Hedera Foundation’s unique fade to accomplice with Zoopto for a late-stage present to produce TikTok has sparked renewed investor hobby in HBAR, riding a peculiar wave of ask for the altcoin.

Market participants have grown increasingly bullish, with a notable uptick in long positions signaling rising self belief in HBAR’s future price efficiency.

HBAR’s Futures Market Sees Bullish Spike

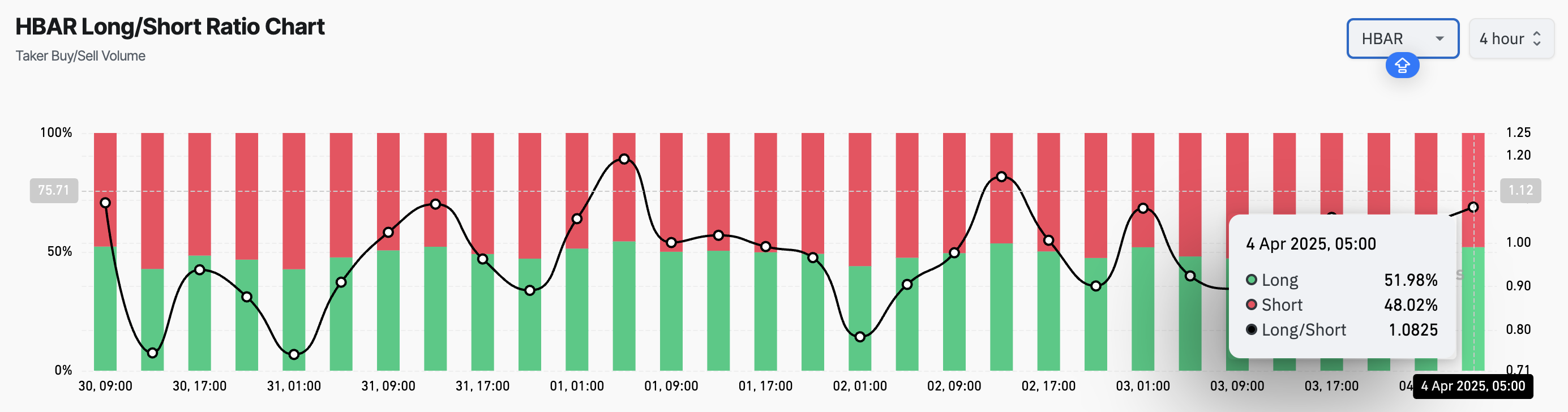

HBAR’s long/short ratio at display sits at a month-to-month high of 1.08. Over the last 24 hours, its price has climbed by 17%, reflecting the surge in ask for long positions among derivatives traders.

An asset’s long/short ratio compares the proportion of its long positions (bets on price increases) to short ones (bets on price declines) within the market.

When the long/short ratio is above one worship this, more traders are conserving long positions than short ones, indicating bullish market sentiment. This means that HBAR traders are looking ahead to the asset’s price to upward push, a pattern that would drive trying for activity and field off HBAR’s price to develop its rally.

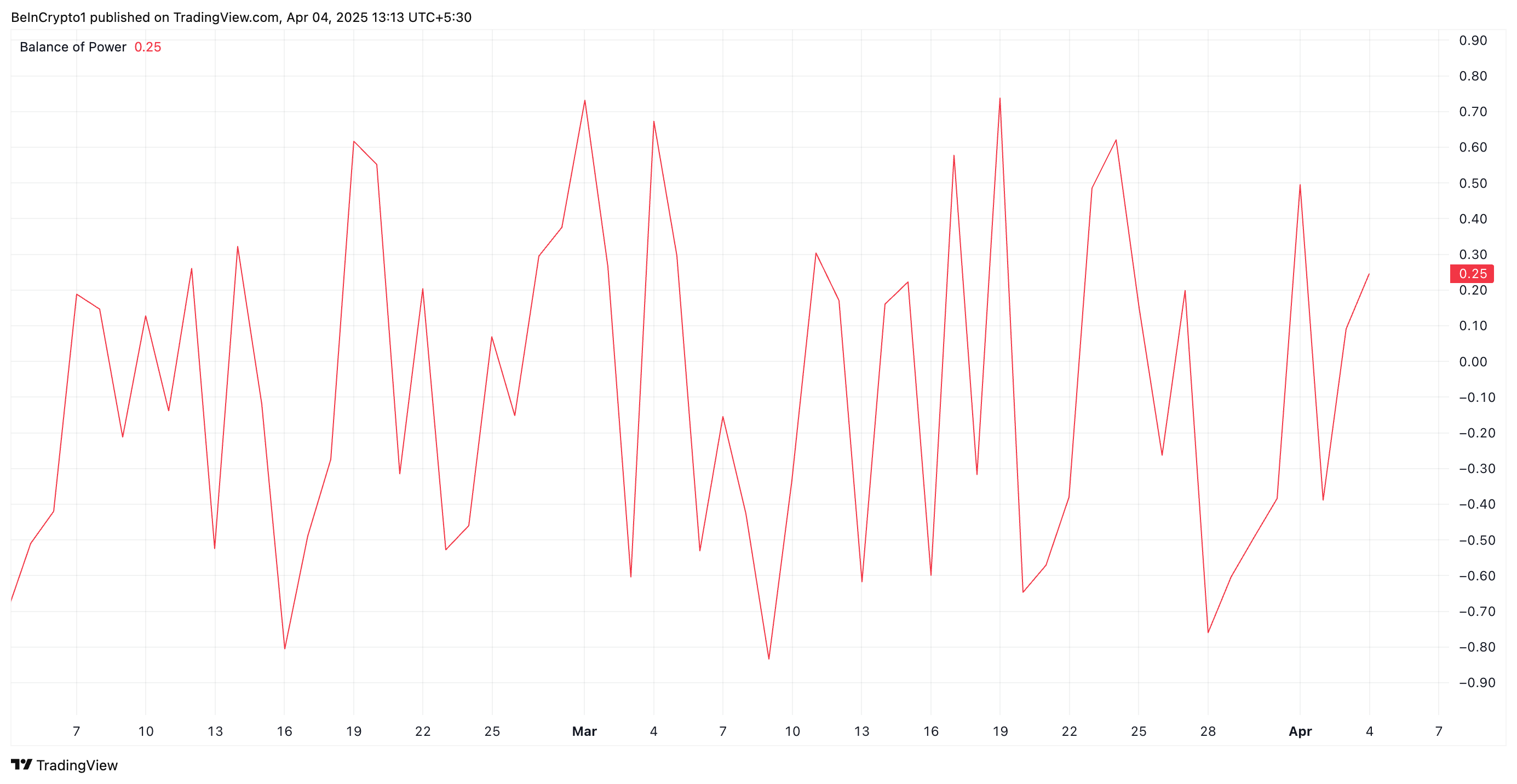

Extra, the token’s Balance of Energy (BoP) confirms this bullish outlook. At press time, this bullish indicator, which measures trying for and selling stress, is above zero at 0.25.

When an asset’s BoP is above zero, trying for stress is stronger than selling stress, suggesting bullish momentum. This means HBAR traders dominate price action, and are pushing its price higher.

HBAR Merchants Push Serve After Hitting Multi-Month Low

Eventually of Thursday’s shopping and selling session, HBAR traded temporarily at a four-month low of $0.153. Nonetheless, with strengthening trying for stress, the altcoin appears to be correcting this downward pattern.

If HBAR traders consolidate their take care of watch over, the token could perchance perchance flip the resistance at $0.169 real into a make stronger floor and climb toward $0.247.

Nonetheless, a resurgence in profit-taking activity will invalidate this bullish projection. HBAR could perchance perchance resume its decline and descend to $0.129 in that scenario.