Hedera (HBAR) designate has been consolidating at some level of the final few weeks, with a modest 3.8% develop in the final seven days. The token is striving to withhold its market cap above $11.5 billion as market momentum shows indicators of weakening.

Whereas HBAR remains in an uptrend, mixed signals from technical indicators counsel the capability for both a persisted rally or a reversal. Merchants are searching at carefully to view whether or no longer HBAR can wreck above key resistance stages or if it’ll test lower give a take to zones.

Hedera Stays in an Uptrend, but a Shift Might well Be Terminate to

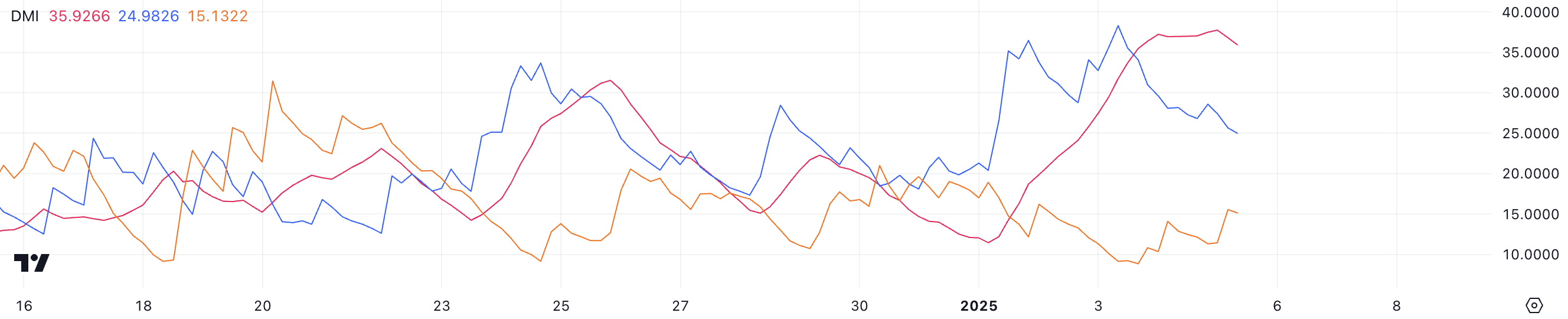

The Sensible Directional Index (ADX) for Hedera is currently at 35.9, reflecting stable construction strength, though a petite down from 37.7 just a few hours ago. The ADX measures the strength of a construction on a scale of 0 to 100, with values above 25 indicating a stable construction and values below 20 signaling frail or absent momentum.

The fresh stage means that HBAR designate is unexcited experiencing a stable uptrend, though the petite decline in ADX hints at a skill easing in momentum.

The directional indicators present additional context, with the +DI at 24.9, down from 38.2 two days ago, and the -DI at 15.1, up from 9.1 over the identical length. This signifies that while procuring for stress remains dominant, it has weakened greatly, and promoting stress is starting to upward thrust.

If this construction continues, the uptrend may per chance presumably also lose steam. HBAR may per chance presumably maybe enter a consolidation portion and even a skill downtrend unless renewed procuring for exercise strengthens the +DI and stabilizes the ADX.

HBAR Ichimoku Cloud Presentations Mixed Indicators

The Ichimoku Cloud chart for Hedera currently displays a mixed setup. The worth is trading cease to the crimson cloud, signaling a length of uncertainty as the market struggles to place a transparent path.

Whereas the inexperienced cloud forward suggests skill bullish momentum, the worth’s set aside cease to the crimson cloud signifies the need for added affirmation to solidify the uptrend.

The blue Tenkan-sen (conversion line) is trending downward and has moved nearer to the orange Kijun-sen (baseline), indicating weakening brief-timeframe momentum.

For HBAR designate to accept its upward trajectory, it must bound decisively above the cloud and withhold its set aside. Conversely, if the worth breaks below the cloud, this is able to presumably presumably label a bearish shift, potentially ensuing in additional declines.

HBAR Label Prediction: Will Hedera Tumble Again to $0.23 In January?

HBAR designate is currently consolidating between a key give a take to stage of $0.274 and a resistance of $0.311. It fashioned a golden nasty just a few days ago, but HBAR designate wasn’t in a situation to damage the resistance around $0.32.

If the continuing uptrend regains its strength and successfully breaks above the $0.311 resistance, Hedera may per chance presumably maybe survey additional upward momentum, potentially sorting out the following resistance at $0.338.

Alternatively, if the $0.274 give a take to fails to take care of, the fresh construction may per chance presumably maybe reverse into a downtrend. In this kind of scenario, the HBAR designate may per chance presumably also face additional promoting stress, pushing all of it the sort down to retest the following give a take to stage at $0.233.