What could perhaps well be the affect on XRP designate if SWIFT corridors migrated to RippleNet, Ripple’s XRPL-essentially based fee community?

Over the previous few years, XRP proponents and industry leaders dangle talked about whether or no longer XRP could perhaps well at closing work with SWIFT and even replace the community.

Might well possibly also XRP Work with SWIFT?

As an illustration, in 2015, Ripple Chairman Chris Larsen knowledgeable International Finance Journal that Ripple connects fee networks for right-time settlement in any foreign money and could presumably work alongside existing systems admire SWIFT or ACH.

Furthermore, earlier this year, Ripple CEO Brad Garlinghouse said XRP could perhaps well capture 14% of SWIFT’s volume inner 5 years.

Particularly, these comments dangle ended in an overview of how XRP designate could perhaps well react if SWIFT corridors, which facilitate the community’s funds, moved to RippleNet.

SWIFT Corridors

For context, SWIFT corridors represent instruct fee routes between financial establishments in numerous countries and currencies in some unspecified time in the future of the SWIFT community. SWIFT currently runs about 40,000 of those routes, covering greater than 150 currencies and greater than 200 countries and territories.

Recent files presentations the existence of about 40,000 total corridors in 2024. These corridors take care of about $150 trillion in wicked-border cost each and each year, equal to about 1.5x global GDP. Moreover, the community processes greater than 47 million day-to-day messages as of mid-2025.

Particularly, about 60% of wholesale funds reach in walk express accounts inner 1 hour after a SWIFT message goes out. Essentially the most frail currencies consist of USD at 50% of total cost, EUR at 23%, and CNY at decrease than 4% as of early 2025.

Meanwhile, SWIFT has also persisted to increase of leisurely. Day to day messages rose from about 32 million in 2015 to greater than 47 million in mid-2025. Moreover, annual cost is projected to reach $125 trillion in 2025, which marks 4% annual articulate. The community now moves an amount equal to global GDP roughly every 3 days. SWIFT also announced ISO 20022 migration in November 2025.

XRP Sign if SWIFT Corridors Migrated to RippleNet

Pondering this scale, we no longer too lengthy ago assessed how the crypto asset could perhaps well react if SWIFT corridors at closing migrate to RippleNet, with XRP procuring and selling at $2.04 on the time of research. To web an overview, we turned to Google Gemini.

Gemini modeled what would happen if RippleNet handled your total $150 trillion in annual flows. It outlined that this type of mannequin must accept as true with in mind each and each transaction utility and the liquidity depth establishments require to handbook obvious of heavy designate swings. In numerous words, the asset must accept as true with ample market cost to settle global funds with out excessive volatility.

In step with Gemini, $1150 trillion in volume per year equals about $410.9 billion per day. Meanwhile, analysts frequently apply a “liquidity multiplier” in these calculations.

In usual utility systems, instant settlement permits decrease prices for the reason that asset moves continuously per day. However, in institutional systems, deep liquidity matters. Outmoded FX markets frequently accept as true with market values 10x–20x day-to-day volume. Which capability that, Gemini frail a 15x multiplier.

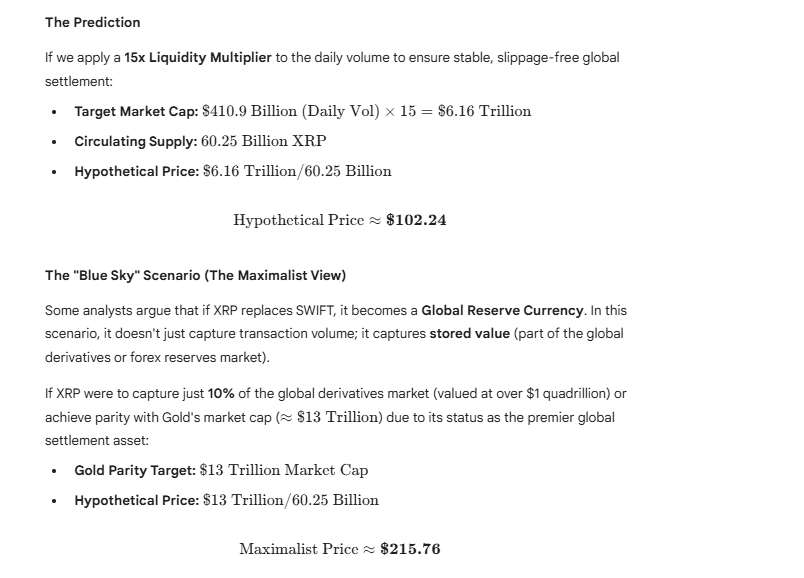

A $410.9 billion day-to-day requirement multiplied by 15 produces a hypothetical market cap of $6.16 trillion. With a circulating provide of 60.25 billion XRP, this mannequin locations the token at around $102.24.

Meanwhile, a extra bullish outlook considers global reserves and derivatives. If XRP captured 10% of the worldwide derivatives market, which exceeds $1 quadrillion, or matched gold’s $13 trillion market cap, the mannequin locations XRP at about $215.76.

Here’s What 3,000 and 7,000 XRP Will be Price

This presentations how a lot retail holders could perhaps well catch if this impolite scenario performs out, especially for those retaining 3,000 to 7,000 XRP. At the moment prices, 3,000 XRP price $6,120 could perhaps well leap to $300,000 to $645,000. This affect greater would give the holder earnings of $293,880–$638,880.

Meanwhile, traders with 7,000 XRP, currently valued at $14,280, could perhaps well watch their holdings climb to $700,000 to $1.505 million, surroundings up earnings of $685,720 to $1.49 million.

However, these projections rely on XRP capturing 100% of SWIFT’s volume and bid establishments would accept as true with XRP in living of procuring and the usage of it inner seconds.

This scenario remains no longer going, especially since SWIFT continues to stumble on blockchain strategies similar to a SWIFT-issued blockchain whereas ignoring the XRPL. These projections also affect no longer element in competition from CBDCs and private stablecoins, which now pursue same settlement aims.