U.S. digital asset reserve.

Ripple has been actively enticing with policymakers. In explicit, CEO Brad Garlinghouse has mentioned blockchain’s goal within the monetary system with U.S. leaders, alongside side President Donald Trump.

If the U.S. executive were to leverage Ripple’s 37.7 billion escrowed XRP for national monetary ideas, some imagine it would possibly well well possibly support offset the national debt, which for the time being stands at $36 trillion.

Nonetheless, at XRP’s most recent trace of $2.58, Ripple’s escrow holdings are rate handiest $97.26 billion. Here is grand from making a necessary affect on the debt.

For XRP to single-handedly set away with the U.S. national debt, its trace would must upward thrust dramatically.

Particularly, to compare the $36 trillion debt settle, XRP’s trace would must surge to $955 per token. This would label a staggering 36,911% lengthen from on the present time’s levels.

While such an is extremely speculative, it highlights the form of valuation XRP would possibly well perhaps attain if it becomes a core monetary asset for the U.S. executive.

XRP ETF Approval—How Excessive Can It Plod?

Even though XRP doesn’t change staunch into a reserve asset, one other predominant catalyst would possibly well perhaps propel its trace: the approval of an XRP ETF. Bitcoin’s ETF approvals in 2024 precipitated wide inflows, with over $35 billion pouring into the market.

If XRP ETFs seize simply 50% of Bitcoin ETF inflows, that will translate to a $17 billion capital injection. Making exhaust of a conservative 1:10 inflow-to-market cap multiplier, XRP’s total valuation would upward thrust by $170 billion.

XRP’s most recent market cap of $150 billion would bring its total valuation to roughly $235 billion. With a circulating offer of 57.7 billion tokens, this original valuation would push XRP’s trace to $5.54 per token—a 115% lengthen from on the present time’s trace of $2.58.

Why Defending 1,000 to 10,000 XRP Could possibly also Be Existence-Changing

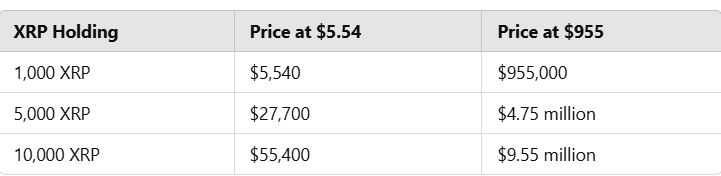

For patrons amassing XRP now, these trace scenarios record necessary upside most likely. Here’s how varied holdings would translate if XRP reaches these targets:

Even within the extra conservative ETF-pushed wretchedness, a 1,000 XRP investment on the present time ($2,580) would possibly well perhaps change into $5,540. If XRP were ever to reach $955 as a reserve asset, a 10,000 XRP conserving would be rate an improbable $9.55 million.

While these projections are enticing, they continue to be speculative, and there is no longer any guarantee any of the projected illustrations would possibly well perhaps materialize.