XRP team pick Chad Steingraber as of late suggested that by the stop of 2026, all mixed XRP ETFs would possibly per chance per chance perhaps enact the largest first-300 and sixty five days proportion accomplish in Wall Avenue history.

If this sort of milestone involves cross, the affect on XRP’s label would possibly per chance per chance perhaps even be dramatic. This article examines the build XRP’s label would possibly per chance per chance perhaps realistically land by the stop of 2026 below this scenario.

XRP ETFs Are Already Surroundings Files

XRP ETFs are already posting account-breaking inflows, involving XRP present at an out of the ordinary fee. As an instance, Canary Capital opened on November 14 with a first-day inflow of $243 million.

Per Bloomberg senior analyst Eric Balchunas, this used to be the largest first-day turnover of the over 900 ETFs that entered the market in 2025.

Meanwhile, the momentum has persevered, with constant each day inflows since that day and no outflows recorded all the plan in which throughout the 15 days of trading. Various ETFs have joined alongside the road, including Bitwise, Grayscale, and Franklin Templeton.

Together, these XRP ETFs have pulled in inflows of $897.35 million, amassing over 430 million XRP. Particularly, this additionally represents one other account for the XRP ETF market.

In explain, XRP ETFs have emerged because the 2d-quickest crypto ETFs to hit the $800 million inflow milestone. Inflows are now drawing shut the most most distinguished $1 billion target.

Such inflows minimize liquid circulating XRP, assassinate bigger competitors for space present, and flee label discovery.

Meanwhile, extra XRP ETFs are on the horizon from WisdomTree and 21Shares. Accordingly, Steingraber predicts that, by the stop of 2026, the mixed XRP ETFs would possibly per chance per chance perhaps enact the absolute best first-300 and sixty five days proportion gains in Wall Avenue ETF history.

What Could well per chance This Mean for XRP’s Tag?

Harmful Case for XRP Tag

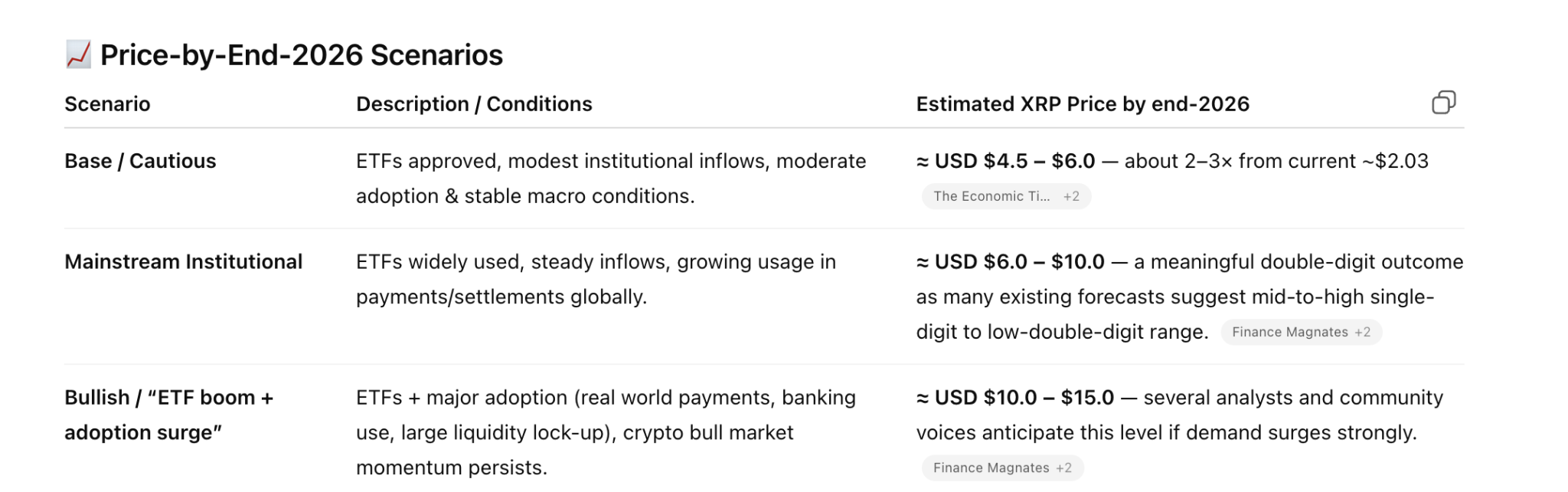

Per an diagnosis by OpenAI’s mannequin, ChatGPT, if ETF adoption grows incessantly but stays within sensible bounds, XRP would possibly per chance per chance perhaps stop 2026 in the $4.50 to $6 vary. This assumes a exact float of resources below administration and a supportive macro environment.

In this scenario, XRP doesn’t need explosive enhance to outperform. The asset simply wants its ETFs to defend tough inflows and note a broader crypto uptrend all the plan in which through 2026.

Mid-Vary Bullish Scenario

The mannequin additionally suggests that if XRP ETFs no longer totally attach effectively but replicate the early surge viewed in Bitcoin ETFs, mixed with increasing utility in funds and inferior-border settlements, costs in the $6 to $10 vary are a sensible outlook.

This scenario relies on deeper institutional publicity, diminished alternate liquidity, and XRP’s usefulness in settlement gaining mainstream recognition.

High-Stop Scenario: Checklist ETF Yr Creates a Excellent Storm

Particularly, Chad Steingraber’s prediction implies one thing a ways larger than in vogue success. A account-atmosphere ETF performance would require intense inflows, global ask, and crucial present compression. Steingraber argues that XRP ETFs would possibly per chance per chance perhaps absorb half of of XRP’s present in one 300 and sixty five days.

In that environment, XRP’s label would possibly per chance per chance perhaps push into the $10 to $15 vary by the stop of 2026.

Meanwhile, the mannequin suggests that if global institutions treat XRP as a huge-scale liquidity asset, costs would possibly per chance per chance perhaps even exceed these larger estimates. Nonetheless, such outcomes depend closely on out of the ordinary adoption.

Opposing Views

Some market contributors reacting to Steingraber’s put up pointed out that first-300 and sixty five days ETF records are no longer in actuality about proportion gains but about resources below administration (AUM).

X consumer OGA NFT argued that even if XRP ETFs 10x from here, they’d silent be shrimp when put next with the records put by gold and Bitcoin. For context, Bitcoin ETFs pulled in over $50 billion in one 300 and sixty five days.

Per OGA NFT, the genuine inquire is whether XRP ETFs would possibly per chance per chance perhaps even attain $5 billion AUM to compete with Bitcoin and gold.

First-300 and sixty five days ETF records are no longer in actuality about proportion gains – they’re about resources below administration (AUM).

Even supposing XRP ETFs 10x, they’d silent be shrimp vs gold/BTC.

The genuine inquire: can they crack $5B AUM to compete?

— OGA NFT (@OGA_Studio) November 22, 2025

Particularly, while account inflows in Bitcoin ETFs helped its label inferior $100K, identical account ETFs in Ethereum have failed to vastly affect the label of ETH. This raises questions in regards to the particular affect of ETFs on XRP’s label.

Furthermore, for the reason that ETF accumulation in November, XRP’s label has dipped as adversarial to surged.