Despite the Bitcoin mark staying above the $50,000 label, the past three days are marked crimson and personal led to a 2.65% drop. Improving from the cold days after the ETFs itemizing, the pre-halving rally boosts the crypto and accounts for an nearly 20% jump this February. Nonetheless, no topic the contemporary pump, Grayscale, the digital asset management firm, is starting up to transfer in opposition to the tide.

Unfavorable for inflicting a endure market after the Bitcoin Space ETF approval, the Grayscale Bitcoin Belief (GBTC) continues to dump Bitcoin.

Grayscale Sells Off $175 Million Worth Bitcoin

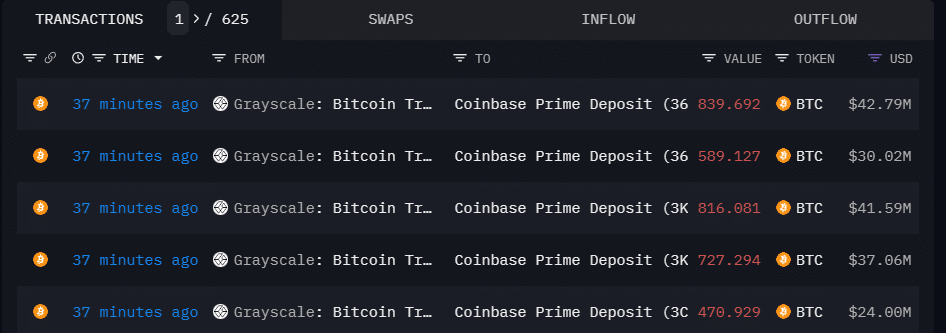

In a necessary transaction noticed by Arkham, Grayscale performed a famous transfer of Bitcoin on February 23 at 22:12 UTC+8. The transaction eager sharp 3,443.1 BTC into the Coinbase Top Deposit take care of.

Arkham Intelligence

This transfer is particularly great due to its gigantic fee, estimated at approximately US$175 million, with the contemporary Bitcoin mark around $50,920.

Why the sudden promote-off?

The accurate causes for the swift capital outflows noticed no longer too prolonged previously stay risky at this 2nd. Nonetheless, one plausible clarification is also that traders determined to liquidate their holdings to capitalize on the profits from the contemporary surge in market values, particularly after having their investments tied up in the fund for a protracted interval.

Within the U.S. essentially based relate Bitcoin ETFs, GBTC stands out for its comparatively excessive management price, plan at 1.5%. This price is vastly better when put next with its opponents, equivalent to BlackRock’s IBIT, which has a famous decrease price of 0.12%. Nonetheless, it’s crucial to provide an clarification for that BlackRock has offered plans to alter IBIT’s price boost, raising it to 0.25% in the coming twelve months.

The variation in management fees also can additionally be a severe component for investors when selecting between various funding alternate solutions, as decrease fees in total translate to better receive returns over time, making merchandise love IBIT extra elegant to fee-aware investors.