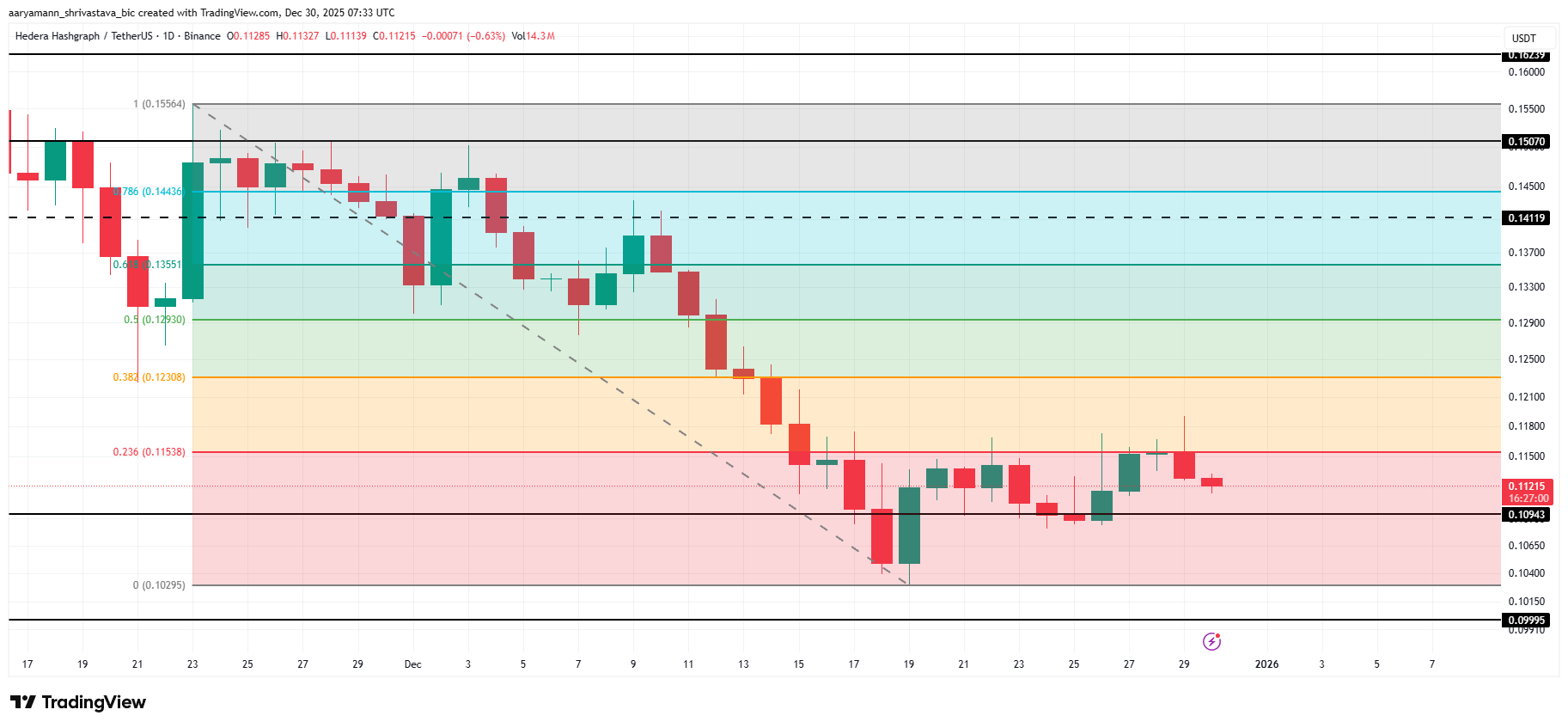

Hedera has attempted a modest recovery in present sessions, but HBAR remains capped below a key technical barrier. The altcoin continues to alternate below the 23.6% Fibonacci Retracement stage, limiting upside momentum.

While Hedera is getting ready structural changes for 2026, investors live centered on whether these inclinations can meaningfully affect HBAR label performance.

Hedera Hikes Its Carrier Rate

Hedera announced in July that this may per chance well create bigger its ConsensusSubmitMessage transaction fee by 800% initiating January 2026. The associated fee will upward thrust from $0.0001 to $0.0008. ConsensusSubmitMessage transactions allow users to put up recordsdata to the Hedera network for trusted timestamping and ordering.

🚨Indispensable update for Hedera users🚨

📢 Starting Jan 2026, #Hedera’s ConsensusSubmitMessage label strikes from $0.0001 → $0.0008 (USD fastened).

Why?

✔️ Long-term sustainability

✔️ Predictable pricing

✔️ Peaceable one in every of the bottom-fee alternate suggestions in Web3— Hedera (@hedera) July 24, 2025

Despite the magnitude of the proportion create bigger, completely the fee remains minimal. Industry contributors have faith debated the precedent of higher network costs, but the trade is now not going to materially have faith an affect on set aside a question to. The associated fee adjustment basically targets enterprise expend circumstances and would now not considerably alter the fee construction for most applications or users.

Hedera Holders Are More Bearish Than Bullish

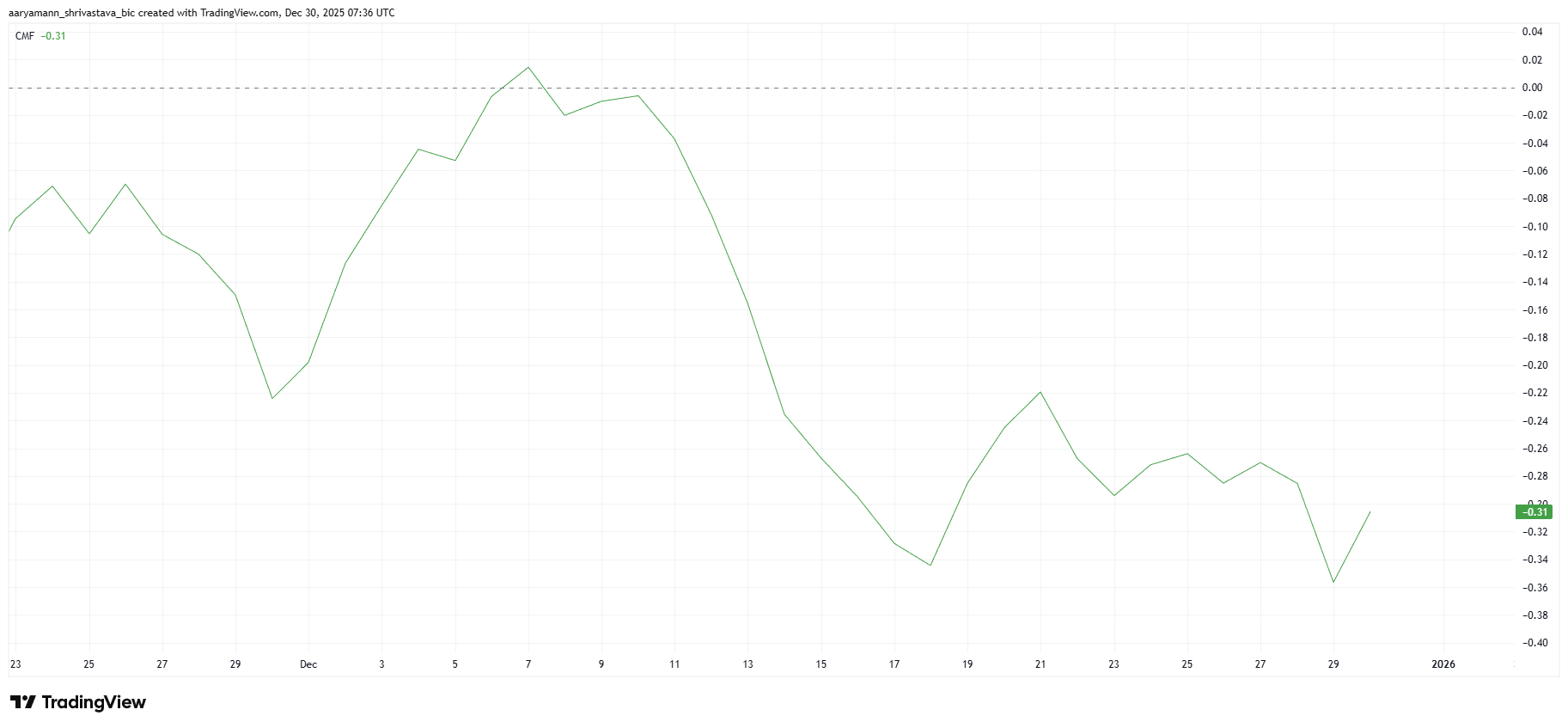

Technical indicators replicate a cautious to bearish investor outlook. The Chaikin Cash Waft, or CMF, remains neatly below the zero line, signaling sustained capital outflows from HBAR. This means that investors are reducing publicity in preference to positioning for a recovery.

The absence of real bullish macro indicators has bolstered this style. Risk appetite across altcoins remains muted, and HBAR has now not attracted consistent inflows. Given present stipulations, this bearish capital drift dynamic is more likely to persist into 2026 except broader sentiment improves materially.

Prefer extra token insights love this? Signal in for Editor Harsh Notariya’s Each day Crypto Newsletter here.

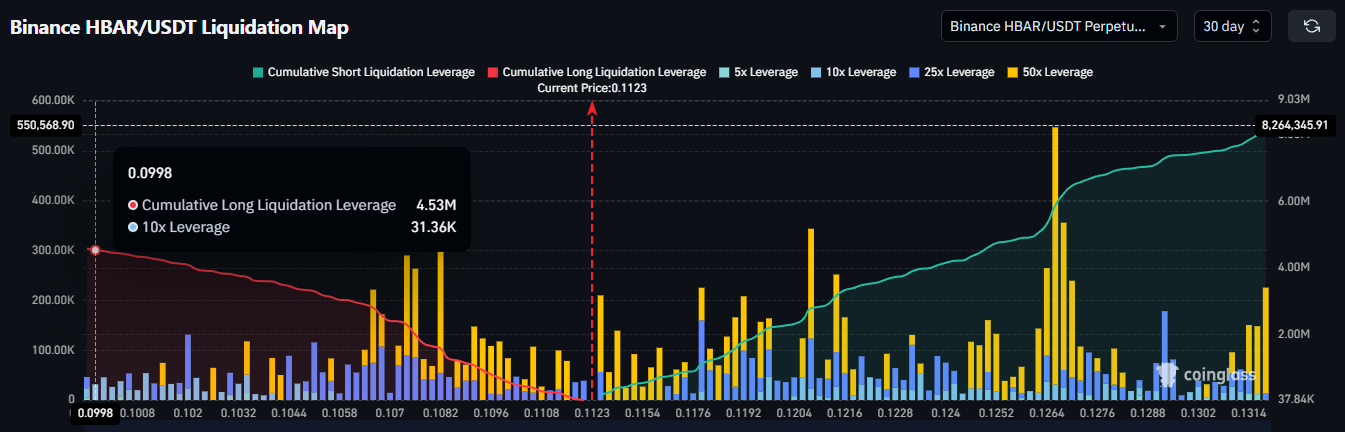

Derivatives recordsdata additional highlights ragged macro momentum. The liquidation procedure shows that merchants are positioning for downside threat. Short publicity in HBAR currently stands stop to $8.21 million, while lengthy publicity is considerably decrease at roughly $4.5 million.

This imbalance indicates that bearish contracts dominate market positioning. Merchants appear extra assured in a potential label decline than a sustained rebound. Such skewed positioning in most cases amplifies downside volatility, in particular all over sessions of low liquidity or negative market catalysts.

HBAR Rate Desires To Flip This Excessive Level Into Enhance

HBAR trades at $0.112 at the time of writing, keeping above the instantaneous $0.109 strengthen stage. Nonetheless, label remains constrained below the 23.6% Fibonacci Retracement line stop to $0.115. This confluence continues to act as a real resistance zone, limiting upward progress.

The existing technical and on-chain indicators point out that any recovery strive will likely live shallow. Consolidation above $0.109 looks extra attainable than a decisive breakout for HBAR. This differ-sure habits shows ragged set aside a question to and restricted speculative hobby below present market stipulations.

A shift within the broader cryptocurrency market would maybe per chance alter this outlook. If macro stipulations flip decisively bullish, HBAR would maybe per chance also wait on from renewed threat appetite. Flipping the 23.6% Fibonacci stage into strengthen would ascertain a recovery transfer, opening a potential course toward $0.120.

The put up Hedera’s 800% Rate Hike in 2026: Will It Undergo Impact on HBAR’s Rate? looked first on BeInCrypto.