Digital sources-centered funding agency Pantera Capital is highlighting key causes for why they imagine the altcoin market is sad.

In its most current Blockchain Letter, Pantera Capital portfolio supervisor Cosmo Jiang says that macroeconomic prerequisites are hurting the crypto market along side fears over a present overhang and an enlarge in altcoin initiatives.

Jiang moreover says that the U.S. Securities and Change Commission’s (SEC) recent actions against blockchain pattern company Consensys and decentralized alternate (DEX) Uniswap (UNI) over alleged securities legislation violations created regulatory uncertainty for alt initiatives.

“We uncover a pair of macro-related and crypto-explicit causes for the decline. The predominant macro headwind in early April used to be the markets started repricing a scenario of elevated-for-longer rates due to a calm-assemble economic system and high inflation, not just like the prior ogle that there would possibly perhaps be a like a flash chop again in rates.

On the crypto facet, the markets had been weighed down primarily due to fears of a present overhang. For Bitcoin, the German government started liquidating its $3 billion location and the timeline of the $9 billion Mt. Gox distributions used to be confirmed. Long-tail tokens private faced present headwinds both from the enlarge in recent token launches, diversifying customers’ consideration and restricted capital, moreover as ongoing vesting of private customers from newly-launched tokens over the supreme Twelve months.

Besides to, SEC investigations into Consensys and Uniswap created some uncertainty for certain protocols.”

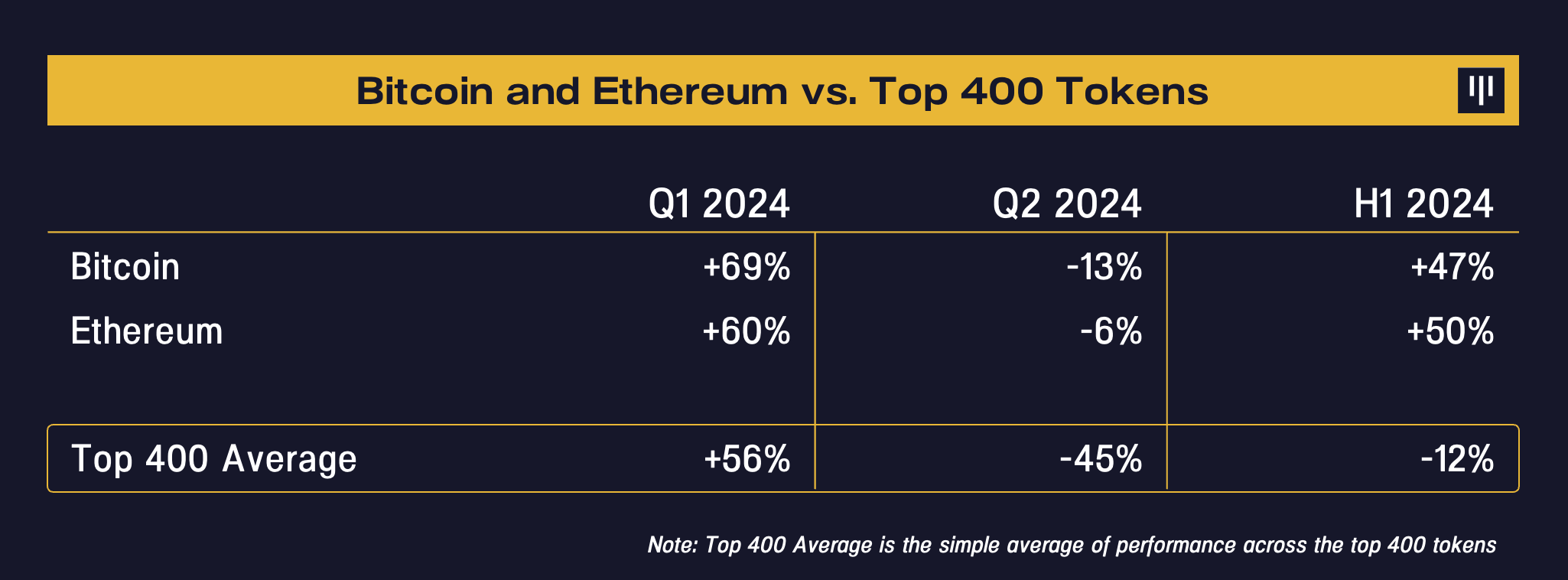

Jiang says that Bitcoin (BTC) and Ethereum (ETH) private vastly outperformed the broader crypto market to this level in 2024.

“Overall, breadth has been narrow and there has been vital underperformance Twelve months-to-date across the broader crypto landscape relative to Bitcoin and Ethereum, which is equivalent to the dynamic in equities this Twelve months, the Graceful 7 versus the remainder. To help illustrate this level, we have got included below the distributions of returns for the tip-400 tokens by market capitalization this Twelve months.”

Bitcoin is buying and selling for $65,314 at time of writing, up 1.6% in the supreme seven days. Meanwhile, Ethereum is buying and selling for $3,327 at time of writing, down nearly 2% in the supreme week.

Generated Image: DALLE3