This day, Bitcoin reached a contemporary sage, efficiently recapturing the necessary-anticipated $70,000 stage—a threshold it had struggled to safe over the final four months.

Bitcoin has no longer simplest re-entered the $70,000 vary nonetheless is also progressing as we insist in direction of its all-time excessive. Particularly, it has hit an intraday excessive of $71,475 and continues to defend up its beneficial properties. Now, Bitcoin is upright 3.5% skittish of its peak of $73,750.

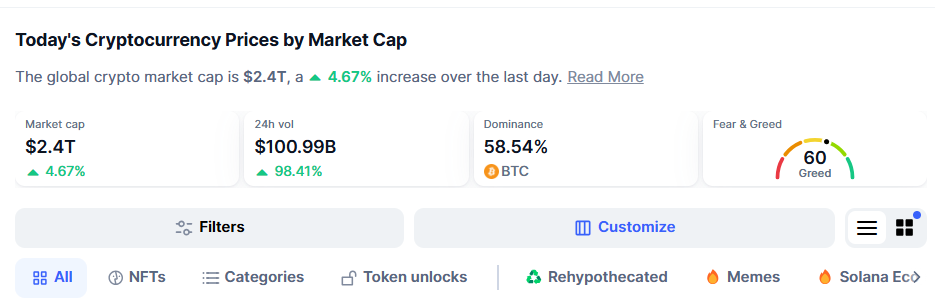

Bitcoin’s rally has been felt within the future of the crypto market. The realm market skilled a 4.56% amplify within the future of the last day, bringing it to $2.4 trillion. This reflects a contemporary influx of roughly $112.08 billion entering the market within the final 24 hours. Furthermore, market volume has surged by 89.41%, now standing at $100.ninety 9 billion.

This surprising pattern has prompted market contributors to steal into legend the factors within the relieve of the turnaround. Analytics platform CryptoQuant attributes the Bitcoin uptrend to very huge purchasing and selling activity, in particular from Binance whales—sizable merchants on the Binance alternate.

How Binance Whales Are Utilizing Bitcoin Tag

In an diagnosis this day, CryptoQuant market watcher Mignolet highlighted that Binance whales had been partaking on the market within the future of Asian purchasing and selling hours, initiating around October 14.

This activity has impacted the Coinbase Premium Hole (CPG) recordsdata, which tracks ticket variations between Coinbase and Binance—powerful exchanges for U.S. and worldwide merchants. As of this day, the CPG is declining even as Bitcoin’s ticket rises, exhibiting a “negative top class.”

Mignolet cautions against decoding this as a fall in U.S. search recordsdata from. Actually, since October 14, U.S. Bitcoin space ETFs bear seen heightened influx, with ranking influxes of about 47,000 Bitcoin—roughly $3.34 billion, given Bitcoin’s most modern market value above $71,000.

Additionally, most modern inflows into U.S. Bitcoin ETFs reached a six-month excessive, as reported by The Crypto Commonplace final week.

Mignolet extra accepted that CPG recordsdata closely tracks ETF search recordsdata from, as most ETF merchandise utilize Coinbase. Veritably, excessive U.S. search recordsdata from would pressure the CPG certain, nonetheless the negative top class as an different suggests that Binance whales are taking half in a central goal in using Bitcoin’s ticket. In distinction, U.S. search recordsdata from stays sturdy nonetheless isn’t fully reflected in Coinbase prices.

Actually, basically the most modern Bitcoin ticket is being influenced primarily by Binance whales, with solid enhance from precise U.S. capital inflows.