Snappily Take dangle of

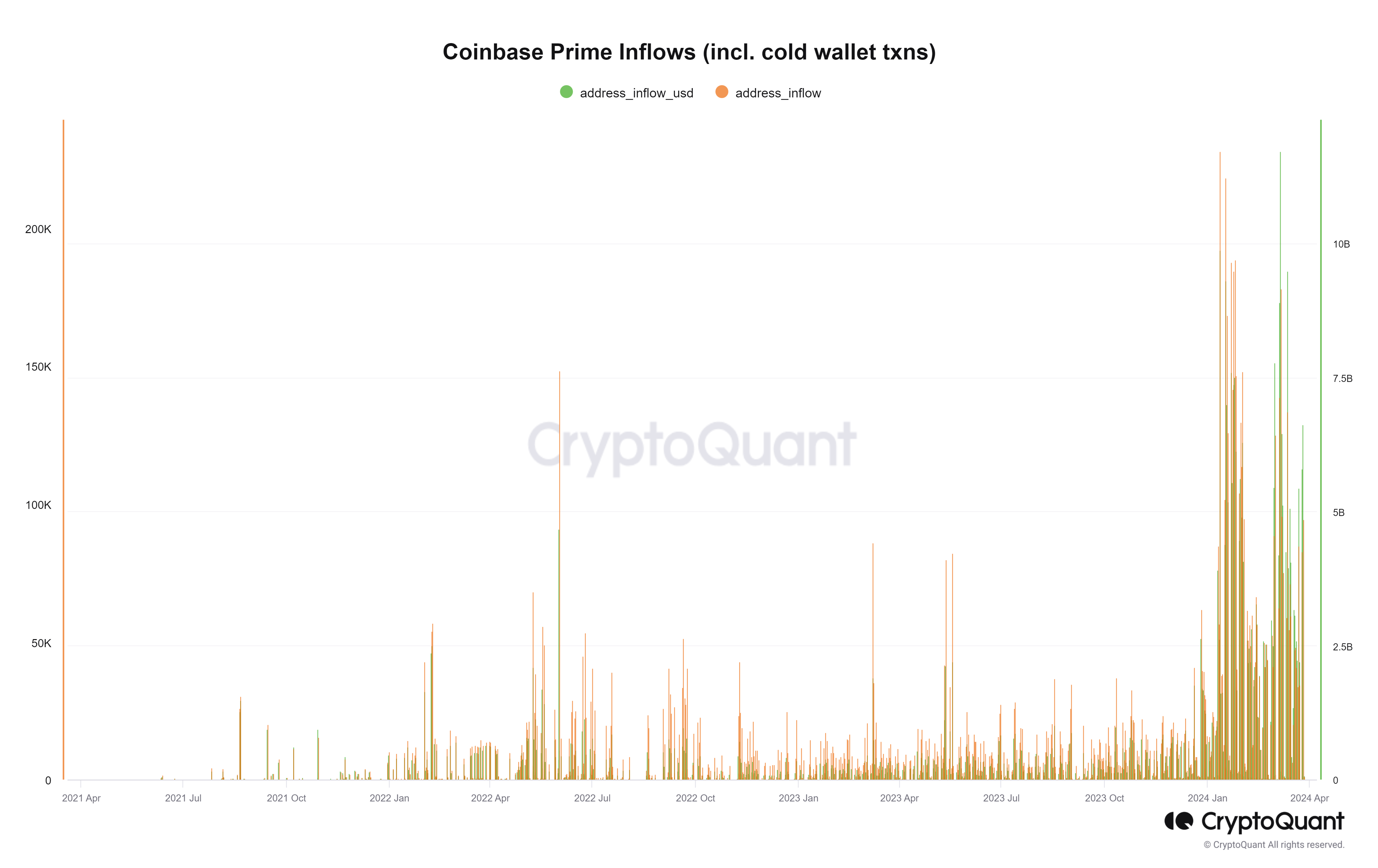

Valuable Bitcoin inflows into Coinbase’s Top Brokerage products and companies, which cater essentially to US institutional investors, could perchance be viewed by skill of CryptoQuant data. Coinbase Top provides superior trading platforms, over-the-counter (OTC) desks, and custody products and companies – moving sides for institutional purchasers. This inflow aligns with the launch of Bitcoin exchange-traded funds (ETFs) on Jan.11; CryptoQuant means that extra than one OTC trades are additionally taking region.

Procuring Bitcoin OTC minimizes slippage and permits the execution of immense transactions without impacting the bother market trace. Notably, immense inflows into Coinbase Top were seen all the device in which through the 2022 undergo market when Bitcoin traded spherical $20,000 amid the Luna crumple, in response to CryptoQuant data.

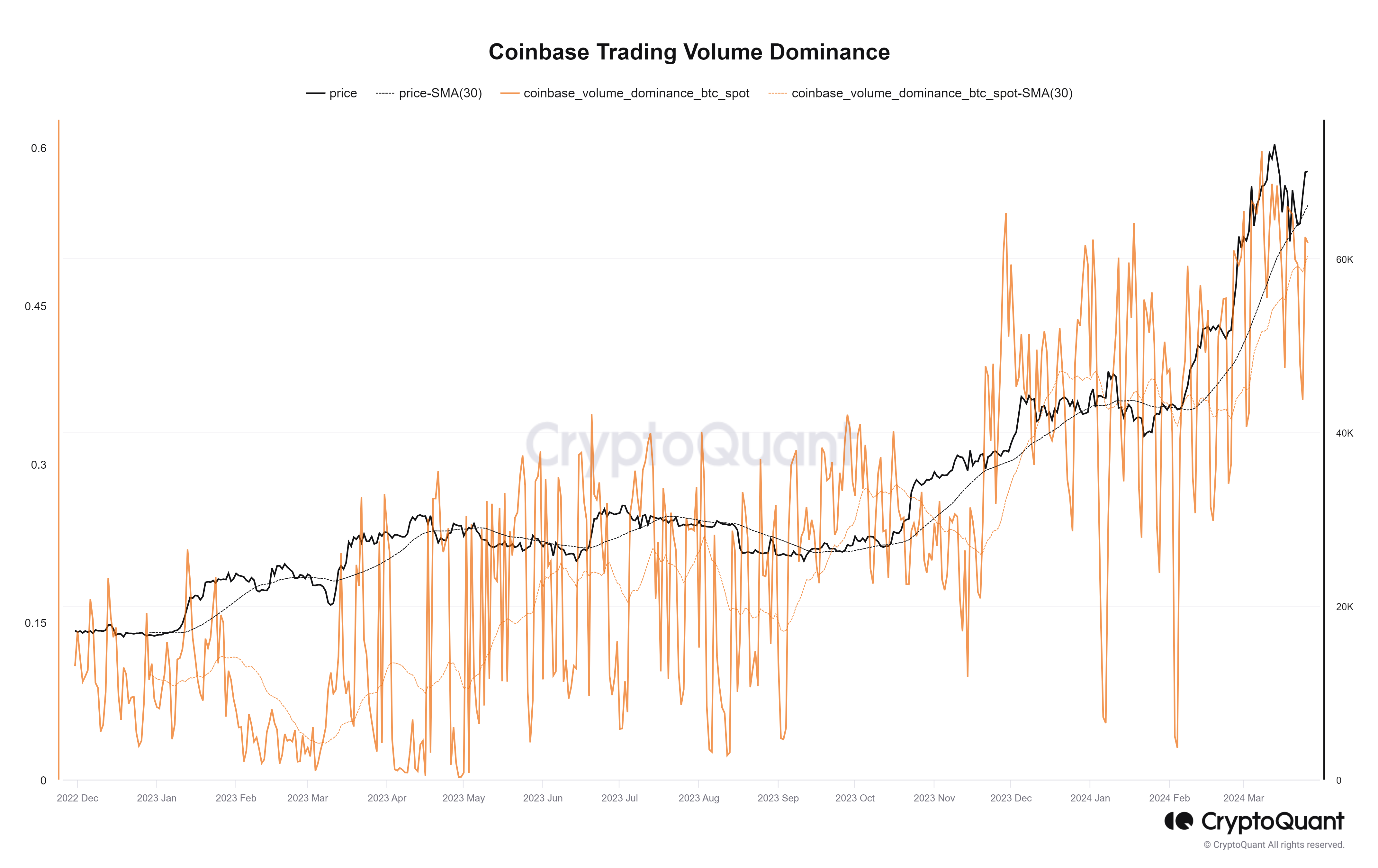

Furthermore, Coinbase’s bother trading volume dominance has surged to spherical 50% market fragment since the ETF launch. This surge presentations the impact of the involvement of US institutional investors in Coinbase’s platform and products and companies.