Fundstrat’s head of overview Tom Lee says there are four astronomical indicators backing up the basis that the stock market is in the center of a bullish reversal.

In a new video update on Fundstrat’s YouTube channel, Lee starts off by noting that on April Twenty fourth, a Zweig breadth thrust used to be introduced about on the S&P 500 index.

The Zweig breadth thrust is an indicator that attempts to detect the early stages of a seemingly bull speed by dividing the 10-day fascinating moderate of the number of advancing shares by the total number of shares.

Lee says that the Zweig breadth thrust has practically continually signaled drawing close stock market rallies.

“That has befell 11 cases since 1978 and particularly, one month, six months and 300 and sixty five days later, stock markets are continually up. And this used to be introduced about on April 24.”

Secondly, Lee notes that the excessive yield alternate choices adjusted spreads (OaS) retraced 50% of its widening on April Twenty third. A disquieted of credit score spreads – the variation in yield between riskier junk bonds and “probability-free” authorities bonds – in total signals steadiness and healthy investor probability appetite.

“That’s a decided trend because we are essentially walking aid from a recession probability. If excessive yield spreads had long gone from 500 [basis points] to 1,000, a recession used to be guaranteed, but as a change it’s reversed practically the total widening aid to even ranges sooner than April 2nd.”

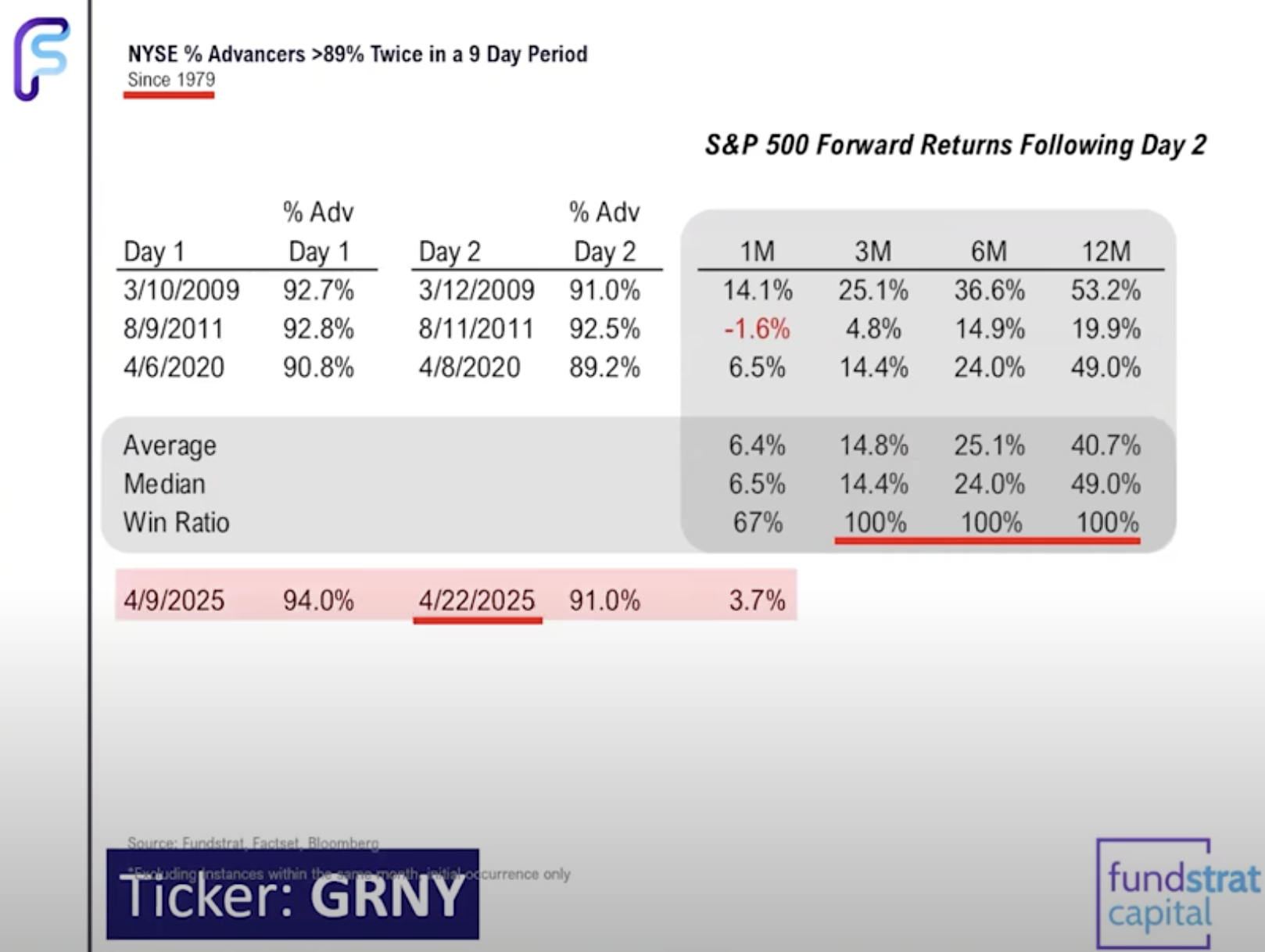

Lee additionally says that the S&P 500 saw two straight days the establish 90% of the S&P 500 shares rallied, an tournament that has historically ended in extra upside.

“That formula that shares, inside of about a days apart, had posted two days the establish the advancing beneficial properties were 90% or more. As you might likely additionally scrutinize right here, three cases since 1979, shares are greater three, six and 300 and sixty five days later.”

Lastly, the investor takes display conceal of the volatility index (VIX) – a measure of market volatility in accordance to facts from the Chicago Board Solutions Switch – closing beneath the 31 stage.

In response to Lee, the VIX is now signaling a plunge off in future volatility and sure energy for equities.

Generated Image: Midjourney