For the reason that launch of June, investors were watching Bitcoin (BTC), the sphere’s premier cryptocurrency, with an additional and extra cautious sight.

Indeed, regardless of the long-standing hopes that the a huge amount of sure trends of 2024 – equivalent to the approval space BTC change-traded funds (ETFs) – will pressure the coin’s tag up against $100,000 or even to $300,000 as some consultants beget predicted, the true crypto market moves were pretty assorted.

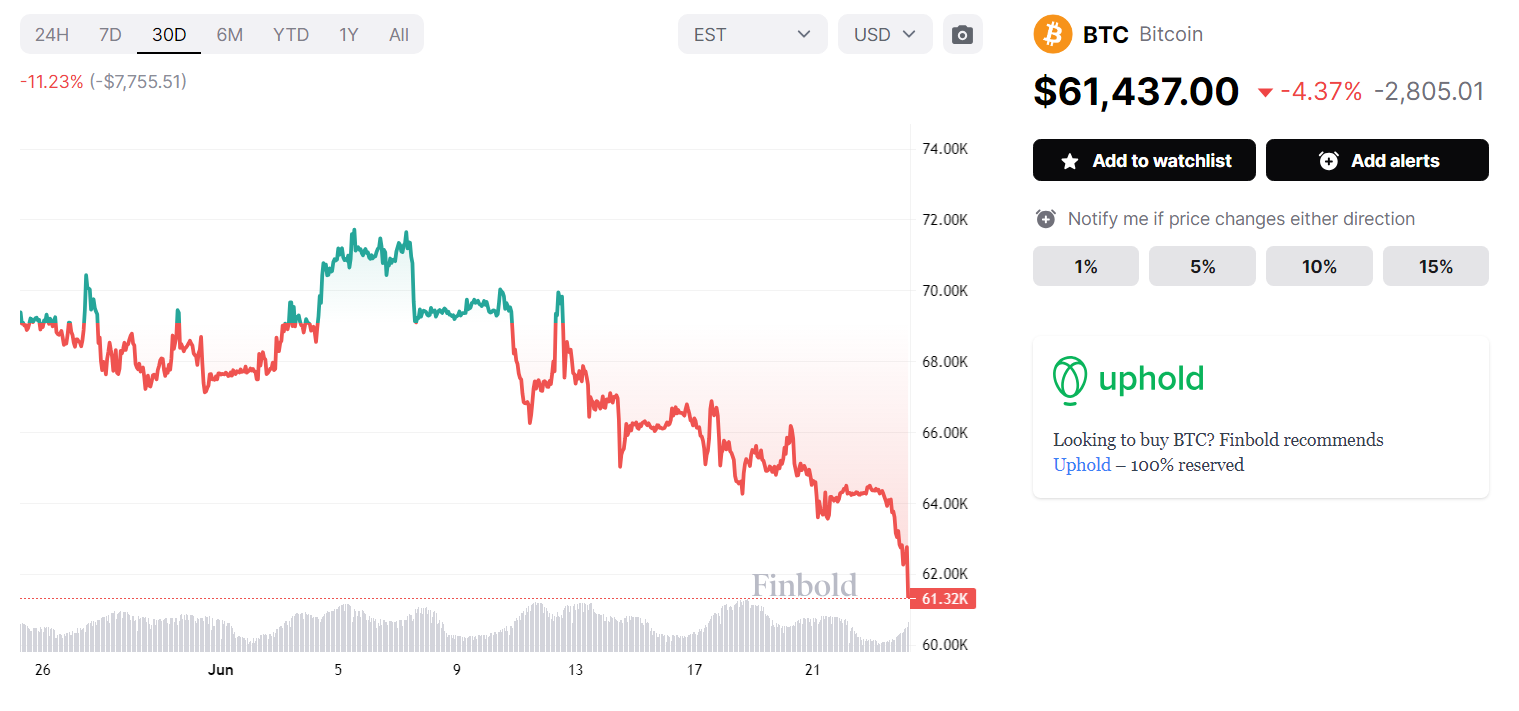

For a long way of the final 30 days, BTC has been on a downtrend and fell as phenomenal as 11.23%. Bitcoin tag this day stands at $61,437 – successfully below its multi-month average between approximately $65,000 and $67,000.

Whereas it is complex to positively establish the availability of the hot selling rigidity that prompted BTC to fall from correct below $67,000 to correct above $61,000, recent weeks beget featured several events seemingly to beget made traders ‘sell contented,’ leading to some $100 billion in losses within the time body.

Why is Bitcoin crashing?

Around the center of the month, the German authorities started depositing gigantic quantities of BTC seized in January to several cryptocurrency exchanges, in conjunction with Coinbase (NASDAQ: COIN), Kraken, and Bitstamp.

The switch mercurial prompted some issues among investors given the very fact that the Central European nation has as many as 50,000 Bitcoins to sell – an amount that will without advise trigger necessary tag disturbance.

Aloof, earlier authorities gross sales of great quantities of BTC – simplest exemplified with United States’ sale of fifty,000 Bitcoins seized from the sad web community Silk Facet street – show off that law enforcement offloadings are unlikely to consequence in tag dumps.

On the opposite hand, fears are seemingly to beget totally been fueled extra by the Would maybe maybe also news that the bankrupt cryptocurrency change Mt. Gox is poised to launch redistributing resources to its collectors and fully ignited by a June 24 confirmation the funds will launch in July.

On condition that this involves approximately $9 billion value of Bitcoin, there might be a hazard that this is able to presumably trigger sizable selling rigidity and a reach guarantee that the fears will consequence in real selling rigidity.

Germany is dumping $3B and now MtGox is dumping $9B Bitcoin. pic.twitter.com/O5zWlzr6iG

— Charles Edwards (@caprioleio) June 24, 2024

Along with the principle moves stemming from rather queer BTC whales, the low quantity reported at the launch of June is seemingly to beget amplified any tag modifications increasing from the gross sales.

Furthermore, the hot results of technical diagnosis (TA) performed by several excellent cryptocurrency consultants – results that hinted a substantial downtrend is incoming, would maybe presumably just beget extra spooked investors.

In a roundabout plot, the aforementioned optimistic tag targets – particularly coming within the wake of the Bitcoin halving, nevertheless additionally extra now now not too long within the past when Current Chartered launched the developing of a space BTC and Ethereum (ETH) shopping and selling desk – would maybe presumably just beget prompted traders to lose persistence and launch taking profits as the sphere’s predominant cryptocurrency stagnated reach $67,000 for added than one months.

Disclaimer: The announce material on this space would maybe presumably just light now now not be even handed as investment advice. Investing is speculative. When investing, your capital is in threat.