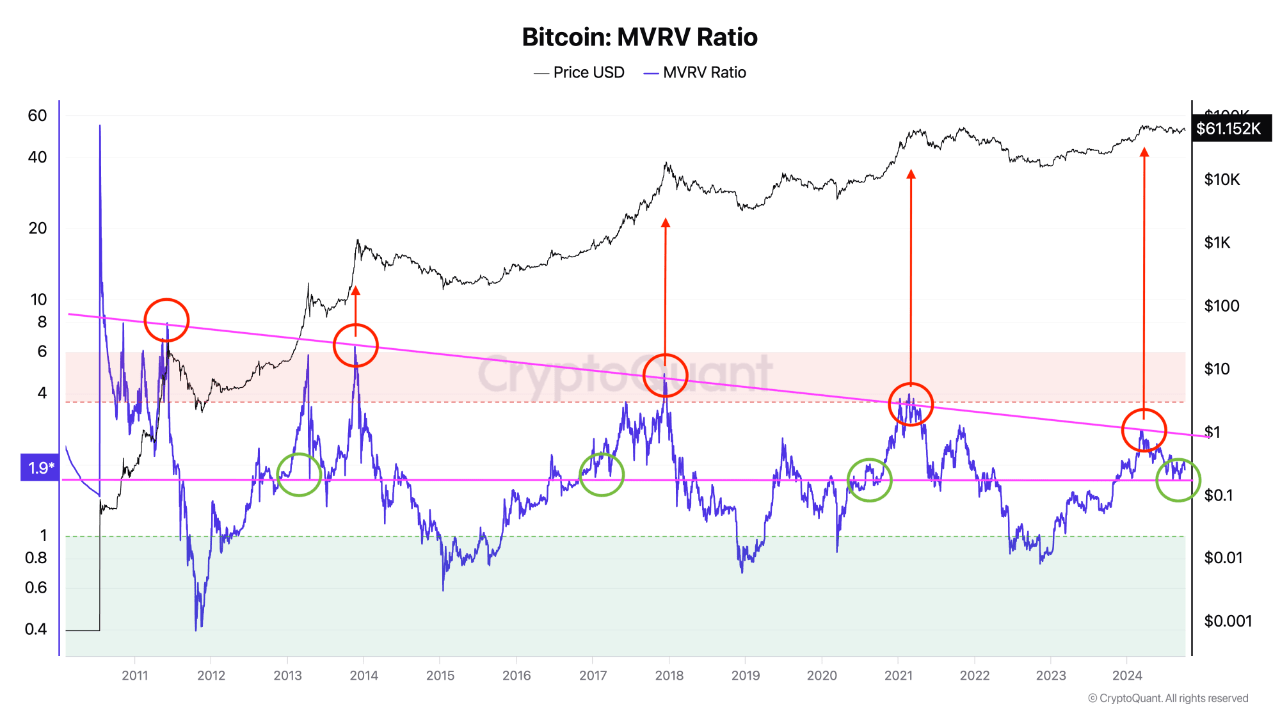

A CryptoQuant analyst the employ of the pseudonym “tugbachain” has currently shed light on a key vogue within the Bitcoin market. Posting on the CryptoQuant QuickTake platform, the analyst focused on the Market Value to Realized Value (MVRV) ratio, a considerable metric in the Bitcoin market.

In step with tugbachain, the MVRV ratio displays a historical downward vogue. Must still this vogue continue or pick up breached, it ought to also lead to a predominant affect on Bitcoin.

MVRV Ratio And Its Impending Impact On Bitcoin

The MVRV ratio, as explained by tugbachain, is a instrument feeble to gauge whether a cryptocurrency is overrated or undervalued. This ratio is calculated by evaluating the market designate to the realized designate of Bitcoin, providing insights into investor habits and market trends.

The analyst highlighted that the MVRV has confirmed distinguished in figuring out market tops, bottoms, and vital peaks and troughs over the years. The MVRV ratio has historically demonstrated three distinguished Bitcoin halving cycles, each and every marked by unfamiliar designate habits and investor sentiment.

The contemporary ratio sits spherical 1.9, with predominant reinforce noted at 1.75. The ask raised by tugbachain is whether breaking the downtrend would possibly lead to a upward thrust in the MVRV ratio to the 4-6 range, which has historically signaled a Bitcoin peak.

The analyst wrote in the post:

At the 2nd, the MVRV ratio displays a historical downtrend with predominant reinforce at 1.75. With the ratio now sitting at 1.9, the ask arises: if it breaks the downtrend and reverses the downtrend, would possibly it as soon as again climb to the 4-6 range, marking a Bitcoin peak as seen in earlier cycles?

BTC Market Performance And Technical Outlook

Bitcoin has seen heightened designate activity in contemporary weeks in the broader market context. The asset rallied above $66,000 closing week, sparking enthusiasm in the crypto community with hopes for a bullish October, playfully termed “Uptober.”

Then again, this upward momentum became as soon as rapid-lived, as BTC skilled a vital designate correction quickly after. Within the previous week on my own, Bitcoin has seen a decline of spherical 7.2%, falling to a trading designate of $61,496 on the time of writing.

Despite this correction, BTC has rebounded a minute bit of, posting a modest 1.9% prevail in over the last 24 hours. With the exception of tugbachain’s diagnosis, other crypto market analysts win offered extra perspectives on the MVRV ratio’s implications for BTC.

Ali, a excellent analyst on the social media platform X, has identified that the MVRV ratio’s habits since Could fair has severely impacted Bitcoin’s designate movements.

Ali seen that every and every rejection of the MVRV ratio from its 90-day moderate has historically ended in a predominant correction in Bitcoin’s designate. In step with Ali, the most contemporary rejection has already resulted in a 10% fall, suggesting the different of extra blueprint back stress.

Featured portray created with DALL-E, Chart From TradingView