Whereas a likely quandary Ethereum ETF approval looms ahead, Grayscale experts judge an upcoming technological development is within the abet of most up-to-date ticket upticks.

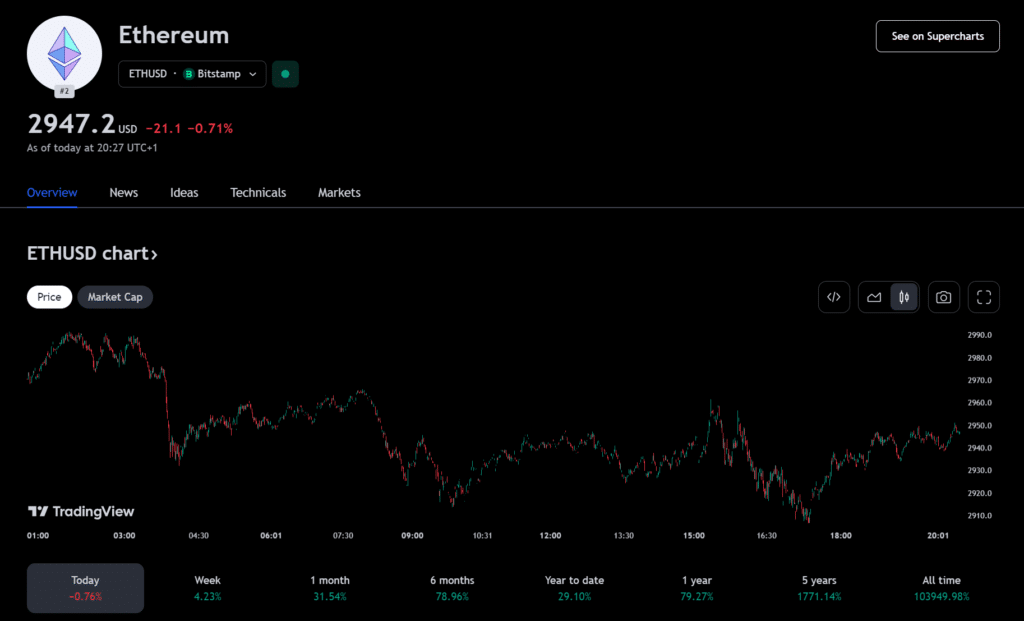

Grayscale be taught analyst William Ogden Moore said in a Feb. 23 report that Ethereum’s Dencun make stronger has in all probability prompted rallies in Ether (ETH) costs. In accordance to CoinMarkerCap, ETH is up 34% within the closing 30 days and 28% year-to-date per TradingView.

Ethereum’s Dencun make stronger, scheduled for March thirteenth, 2024, represents a prime step forward and would possibly per chance per chance support Ethereum compete by system of scalability with sooner chains within the Tidy Contract Platforms Crypto Sector, corresponding to Solana. We judge that most up-to-date ticket performance reflects the market’s anticipation of this make stronger.

William Ogden Moore, Grayscale be taught analyst

Dencun promises to uplift throughput and prick transaction costs, allowing users to exhaust much less gasoline costs and win extra transactions on ETH’s mainnet and layer-2 scaling alternate strategies worship Arbitrum.

Builders notion to remember that key overhaul by ability of proto-danksharding, introducing records blobs.

Moore’s report suggests that Ethereum would possibly per chance per chance rob elevated handsome contract business fragment from rivals worship Solana if the community can offer more inexpensive costs. Moore opined that this would possibly per chance per chance free up a multi-billion market tied to explicit-world property.

If Ethereum can simply turn out to be extra competitive in throughput and value, it can per chance situation itself to capture handsome contract applications that rely on excessive ranges of security and censorship-resistance worship stablecoins or tokenized monetary property.

William Ogden Moore, Grayscale be taught analyst

Grayscale’s bullish outlook on ETH and its blockchain complements the investment firm’s uncover for a quandary change-traded fund following its winning GBTC conversion closing month. In accordance to Yahoo Finance, the company hopes to realize the same with its Grayscale Ethereum Belief (ETHE), which holds over $7 billion in property under administration (AUM).

The U.S. SEC delayed a resolution on Grayscale’s utility till Would possibly perchance, along with lots of diversified issuers.