HBAR has remained in a chronic interval of consolidation, with restricted snort over the final two months. Its repeated makes an try to procure away of the $0.40 resistance level agree with failed, dampening trader sentiment.

This lack of upward momentum has resulted in rising skepticism in the market concerning the token’s non permanent efficiency.

HBAR Traders Switch Their Idea

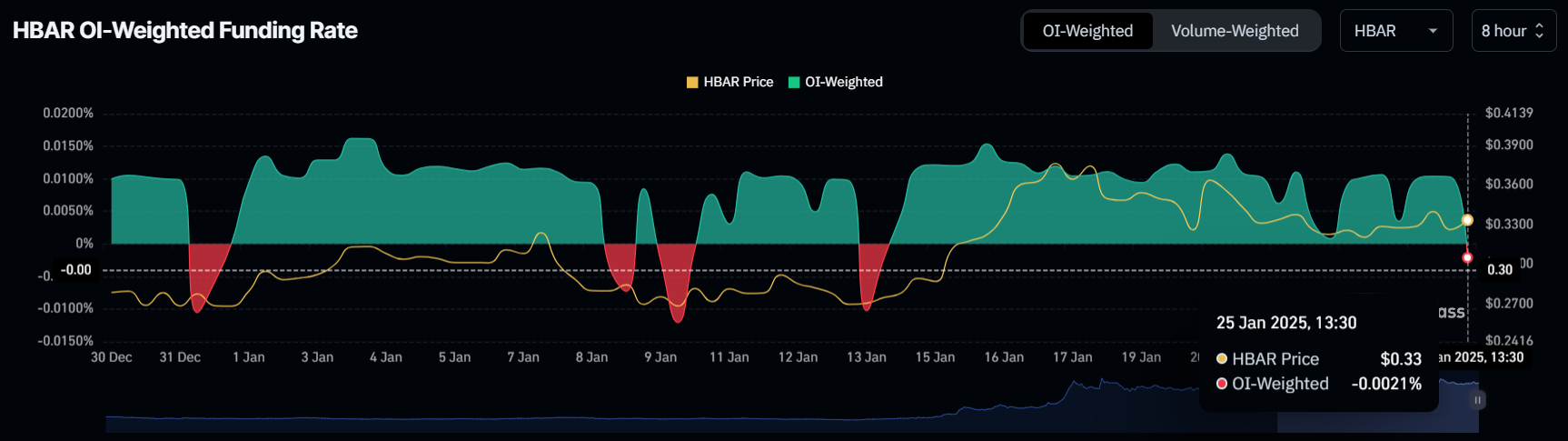

HBAR’s funding price recently dipped into the bearish zone after affirming definite ranges for over 11 days. This shift signifies that traders agree with became bearish as short contracts gained dominance over long positions. The failed breakout makes an try agree with caused traders to reevaluate their outlook, ensuing in a cautious stance on HBAR.

The rising need for short contracts suggests rising uncertainty amongst market contributors. This stems from skepticism about HBAR’s capability to conquer resistance ranges, reinforcing the need for the token to procure stronger strengthen to accumulate investor self belief.

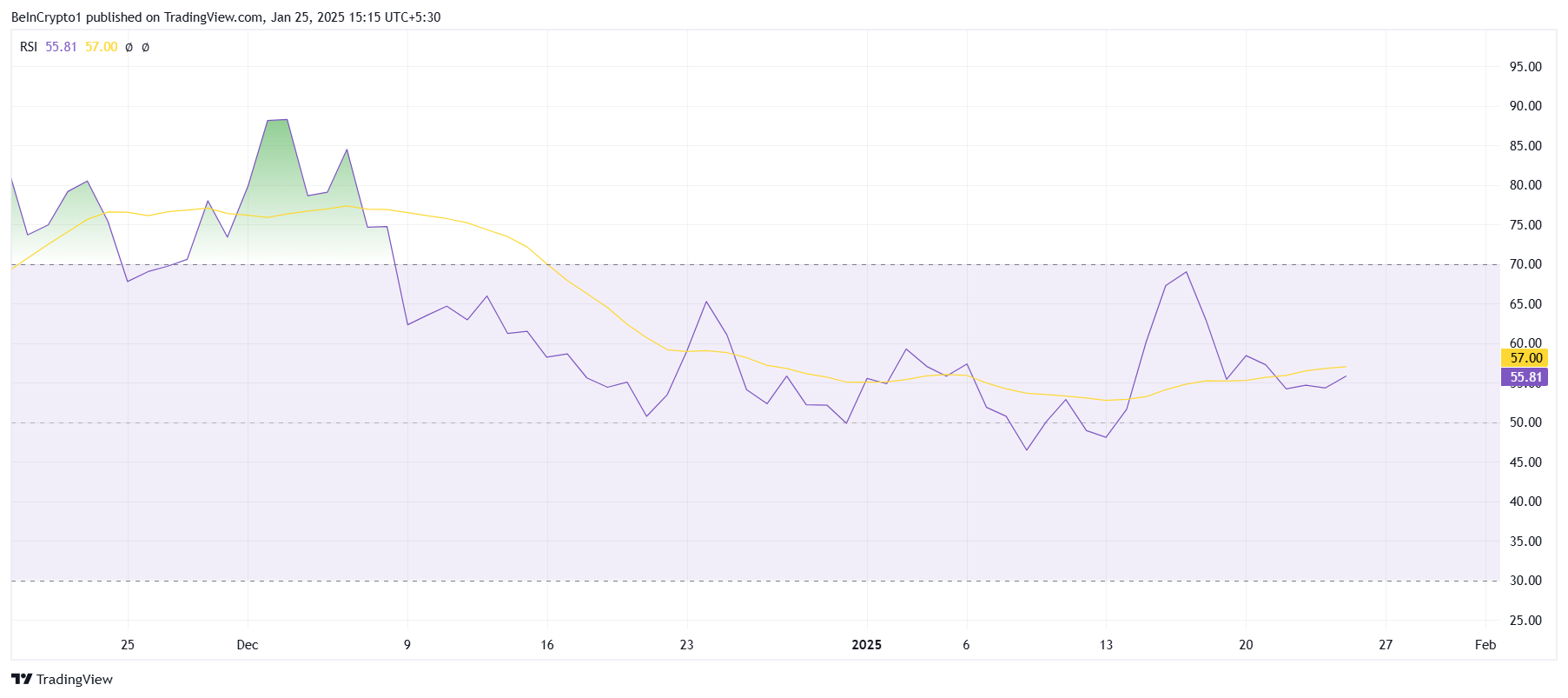

Despite the bearish sentiment, HBAR’s Relative Strength Index (RSI) remains above the impartial 50.0 tag. This capacity that the broader market momentum is aloof favoring bullish traits, offering a capability buffer against bearish strain. The RSI’s bid highlights that HBAR retains some underlying strength.

The RSI’s balance could perhaps pause HBAR from experiencing spirited declines, whilst bearish cues dominate non permanent market sentiment. If the broader cryptocurrency market continues to preserve bullish momentum, HBAR could perhaps honest procure strengthen and steer clear of additional consolidation at lower ranges.

HBAR Trace Prediction: Breaking Out

HBAR is for the time being procuring and selling at $0.33, aiming to put this level as a strengthen floor. Efficiently doing so is extreme for the token to scenario the $0.39 resistance level. A break above this resistance could perhaps predicament the stage for additional upward motion.

The blended market sentiments could perhaps play a pivotal role in determining HBAR’s direction. If the token manages to upward thrust previous $0.39, it would possibly most likely perhaps rally toward $0.47, bringing it nearer to its all-time excessive of $0.57. This scenario would require sustained bullish momentum and renewed market self belief.

On the opposite hand, a decline to $0.25 would most likely consequence in endured consolidation for HBAR. Any additional tumble below this level would invalidate the bullish outlook entirely, signaling capability long-term weak spot.