Whereas Bitcoin (BTC) flirts with the lengthy-awaited $100,000, and Jim Cramer recommends a “aquire,” crypto merchants glimpse the Altseason. Historically, money has circled from Bitcoin into altcoins after well-known breakouts, which could presumably per chance happen but every other time this cycle, starting up on Sunday.

It is miles on myth of Sunday, November 24, will shut the third consecutive week above Bitcoin’s final weekly candle’s excessive. In actuality, an altseason began every time this sample happened in the earlier two cycles, as TechDev shared on X.

An altseason occurs when altcoins outperform Bitcoin, diminishing its market cap dominance. Some analysts are already with the exception of for Ethereum (ETH) as share of “altcoin” diagnosis, given its market dimension and relevance.

In summary, trading experts and crypto merchants count on mid-to-low-caps to outperform the leaders, higher distributing the capital among all cryptocurrencies.

The altcoins season (altseason) is starting up

On TechDev’s perception, the Bitcoin and crypto analyst pointed out a sample that dates help to March 2017. In step with him, the final two altseasons began after three consecutive weekly closes above the final Bitcoin weekly excessive.

This sample is in play merely now, with the third consecutive week to shut the next day to come, Sunday evening, starting up on Monday. Therefore, this week might presumably per chance even very nicely be a key period for what some experts are labeling “utility altcoins,” with excessive issue attainable.

Notably, TechDev crossed over the Bitcoin Dominance Index (BTC.D) with Bitcoin’s weekly chart, illustrating the open of the altseason.

On this context, some altcoins private already began surging, leading the design for varied cryptocurrencies. Solana (SOL), Ripple (XRP), Cardano (ADA), Algorand (ALGO), Hedera (HBAR), Approach Protocol (NEAR), and Sui Community (SUI) are some of them, outperforming varied tasks in the previous few days as money starts rotating from Bitcoin and Ethereum to lower caps.

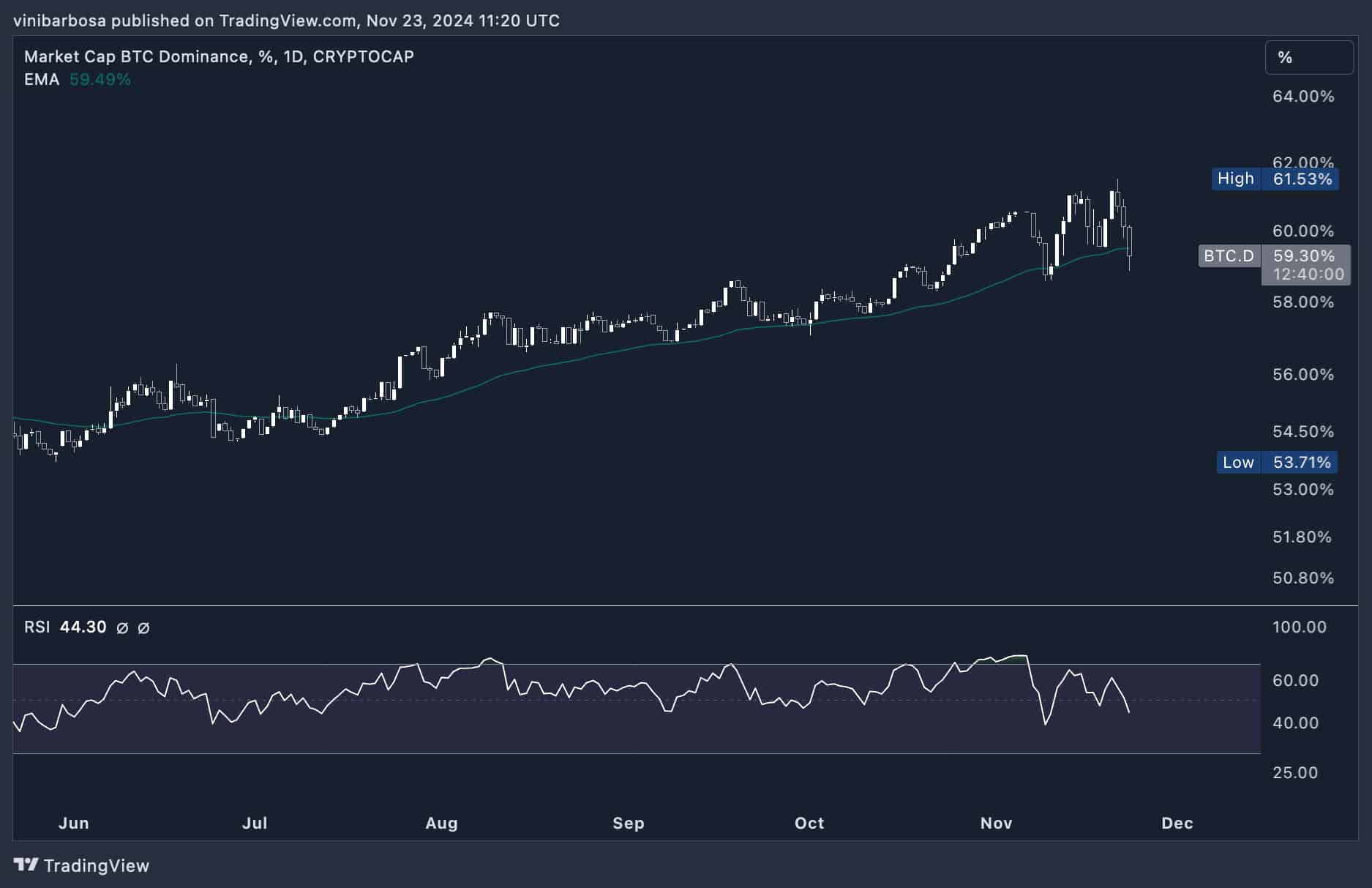

Bitcoin Dominance Index (BTC.D) this day

As of this day, Bitcoin dominance is retracing backward, testing the 50-day exponential spellbinding reasonable but every other time, which is well-known chart toughen. Currently, BTC has 59.30% of your whole cryptocurrency market capitalization, primarily based fully on TradingView’s index.

Confirming a each day tumble below the 59.50% spellbinding toughen might presumably per chance validate the aforementioned historic diagnosis, marking the altseason open.

Interestingly, BTC.D has followed a earlier diagnosis by CrypNuevo, reported on Finbold, alive to to a resistance retest. The analyst forecasted Bitcoin’s dominance would earn a high between 61% and 62%, confirming it with a retest sooner than crashing.

The retest has already came about this week. Now, the market awaits to opinion if BTC.D will revert from its two-year uptrend, down-trending amid an anticipated altseason.

Featured record from Shutterstock.