Helium (HNT) worth has displayed a bullish bias on the day-to-day chart. HNT worth fashioned fixed inexperienced candles this month and over the past 7 days.

Intraday, Bitcoin (BTC) lost withhold of the $58000 degree, and diversified worthy avid gamers also traded in the purple. No subject a dreary market outlook, at the time of writing, HNT soared 3.fifty three% in the past 24 hours and is presently trading at $7.28.

The enviornment crypto market cap displayed a 1.Seventy nine% lower to $2.09 Trillion intraday. Market quantity is down 12.17% to $66.33 Billion.

The associated price stayed on tune this month with the 20-day EMA acting as enhance. The bullish momentum is rising because the histogram turns bullish, and the RSI jumps from the center line at 59.60.

How the Helium Ecosystem is Scaling — An Overview

Helium Cell has strengthened its discipline and has displayed well-known strides in the telecommunications sector. HNT has proven a healthy style owing to Helium’s powerful DePIN story.

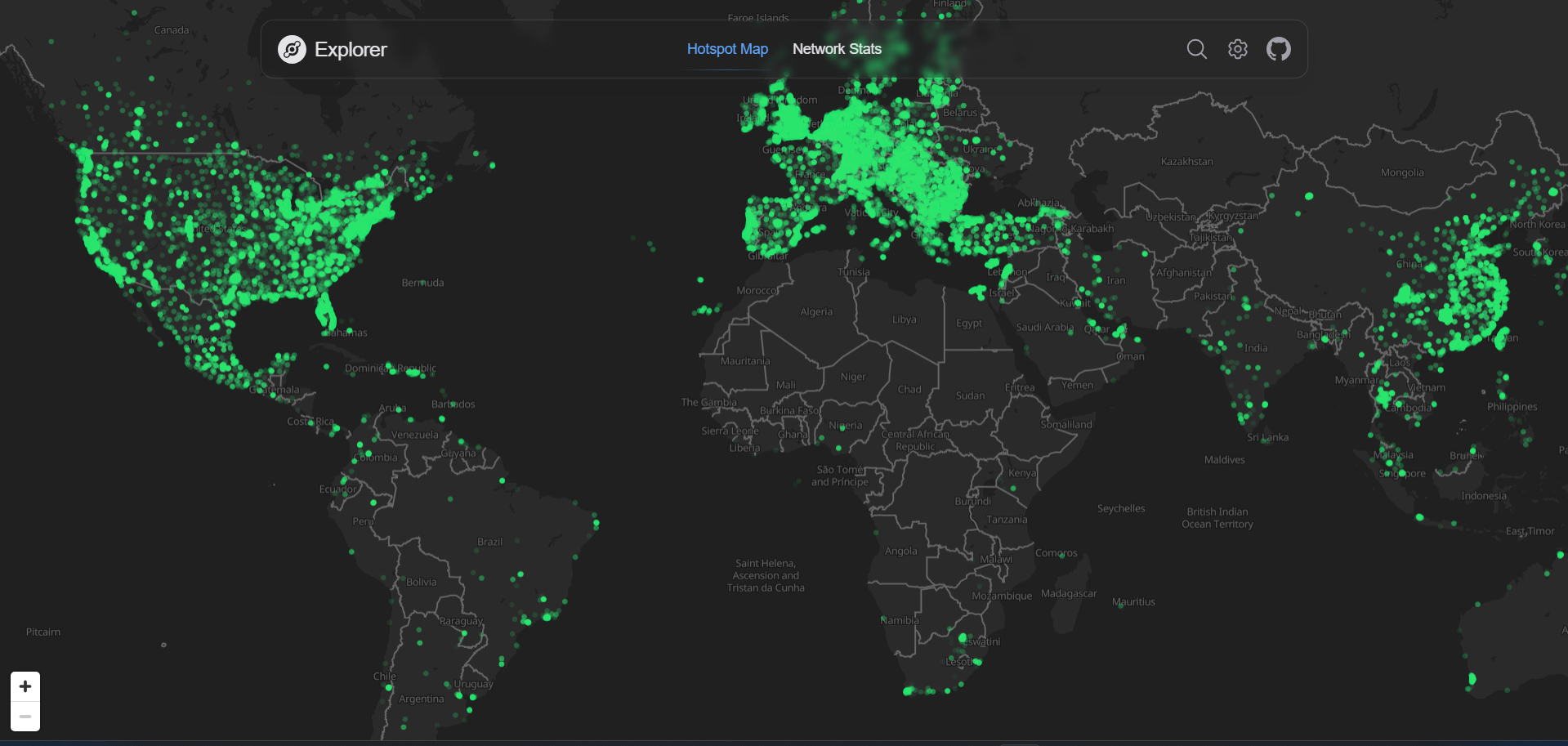

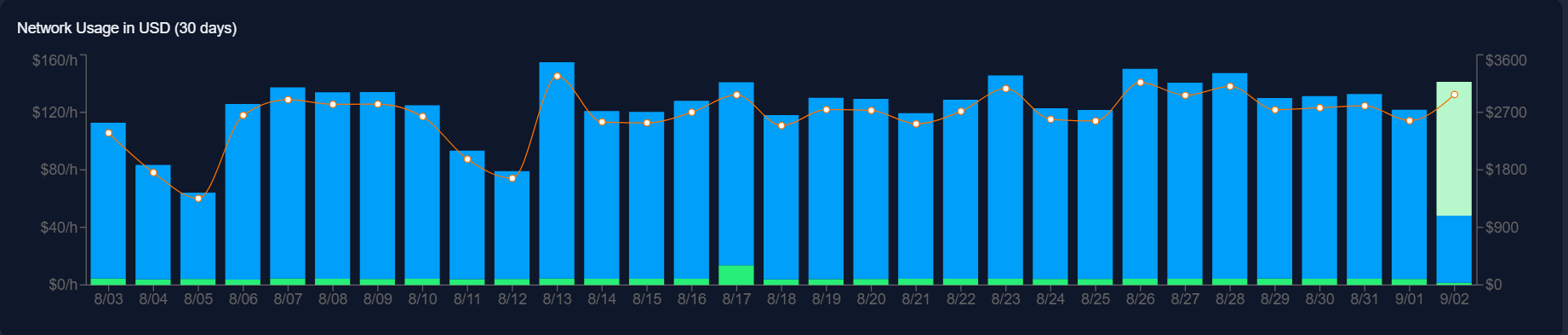

Per the Helium web pages, the Hotspot blueprint confirmed that its network has grown significantly and has more possible. The Helium Cell network usage in the final 30 days has proven traits. As of September 2nd, the estimated day-to-day entire usage would attain nearly $3175.62.

Community statistics prove that Helium IOT active Hotspots get grown to 357,007. The Helium Cell hotspots get grown to 20687.

Implications of Helium Ecosystem Increase on HNT Label

HNT’s day-to-day chart is a hive of process. Since 2023’s final quarter, the worth is up over 700%, peaking at $11.160 from the $1.429 serious query discipline by the principle quarter of 2024.

Thereon, the worth motion displayed instability, because the income takers had been on a discipline day. After mid-February, HNT slipped for nearly 146 days, which created a falling wedge formation.

On July 15th, 2024, the worth ended its broader bullish fragment. This breakout paved the methodology for an even bigger-excessive spree.

The $3.3-$3.5 query zone facilitated the present style. At some level of the last week, fixed features of 17% had been recorded, whereas this month, it displayed 57.27% features.

The associated price over the long high-tail appears to be like optimistic, because it remained above the 50-day and 200-day EMA bands in August. $8.forty five and $9.47 are determined targets for the flee ahead.

There’s an even bigger likelihood that the crypto will soar nearly 100%, reaching $14 by yr-quit. Nonetheless, if the worth gets deflected by the $8.0 degree, bears will location sights at $5.5 and $4.0 as enhance stages, respectively.