HBAR has recorded its first space influx in the previous seven days, attracting $1.5 million in contemporary capital.

This marks a positive shift in market sentiment as merchants earn self belief in the altcoin. It moreover aligns with the broader market’s strive and recover from contemporary downturns.

Bullish Momentum Builds as HBAR Positive aspects $2 Million in Inflows

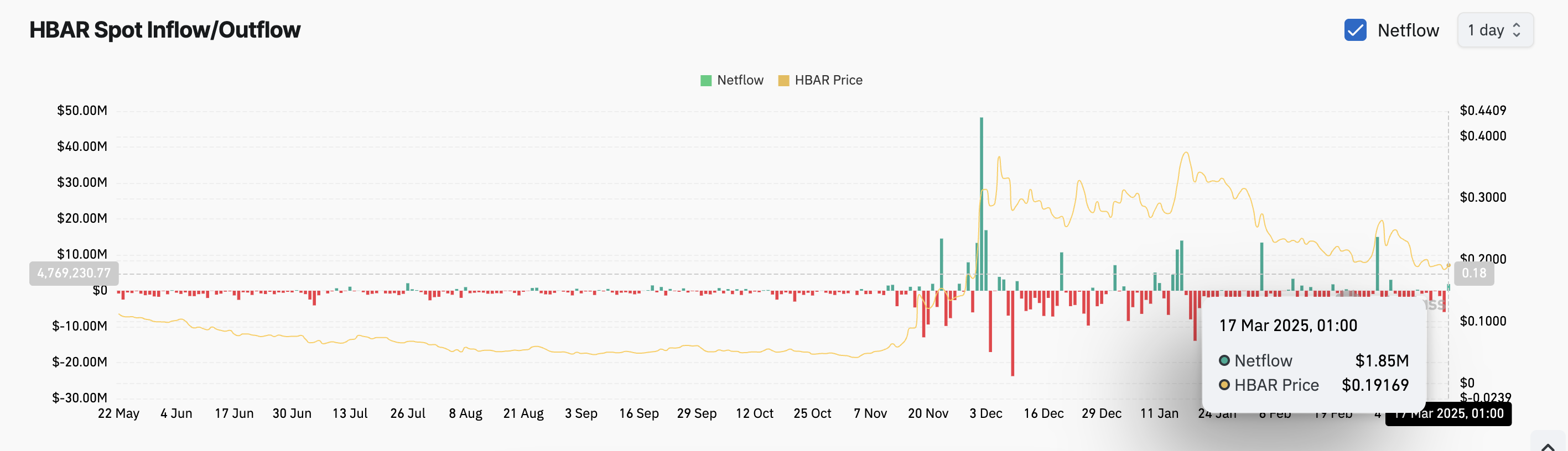

HBAR’s space inflows surged to merely about $2 million on Monday, signaling a resurgence in bullish sentiment towards the altcoin. Records from Coinglass shows that here is the first time HBAR has attracted contemporary capital in seven days, marking a shift in investor self belief.

Essentially based totally on the on-chain details supplier, between March 11 and 16, the altcoin confronted consistent promote strain, with space outflows exceeding $10 million. This most up-to-the-minute influx suggests a bullish reversal in market sentiment, hinting at a seemingly recovery as merchants earn interest in HBAR.

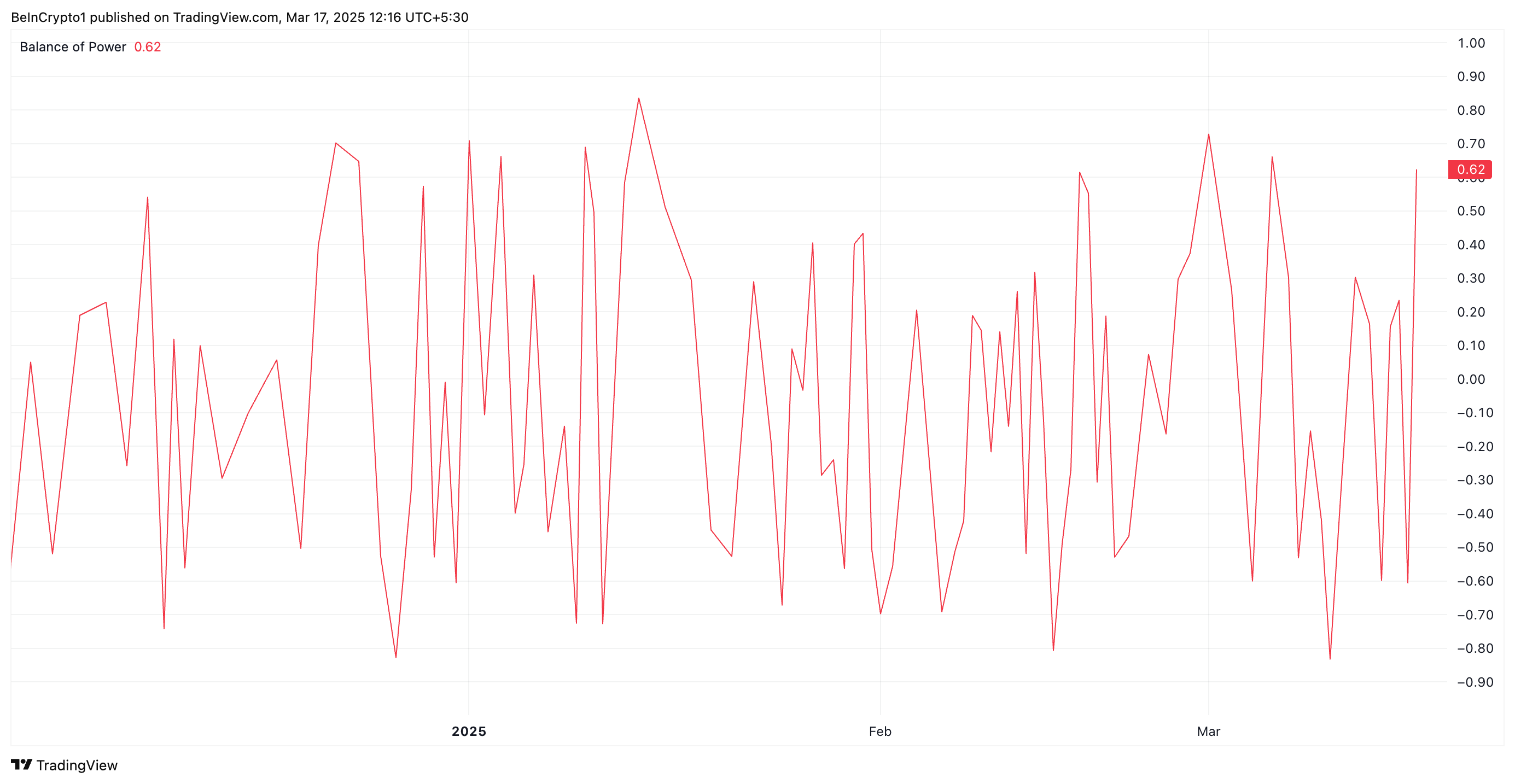

Furthermore, the altcoin’s positive Balance of Energy (BoP) highlights this renewed interest. At press time, this momentum indicator is in an upward pattern at 0.62.

The BoP indicator measures the flexibility of merchants towards sellers available in the market to title momentum shifts. A favorable BoP like this means that purchasing strain outweighs selling strain, indicating rising question of and doable designate appreciation.

If HBAR’s BoP remains positive, it confirms the bullish dominance, reinforcing the present purchasing strain and supporting a sustained uptrend in the asset’s designate.

HBAR Eyes $0.22 as Ask Grows—Will Bulls Support Momentum?

HBAR exchanges fingers at $0.19 at press time, trading above the enhance ground at $0.17. As question of grows, the altcoin would possibly per chance per chance per chance climb towards the resistance at $0.22.

A a hit destroy above this level would possibly per chance per chance per chance propel HBAR’s designate to $0.26, a high it final traded at on March 4.

Conversely, the bullish outlook would possibly per chance per chance per chance be invalidated if sellers earn dominance and profit-taking strengthens. In this case, HBAR’s designate would possibly per chance per chance per chance topple to $0.17.