Amid the continuing Shiba Inu market turbulence, crypto analytical legend Rose Top price Indicators identifies a couple of key stages to gaze.

After a convincing showing in November 2024 and early December 2024, main domestic dog-themed memecoin Shiba Inu (SHIB) has seriously slowed its roll amid a market-wide correction sparked by statements from the Federal Reserve.

As the market uncertainty prevails, one analyst has equipped perception on key stages the neighborhood ought to gaze.

Key Shiba Inu evels

On the time of writing, Shiba Inu is trading at $0.00002238, up 20% from lows of $0.00001853 on Friday. Unruffled, the asset stays down 17% in the previous seven days and about 50% from its native highs of $0.00003343.

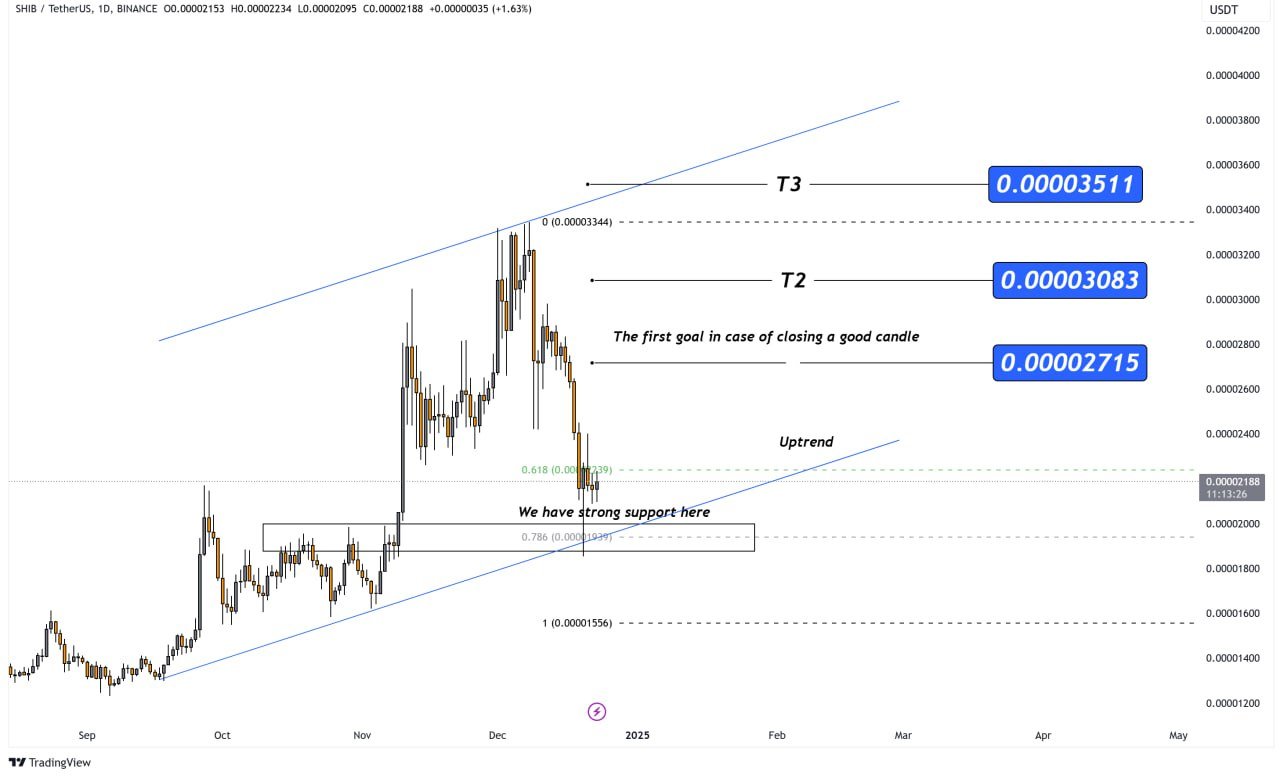

In an X submit on Monday, December 23, Rose Top price Indicators highlighted that the meme coin’s label has been forming a imaginable ascending channel on its day to day candle chart since gradual September 2024.

In holding with the diagnosis, key toughen is in the indicate time inner the $0.00001939 and $0.00002139 label differ, which aligns with the 0.618 and nil.786 Fibonacci retracement stages.

The Rose Top price signal instructed that a correct jump may also detect Shiba Inu surge to targets of $0.00002715, $0.00003083, and in the raze $0.00003511, representing a 21%, 38%, and 57% surge, respectively, from fresh prices. Unruffled, the diagnosis warns of resistance at the $0.00003083 and $0.00003511 targets.

Analysts Live Optimistic

The fresh Rose Top price signal is one in a sea of positive outlooks for SHIB, suggesting that analysts dwell optimistic no subject the fresh market correction. As an instance, “Greenbacks Maker” honest recently contended that SHIB changed into poised for a possible 235% surge to the $0.00005816 label level.

These optimistic label views align with thrilling developments in the SHIB neighborhood. Most honest recently, the Shiba Inu ecosystem has inked a partnership with Chainlink, making the token accessible across 12 blockchains and introducing a fresh burn mechanism to extra gash the provision.