Gold and silver pushed to new all-time highs this week, increasing a monetary gap that sets the stage for a doable Bitcoin receive-up rally.

In response to Gold Rate files, gold reached an all-time excessive of over $4,600, with industry experts predicting a upward thrust above $5,000. On the identical time, silver has topped $90, and its market cap crossed $5 trillion for the first time.

Market analysts popular that these treasured metals’ brand movements reflect a “tough asset” dominance, with investors fleeing sovereign debt risks amid increasing worldwide macro uncertainty.

Brooding about this, Bitcoin, widely actually appropriate “digital gold,” has additionally made a solid originate of its have, topping $95,000 for the first time this year within the final 24 hours.

Nonetheless, its slump has been extra muted than the treasured metals’.

For some observers, that drag is less a warning signal than a neatly-identified rotation. Their verify is that Bitcoin tends to coach tough-asset momentum with a prolong, and that a combination of timing indicators and institutional flows can also pull it toward six-resolve costs.

Bitcoin lags gold

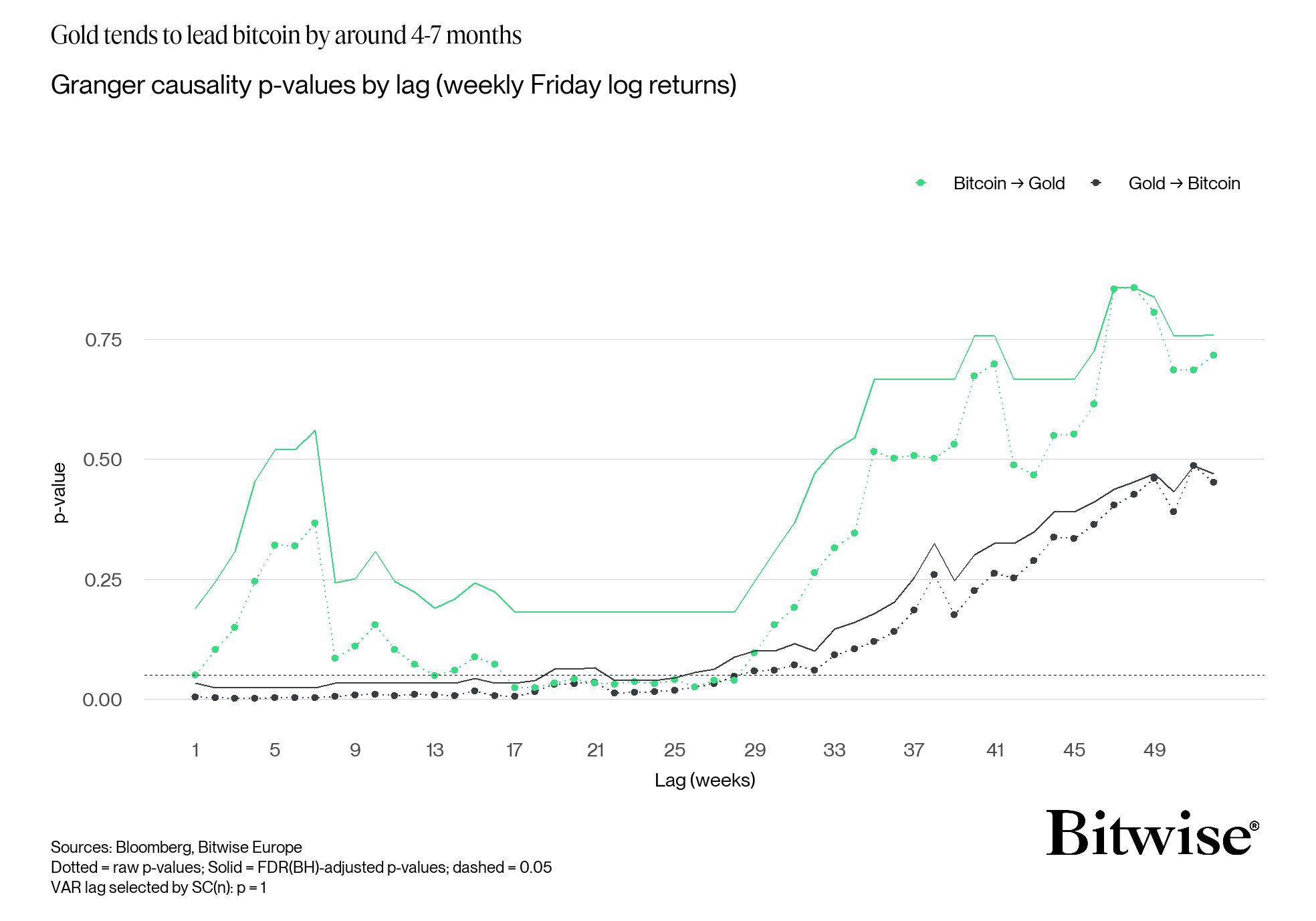

The predominant technical argument for a looming Bitcoin rally rests on statistical evidence that gold costs act as a number one indicator for the crypto market.

André Dragosch, Bitwise Europe’s head of research, highlighted a explicit correlation suggesting that basically the most modern metals rally effectively indicators a subsequent transfer in digital sources.

His region facilities on the thought that of “Gold to Bitcoin Rotation,” a scenario he claims remains firmly in play amid basically the most modern market trajectory.

Dragosch, utilizing Granger causality assessments, identified that gold tends to lead Bitcoin by roughly four to seven months.

This drag duration implies that the institutional capital that floods into gold as a safe haven sooner or later rotates into Bitcoin as inconvenience appetites adjust inside the merciless-asset framework.

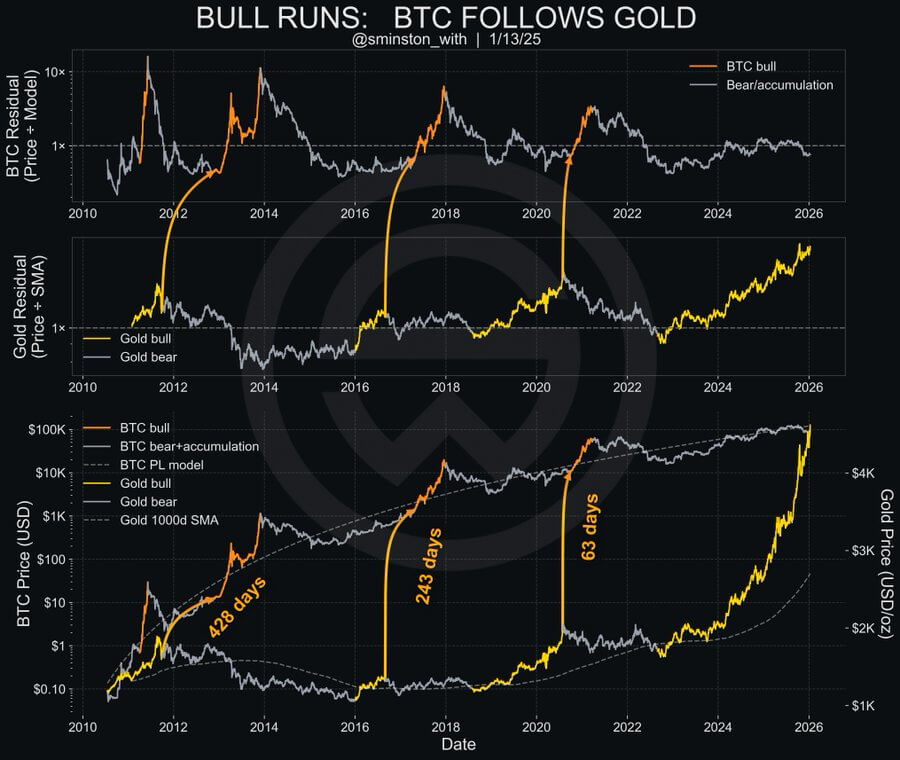

Extra files from Bitcoin analyst Sminston With backs his verify.

In response to With, historical files reveals a habitual sample thru which gold bull runs precede Bitcoin breakouts.

He identified that basically the most modern technical setup depicts gold entering a vertical brand discovery allotment, whereas Bitcoin remains within the early stages of a corresponding shift.

This divergence aligns with Dragosch’s rotation thesis and suggests the explosive transfer in gold is for the time being “loading” the spring for the cryptocurrency market.

If the pattern of diminishing drag events persists, the window for Bitcoin to shut the valuation gap is seemingly shorter than in outdated cycles, validating the urgency seen in most modern institutional flows.

ETF plays

Past statistical correlations, the predominant describe for Bitcoin supports the thesis of an impending breakout.

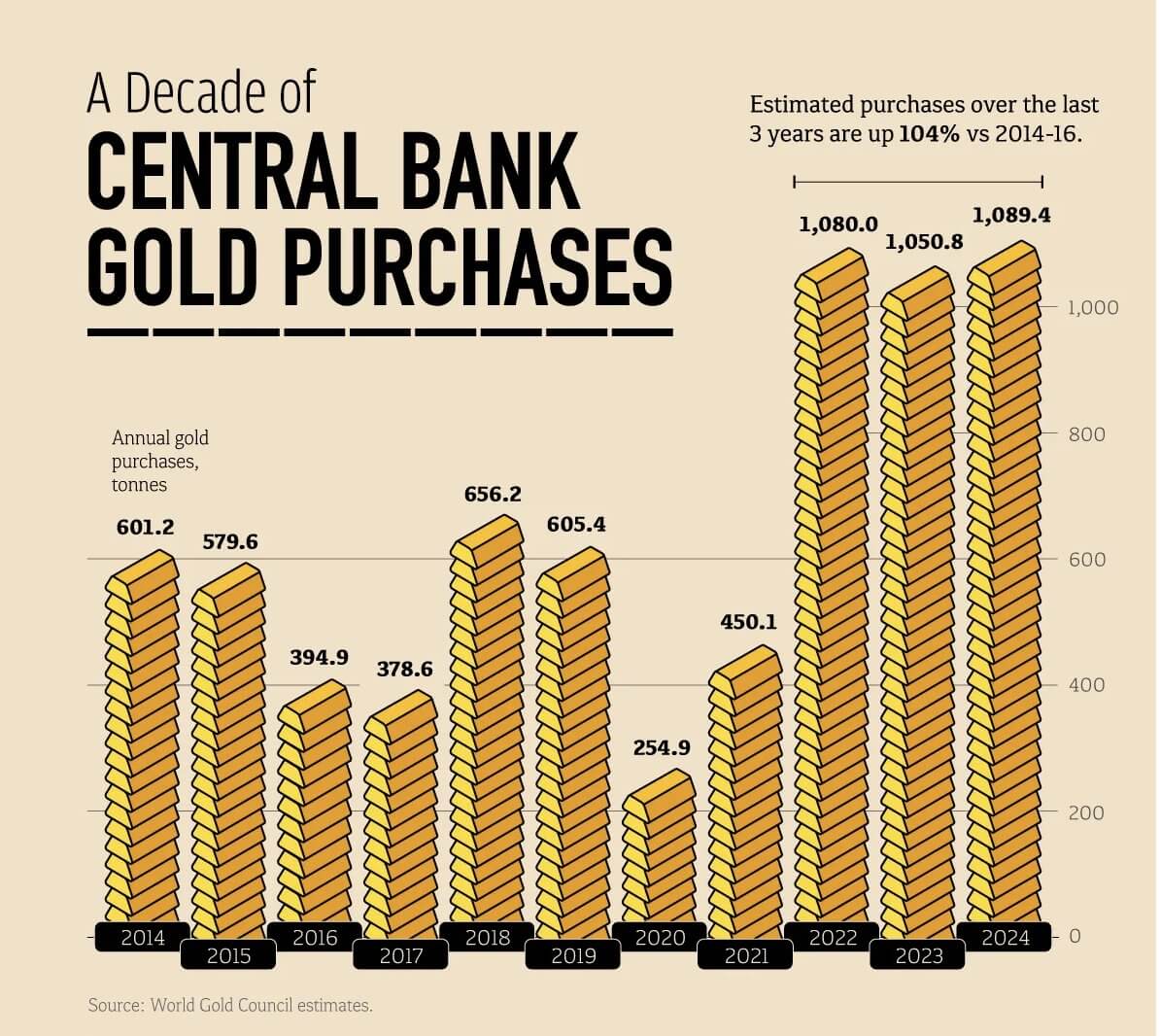

Matt Hougan, Chief Investment Officer at Bitwise, challenges the in vogue tale that the 2025 gold spike became a sudden response to rapid put a matter to. As one more, he argues that brand discovery became a characteristic of provide exhaustion that unfolded over time.

In response to him, the catalyst for the stylish gold slump started in 2022 when Central banks’ aquire of gold spiked from roughly 500 tonnes to 1,000 tonnes yearly following the US seizure of Russia’s Treasury deposits.

He identified that these purchases fundamentally tilted the provision-put a matter to balance, but the price did no longer at this time reflect this shift. Throughout the duration, the gold brand rose most efficient 2% in 2022, 13% in 2023, and 27% in 2024.

Nonetheless, it became no longer until 2025 that gold costs went parabolic, rising 65%. Hougan explains that the preliminary huge central bank put a matter to became met by existing holders who were willing to promote their gold. So, gold’s cost most efficient soared after those sellers sooner or later “ran out of ammo.”

Hougan applies this explicit framework to basically the most modern insist of the Bitcoin market. Since US establish ETFs debuted in January 2024, they win got persistently purchased better than 100% of the contemporary Bitcoin provide issued by the network.

Nonetheless, the flagship crypto’s brand has no longer but long gone vertical because existing holders had been willing to promote into the ETF’s aggressive accumulation. Certainly, CryptoSlate beforehand reported that Bitcoin prolonged-duration of time holders were amongst the heaviest sellers of the end asset over the previous year.

Brooding about this, Hougan argues that BTC’s brand will upward thrust when the provision of willing sellers is sooner or later depleted, upright because it did within the gold market.

When that exhaustion point is reached, the disconnect between provide and put a matter to will seemingly power a parabolic repricing akin to gold’s 2025 efficiency.

Macro drivers and the Fed disaster

Meanwhile, the catalyst for the surge in gold and silver provides further evidence that Bitcoin will instruct suit. The metals market has been reacting to a extreme test of self perception within the US Federal Reserve’s independence.

Experiences of prison investigations into Federal Reserve management win rattled religion within the balance of the buck and the neutrality of monetary coverage. This uncertainty has driven worldwide capital into sources proof against political interference.

Gold serves because the first safe haven for the length of such crises, reacting at this time to news. Bitcoin, customarily viewed as a “inconvenience-on” safe haven, customarily reacts with a prolong as investors first stable their defensive positions in bullion sooner than allocating to digital stores of cost.

So, that “trust top price” that’s for the time being lifting gold to $4,600 is the identical predominant driver that underpins the investment case for Bitcoin.

Because the preliminary shock of the Fed news is absorbed, the market is anticipated to survey out sources with identical scarcity and independence, but with larger upside doable. Bitcoin suits this profile perfectly, providing a convex hedge against the excessive sovereign risks which might be for the time being roiling passe markets.

Bitcoin brand prediction

Bitcoin investors searching forward win known explicit brand levels that can also act as catalysts for the receive-up trade.

Within the ideas market, that positioning has been transferring, but it absolutely quiet aspects to a market thinking about upside breakpoints.

Records from Deribit reveals that BTC traders built bullish exposure thru call ideas with near-duration of time expiries, including Jan. 30 $98,000 calls, and the February $100,000 calls.

This week, a few of that brief-dated optimism became taken off the desk. Level-headed, some older January $100,000 calls were rolled forward into March $125,000 calls, signalling that some traders are maintaining the upside verify but giving it beyond regular time and aiming larger.

These bets can also make what traders call a “gamma magnet.” Because the establish brand of Bitcoin approaches this level, market makers who sold ideas are forced to aquire the underlying asset to hedge their exposure.

This procuring stress can make a feedback loop that attracts costs fleet larger, once in a whereas overshooting predominant targets.

If the correlation with gold holds and the four-to-seven-month drag resolves as Dragosch suggests, analysts factor in Bitcoin is focusing on a transfer into the $120,000 to $130,000 differ within the near duration of time.

This would signify a share make akin to basically the most modern moves in silver, which tends to outperform gold for the length of the latter stages of a tough-asset bull slump.