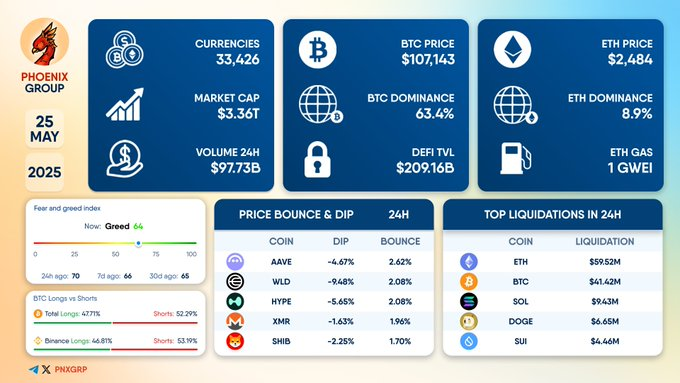

- Bitcoin leads with 63.4% dominance as market sentiment shifts into “Greed” territory.

- Ethereum tops liquidations whereas DeFi TVL rises to $209.16B, signaling solid engagement.

- Altcoins indicate mixed efficiency with though-provoking dips and modest rebounds amid excessive volatility.

The crypto market closed the trading day on Would possibly well possibly also fair 25, 2025, with signs of accelerating investor self assurance, as the Crypto Misfortune and Greed Index reached 64, placing the sentiment squarely in the “Greed” zone.

The realm market capitalization stood at $3.36 trillion, supported by $97.73 billion in 24-hour trading quantity across 33,426 tracked digital sources. While Bitcoin remained the obvious chief on the market, rising activity in derivatives and major strikes among altcoins marked a volatile session.

Every day Summary on Would possibly well possibly also fair 25, 2025$AAVE $WLD $HYPE $XMR $SHIB $ETH $BTC $SOL $DOGE $SUI#dailysummary #DeFi #Crypto pic.twitter.com/bA9Eswm8FD

— PHOENIX – Crypto Data & Analytics (@pnxgrp) Would possibly well possibly also fair 25, 2025

Bitcoin (BTC) led the market with a ticket of $107,143 and held a 63.4% fragment of general market capitalization. Ethereum (ETH) adopted at $2,484, contributing to eight.9% of market dominance. Ethereum’s network prerequisites remained trusty, with gasoline fees recorded at perfect 1 Gwei, reflecting low congestion and comparatively peaceable transaction trudge in conjunction with the scramble.

In decentralized finance (DeFi), total worth locked (TVL) rose to $209.16 billion. The decide pointed to favorite involvement from institutional and retail contributors alike. Despite ticket fluctuations among several major tokens, core blockchain metrics showed consistent engagement ranges, in particular across DeFi protocols.

Derivatives Market Exercise Indicators Elevated Threat Appetite

Liquidation files showed major action in the derivatives market. Ethereum accounted for the very best liquidation worth at $59.52 million, adopted by Bitcoin with $41.42 million. Solana (SOL) posted $9.43 million in liquidations, whereas Dogecoin (DOGE) and Sui (SUI) recorded $6.65 million and $4.46 million, respectively.

Prolonged positions outpaced short trades across the broader market, making up 52.97% of all activity. On Binance, on the opposite hand, the pattern reversed, with short positions representing fifty three.99% of total trades. The variance between exchanges indicated mixed market sentiment, with merchants adjusting methods primarily primarily based on localized possibility expectations.

Altcoin Prices Point to Mixed Reaction to Volatility

Within the midst of the session, the efficiency of altcoins differed vastly. At one point, AAVE change worth dipped 4.67%, nonetheless in a while, it acquired 2.62% and ended up being the most promising in the neighborhood. Worldcoin suffered the steepest decline, losing 9.forty eight% of its worth, sooner than Hype, which fell 5.65%.

Monero (XMR) before every thing fell in ticket by 1.63%, nonetheless it later recovered by 1.96%. Shiba Inu (SHIB) started with a 2.25% tumble nonetheless rallied attend with a 1.70% accomplish all the intention by means of the identical day. The reductions showed that many smaller-cap and meme-linked sources were tormented by favorite market swings.

With Bitcoin sustaining dominance and DeFi showing persevered engagement, the quick focal point stays on whether new trading volumes and positioning will result in breakouts or trigger a broader correction. Despite the rising greed sentiment, market behavior continues to indicate warning amid ongoing liquidation events and mixed altcoin efficiency.