Hedera (HBAR) is up with regards to 5% in the last 24 hours because it makes an strive to interrupt above the $0.20 value for the first time in 2 weeks. The present stamp rally comes amid bettering technical signals that hint at a doubtless shift in construction.

No matter the continuing recovery, HBAR level-headed faces key resistance ranges and a bearish backdrop that has dominated in present weeks.

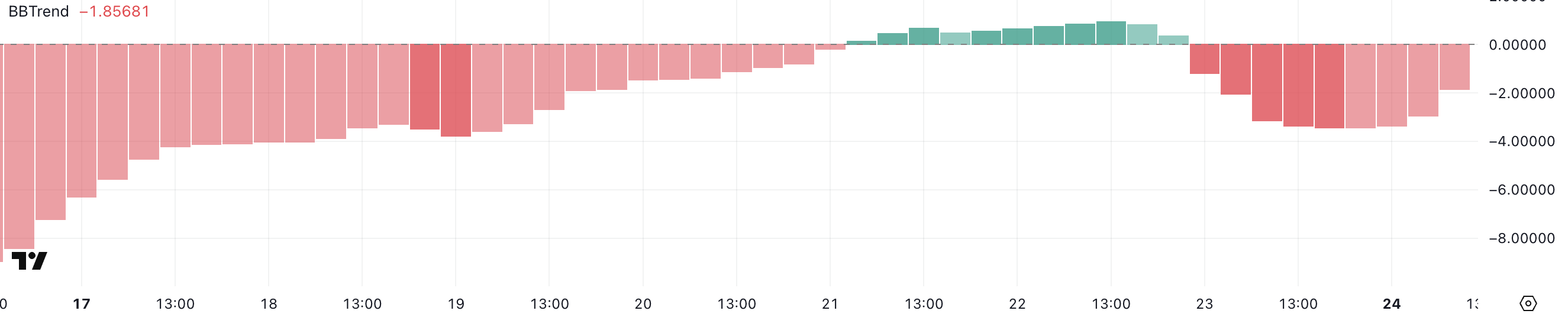

Hedera BBTrend Is Convalescing, However Quiet Unfavorable

Hedera’s BBTrend is at the moment sitting at -1.85, showing a recovery from -3.44 the day before this day, though it become as soon as no longer too prolonged previously as high as 0.96 two days previously.

This present motion suggests some temporary development in stamp momentum after present plan back strain. On the other hand, the general construction level-headed leans negative as Hedera struggles to defend any lasting bullish signals.

The indicator highlights how the token is making an strive to score properly however remains caught in a broader pattern of passe momentum.

The BBTrend (Bollinger Band Pattern) indicator measures how a long way stamp action deviates from the center of the Bollinger Bands, serving to to assess construction energy and route.

Typically, values above 0 counsel bullish prerequisites, whereas values below 0 stamp bearish momentum. With Hedera’s BBTrend at the moment at -1.85, it suggests bearish strain is level-headed uncover, with out reference to the present jump.

Extra importantly, Hedera has shown danger sustaining solid particular ranges for an prolonged length – the last time BBTrend crossed above 10 become as soon as on March 6, highlighting how fleeting bullish momentum has been in present weeks.

HBAR Ichimoku Cloud Shows The Pattern Could maybe Be Transferring, However There Are Challenges Ahead

Hedera’s Ichimoku Cloud chart is showing some early signs of recovery, as the stamp has damaged above the blue Tenkan-sen line and is now checking out the underside of the red Kumo (cloud).

The stamp action has moved into the cloud after procuring and selling below it for an prolonged length, that will most probably be considered as a shift from bearish to more neutral prerequisites.

Whereas the stamp making an strive to climb into the cloud means that selling strain is weakening, it level-headed faces resistance from the thicker piece of the Kumo correct above present ranges.

The cloud’s bearish (red) coloration indicates that the broader construction remains under strain, with out reference to the present upside creep.

The Ichimoku Cloud, or Kumo, is a multi-ingredient indicator that highlights make stronger, resistance, construction route, and momentum all in a single gaze. When prices are below the cloud, it suggests bearish prerequisites, whereas prices above the cloud signal bullish sentiment.

Purchasing and selling internal the cloud generally indicates a consolidation piece or market indecision.

In Hedera’s case, the token’s present positioning internal the cloud signals that it is making an strive to neutralize the present bearish momentum however has no longer but shifted into a clear bullish construction.

Unless HBAR can firmly damage above the upper edge of the cloud, upside doubtless will also fair reside capped by resistance.

Will A Golden Outrageous To find Hedera Surge?

Hedera’s EMA strains are level-headed showing a bearish setup total as prolonged-timeframe EMAs proceed to construction downward. On the other hand, temporary EMAs are foundation to slope upwards and will soon injurious above the longer-timeframe averages, doubtlessly forming a golden injurious.

If this bullish crossover happens, it is going to also fair bellow off a stronger upward creep, with the first resistance stage sitting at $0.199. A damage above this stage would possibly maybe well well originate the route for further beneficial properties toward $0.215, and if the bullish momentum hastens, Hedera stamp would possibly maybe well well even aim for $0.258 in the arrival classes.

Alternatively, if the temporary upside momentum fades and the golden injurious fails to materialize, bearish strain would possibly maybe well well resume. In this scenario, HBAR will also fair revisit key make stronger ranges at $0.184 and $0.178.

A decisive damage below these ranges would possibly maybe well well lead the token abet under $0.17, reinforcing the bearish building.