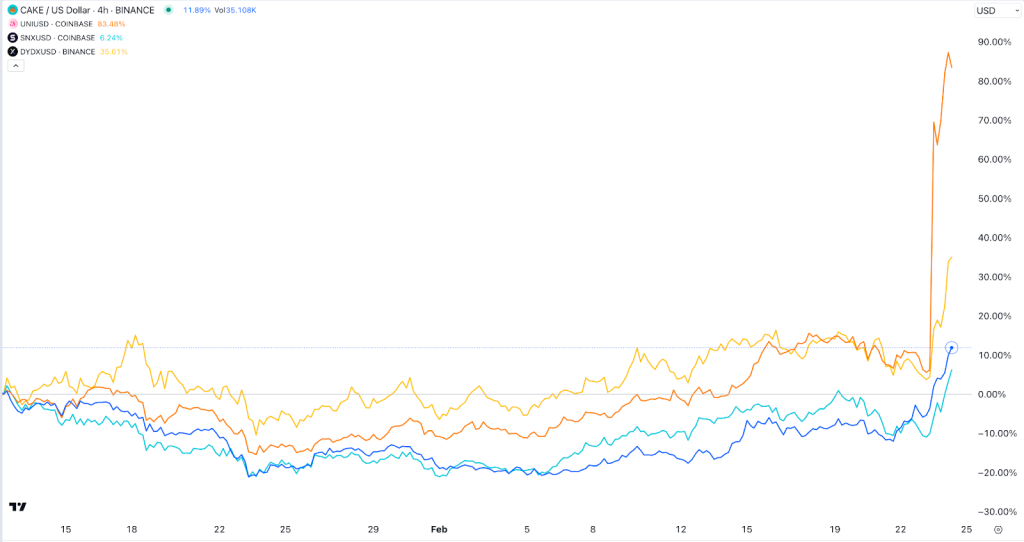

Decentralised Alternate (DEX) tokens were among the supreme performers on Saturday. Uniswap (UNI) token soared by better than 70% while dYdX, Synthetix (SNX), PancakeSwap (CAKE), and THORChain (RUNE) soared by better than 30%. DeFi tokens like AAVE and Lido DAO were among the supreme performers.

Uniswap’s unique governance proposal

The principal reasons why these tokens surged is that Uniswap, the supreme DEX within the change, launched a valuable governance proposal that may per chance per chance presumably change how decentralised networks characteristic within the change.

Based mostly on the proposal, Uniswap will change how it rewards its token holders. On this case, the community will transfer its fees to its token holders. Here is a actually valuable step since Uniswap is the supreme DEX on the earth, processing billions of bucks value of transactions every day.

It is in total one among the most a hit. Based mostly on TokenTerminal, Uniswap generated over $586 million in earnings within the previous twelve months. This made it the fifth most a hit blockchain participant after Ethereum, Tron, Bitcoin, and Lido Finance. Ethereum revamped $2.6 billion within the identical length.

UNI vs dYdX vs CAKE vs RUNE

Why dYdX, PancakeSwap, THORChain jumped

Due to the this fact, the dYdX, PancakeSwap, and THORChain tokens jumped sharply because they are all big gamers within the DEX change.

Based mostly on CMC, dYdX handled over $1.2 billion in crypto transactions within the previous 24 hours. PancakeSwap processed tokens value better than $600 million across its 13 chains while THORChain handled $110 million.

On this case, merchants factor in that these networks will apply within the footsteps of Uniswap if the proposal passes. In most sessions, tokens within the identical change tends to cling a shut correlation with every other.

Synthetix is no longer a decentralised exchange nonetheless it completely plays a actually valuable section within the change. It works with other exchanges to invent liquidity in their ecosystems. Recordsdata reveals that it has handled over $58 billion in transactions and has over $826 million in entire put locked (TVL).

The post Here’s why Uniswap, dYdX, Synthetix, CAKE, RUNE are surging seemed first on Invezz