The crypto market goes up this present day, Nov. 23, as traders aquire the most modern dip and as stablecoin provide in exchanges originate rising.

- The crypto market goes up this present day, with Bitcoin hitting $86,000.

- This rally is going down as traders aquire the most modern dip.

- Futures begin curiosity and stablecoin provide in exchanges grasp been rising.

Bitcoin (BTC) mark rose to $86,000, up by almost 8% from the lowest stage this One year. High altcoins cherish Zcash (ZEC), Cronos (CRO), Monero (XMR), and Aerodrome Finance had been up by over 10% in the last 24 hours.

Info compiled by CoinMarketCap reveals that the market cap of all coins rose by almost 3% to over $2.9 trillion.

Crypto market goes up as traders aquire the dip

One likely causes why the crypto market goes up is that traders are shopping for the dip after most coins dived by double digits in the previous few weeks.

It is some distance abnormal for crypto and stock market traders to switch cut payment looking out after a huge decline. This dip-shopping for is abnormal when these resources switch to the oversold levels. The Relative Energy Index of the crypto market dropped to the oversold stage of 25 this week.

This dip shopping for has additionally been triggered by the fact that American stocks ended the week in the green. The Dow Jones Index rose by 493 facets, whereas the S&P 500 and Nasdaq 100 Indices jumped by 65 and 195 facets, respectively.

Nonetheless, the most well-known threat for the ongoing crypto market rally is that it could possibly possibly perhaps well well be a useless-cat leap or a bull trap. A bull trap is a undertaking the attach apart a falling asset rebounds temporarily and then resumes the downtrend.

Crypto costs rally as begin curiosity and stablecoin inflows rise

The continuing crypto market rebound is going down as process in the futures market toughen. Info compiled by CoinGlass reveals that the futures begin curiosity jumped by 3.3% in the last 24 hours to over $125 billion.

One other recordsdata reveals that the 24-hour liquidations dropped by 88% in the the same duration to $207 million. A combination of rising leverage and low liquidations consistently ends in titanic upward. Tranquil, it’s abnormal for liquidations to drop at some stage in the weekend.

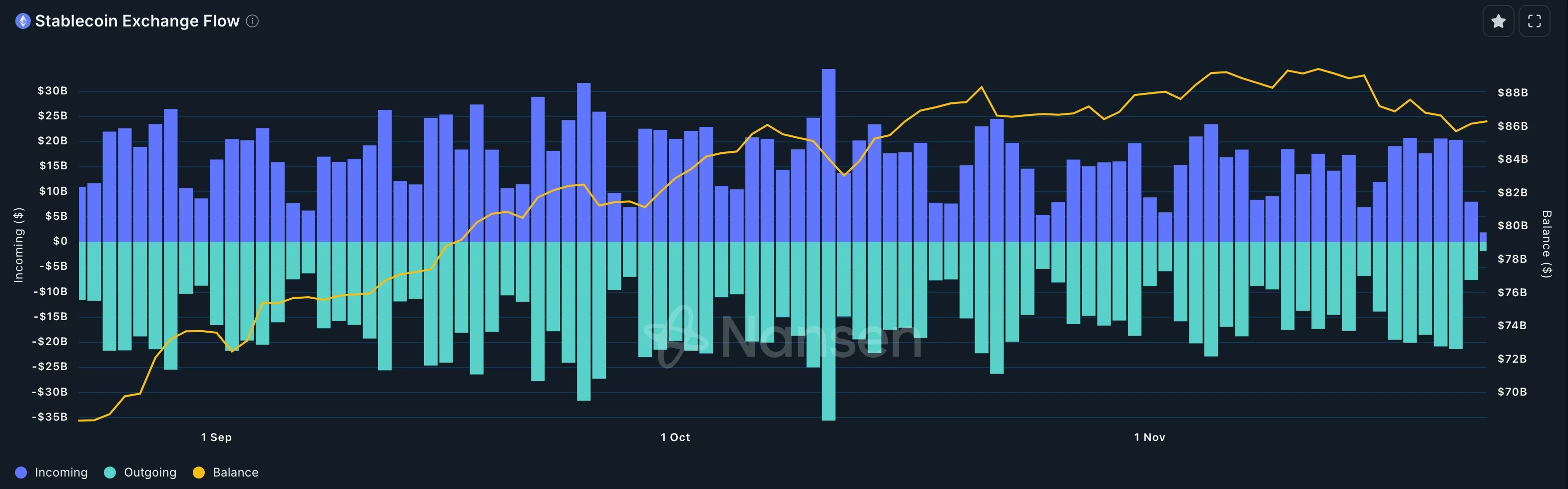

Meanwhile, Nansen recordsdata reveals that stablecoins are transferring support to exchanges. There grasp been $86 billion price of stablecoins in exchanges, up from the Friday low of $85 billion.

The diverse likely catalyst for the ongoing crypto market rally is that there shall be some distinguished altcoin ETF approvals this week. Graycale, 21Shares, and Franklin Templeton will listing their XRP ETFs this week.

Fresh recordsdata reveals that there is a extraordinary ask for XRP ETFs, with the cumulative inflows rising to over $400 million. Grayscale and 21Shares will additionally listing their Dogecoin ETFs.