Hedera (HBAR) appears to be like to be to be regaining market energy after weeks of cautious shopping and selling, with renewed investor self assurance viewed across each and every instruct and futures markets. The token has climbed to $0.21137, bettering technical momentum and signaling the functionality starting up of a sustained recovery segment. As investors live up for the debut of the Hedera alternate-traded fund (ETF) on the Original York Stock Swap, the market outlook continues to brighten, suggesting that HBAR might merely lengthen its upward trajectory into the final quarter of 2025.

Strengthening Fundamentals and Market Structure

HBAR’s label recovery follows a sturdy rebound from its October lows arrive $0.09, mountain climbing over 120% in recent weeks. The token now trades above key exponential engaging averages the 20, 50, 100, and 200 EMAs suggesting a decisive shift in vogue direction. This alignment usually signals a solid bullish setup, supported by improved shopping and selling volumes and renewed investor participation.

Connected: Bitcoin Effect Prediction: Fed QT Dwell And Trump–Xi Summit Establish $118K In Play

Furthermore, the 4-hour chart highlights that HBAR has reclaimed the $0.20 level, which had beforehand acted as heavy resistance. Sustaining closes above this zone might propel prices toward $0.23 and potentially $0.25. Conversely, any failure to tackle the $0.19 strengthen might trigger temporary corrections toward $0.18 or $0.16.

Commence Hobby and Derivatives Exercise

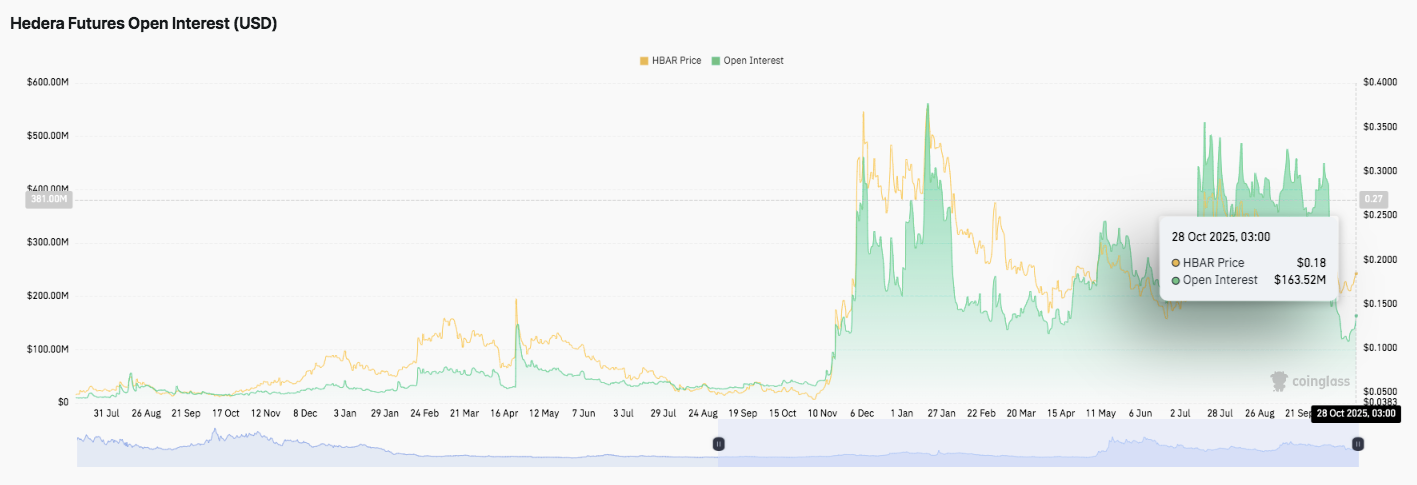

Beyond instruct label motion, Hedera’s derivatives knowledge reflects engaging provider sentiment. Commence hobby, which had peaked above $500 million earlier in 2025 when HBAR neared $0.35, has since declined to $163.52 million. This reduction suggests a decrease in speculative leverage and a extra organic, instruct-driven market recovery. The cooling leverage might merely now provide a extra healthy foundation for sustained enhance if question continues to upward thrust.

ETF Commence Expected to Amplify Procuring Stress

Together with to the bullish setup, Canary Capital is determined to debut its Hedera and Litecoin instruct ETFs on the Original York Stock Swap on Tuesday. The itemizing marks a milestone for HBAR, offering feeble investors instruct publicity to the asset by contrivance of regulated markets. Market observers mediate the ETF debut might enhance liquidity and toughen institutional adoption, echoing the obvious sentiment viewed with earlier instruct crypto ETF launches.

Confirmed. The Swap has just correct posted itemizing notices for Bitwise Solana, Canary Litecoin and Canary HBAR to starting up TOMORROW and grayscale Solana to convert the day after. Assuming there’s no longer some last min SEC intervention, looks adore this is going down. https://t.co/bHwRnc1jsn

— Eric Balchunas (@EricBalchunas) October 27, 2025

Furthermore, Eric Balchunas, Bloomberg’s senior ETF analyst, has confirmed the alternate’s itemizing notices, alongside Bitwise’s Solana ETF, signaling big market readiness. With loads of digital asset ETFs launching concurrently, traders live up for increased volatility and shopping and selling volumes across the broader crypto market.

Technical Outlook for Hedera Effect

Key levels live successfully-defined heading into November:

- Upside targets: $0.2134, $0.2333, and $0.2518 help as instantaneous hurdles for bullish continuation. A decisive breakout above the 0.786 Fibonacci level at $0.2029 might lengthen the rally toward $0.28 within the upcoming sessions.

- Downside levels: $0.1919 (200 EMA) acts as preliminary strengthen, followed by $0.1791 (0.618 retracement) and $0.1619. A fall below these zones might invite a deeper retest toward $0.1457, the place ancient procuring for hobby remains active.

- Resistance ceiling: $0.2333 represents a excessive resistance level aligning with a earlier swing high. Flipping this level would ascertain medium-time duration bullish momentum and potentially starting up the path to $0.25–$0.28.

Will Hedera Retain Its Momentum?

Hedera’s label construction reveals a solid bullish recovery following weeks of consolidation. The token’s skill to encourage above $0.20 remains compulsory for sustaining the upward bias.

If momentum persists with better shopping and selling quantity, HBAR might retest $0.25 and lengthen toward $0.28 in November.

Connected: Dogecoin Effect Prediction: Market Braces For Breakout With $812M Alternatives Spike

Nonetheless, a day-to-day shut below $0.19 would weaken temporary self assurance and likelihood revisiting decrease strengthen zones. For now, Hedera remains in a pivotal accumulation segment, with traders carefully defending key engaging averages whereas waiting for continued energy.

Disclaimer: The suggestions offered listed here is for informational and tutorial capabilities most fascinating. The article doesn’t portray monetary advice or advice of any form. Coin Edition is just not any longer liable for any losses incurred as a results of the utilization of stammer, products, or products and services talked about. Readers are suggested to exercise warning prior to taking any motion connected to the company.