Hedera (HBAR) impress rebounded over 10% in the final 24 hours, as some technical indicators are starting up to flash early indicators of a doubtless restoration. The BBTrend has flipped sure after a full week in the red, hinting at a probable momentum shift.

Then again, the Ichimoku Cloud serene reveals a firmly bearish setup, and EMA traces continue to favor downside possibility. Whether or now not HBAR can reclaim misplaced flooring or continue sliding toward multi-month lows will depend upon how these conflicting indicators resolve in the arriving days.

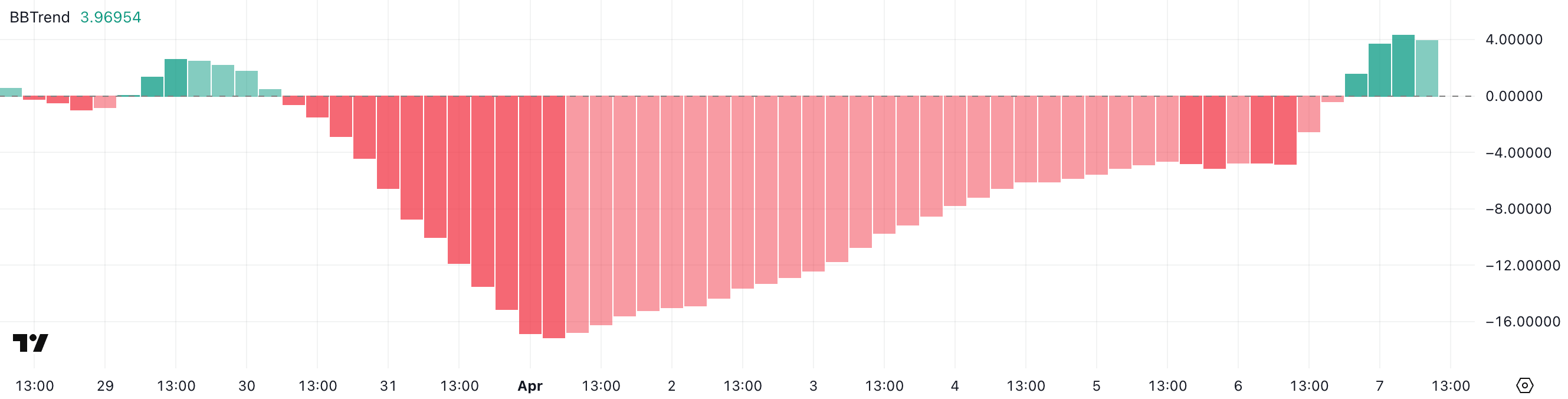

Hedera BBTrend Is Obvious After Seven Days

Hedera’s BBTrend indicator has modified into sure, currently sitting at 3.96 after spending the previous seven days in detrimental territory and hitting a low of -17.12 on April 1.

The BBTrend (Bollinger Band Style) is a momentum-primarily based entirely indicator worn to assess the strength and route of a vogue relative to its method for the period of the Bollinger Bands.

Readings above 0 counsel bullish momentum and doubtless upside circulate, whereas readings beneath 0 point to bearish stress and downward momentum.

HBAR BBTrend. Source: TradingView.

Essentially the most up-to-date BBTrend fee of three.96 means that Hedera is showing early indicators of a doubtless bullish reversal following a prolonged downtrend. The shift into sure territory might presumably imply that procuring for stress is returning and, if sustained, might presumably also toughen a impress restoration.

Then again, given essentially the most up-to-date volatility and overall weak point in the broader market, HBAR will need consistent dispute-through above its mid-vary stages to substantiate this upward shift.

A failure to retain a favorable BBTrend might presumably stop in the continuation of sideways or downward circulate.

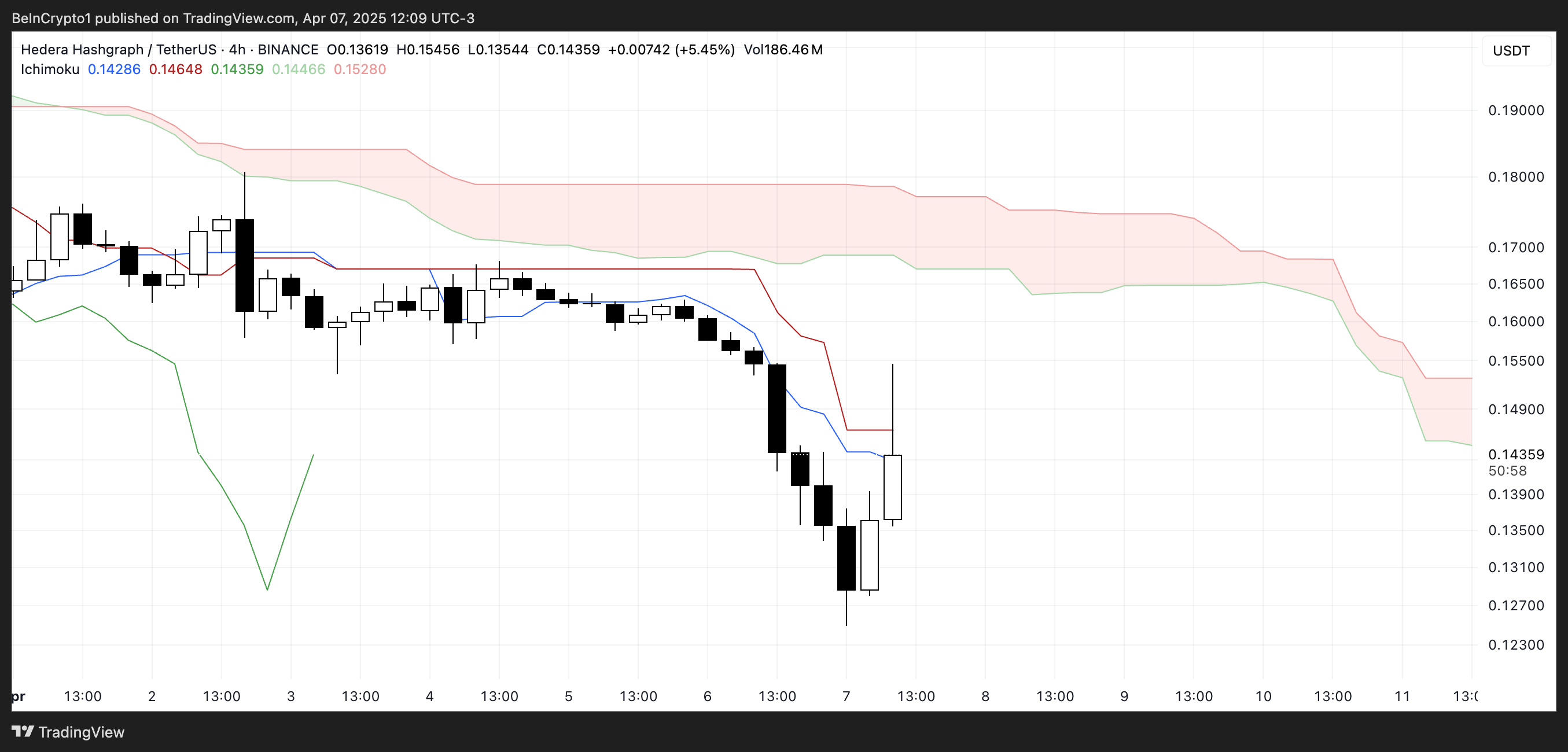

HBAR Ichimoku Cloud Paints A Bearish Image

The Ichimoku Cloud chart for Hedera currently displays a bearish building. The rate is positioned neatly beneath the Kumo (cloud), indicating that downward momentum remains dominant.

The Tenkan-sen (blue line) and Kijun-sen (red line) are both sloping downward and performing as speedy resistance stages, suggesting that sellers serene devour retain watch over over the vogue.

HBAR Ichimoku Cloud. Source: TradingView.

The cloud ahead is thick and red, reinforcing a bearish outlook and signaling that stable resistance lies above essentially the most up-to-date impress action. Then again, a most up-to-date bullish candle pushing toward the Tenkan-sen suggests early indicators of a probable reduction rally.

For any meaningful vogue reversal to happen, HBAR must spoil above both the Tenkan-sen and Kijun-sen, and finally switch into the cloud itself—a though-provoking job given essentially the most up-to-date setup.

Total, the Ichimoku configuration confirms that whereas some quick-term upside is doubtless, the broader vogue remains firmly bearish for now.

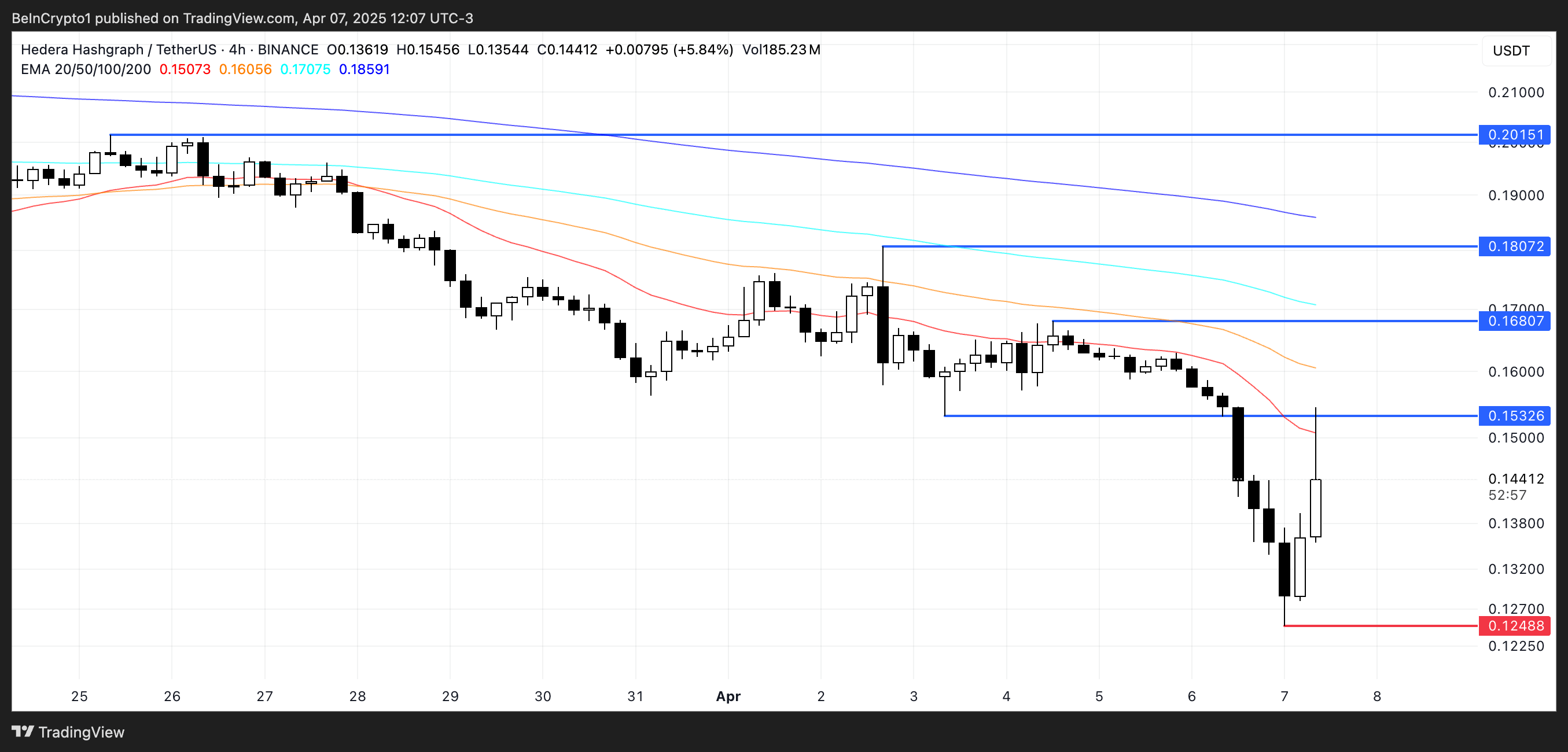

Will Hedera Topple To 5-Month Lows?

Hedera’s EMA (Exponential Shifting Common) traces continue to signal a bearish vogue, with quick-term averages positioned beneath the prolonged-term ones—a fundamental indication of downward momentum.

As prolonged as this alignment holds, HBAR remains at possibility of extra declines.

If promoting stress resumes, the token might presumably plunge to check toughen at $0.124. A breakdown beneath that stage would price the first switch beneath $0.12 since November 2024.

HBAR Note Analysis. Source: TradingView.

Then again, if Hedera impress manages to reverse its most up-to-date correction, a restoration might presumably accomplish traction and push the fee toward resistance at $0.155.

A breakout there might presumably pave the strategy for extra beneficial properties to $0.168, and if bullish momentum hastens, HBAR might presumably even try a switch toward the $0.18 and $0.20 zones.

A crossover of the quick-term EMAs above the prolonged-term traces would be a key signal confirming a doubtless vogue reversal.

Disclaimer

Based on the Belief Mission guidelines, this impress diagnosis article is for informational functions entirely and can now not be regarded as financial or investment advice. BeInCrypto is dedicated to correct, honest reporting, nevertheless market prerequisites are topic to swap with out specialize in. Constantly habits your devour study and search the advice of with a reliable sooner than making any financial selections. Please display cowl that our Phrases and Instances, Privacy Policy, and Disclaimers devour been up so a long way.