Crypto asset supervisor Grayscale has made a strategic switch by transferring 3,443.1 Bitcoin, amounting to over $175 million, to an tackle related with the Coinbase exchange.

Basically the most modern switch became done in 5 separate transactions to Coinbase High, a platform designed to cater to the liquidity wants of institutions.

In step with Arkham, at 22:12 UTC+8 on February 23, Grayscale transferred 2,669.31 BTC to the tackle of Coinbase High Deposit, price roughly US$136 million;it transferred 773.79 BTC to a original tackle, which is suspected to be Grayscale’s original custody tackle.…

— Wu Blockchain (@WuBlockchain) February 24, 2024

The switch has sparked major ardour throughout the financial and cryptocurrency communities, as Grayscale has been known to have an effect on market dynamics critically. The firm’s decision to switch this sort of substantial quantity of Bitcoin to a liquid exchange for possible sale comes at a time when the cryptocurrency market is experiencing a combine of volatility and development.

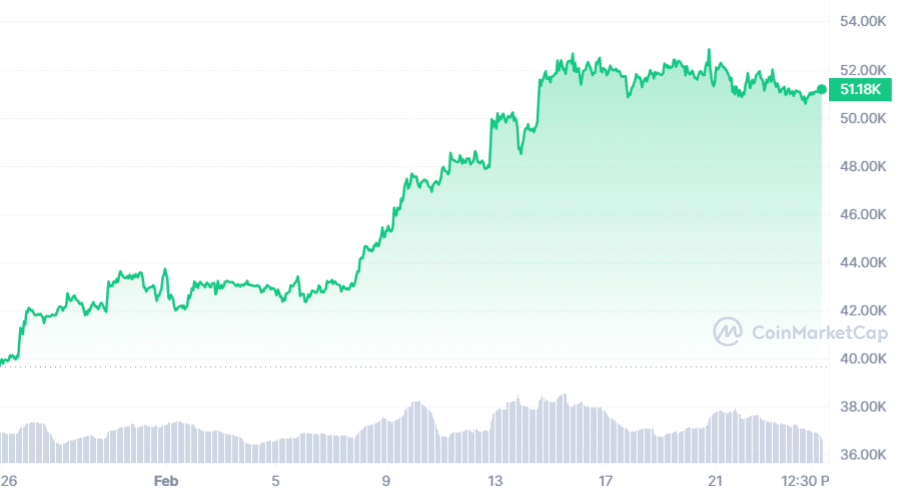

Bitcoin’s tag has no longer too prolonged ago viewed a 20% plan greater this February, despite a miniature 2.65% topple all over the last three days, affirming its price above the $50,000 stamp.

Speculations abound concerning the causes in the abet of Grayscale’s most modern transactions. Some market observers suggest that the switch might be allotment of a technique to capitalize on most modern market good points. This theory good points weight fascinated with the prolonged duration investors maintain had their investments locked in the fund, making essentially the most modern market surge, especially after having a tempting alternative for liquidation.

You may well additionally admire: Grayscale: Ethereum’s Dencun toughen using tag upward

The timing of Grayscale’s actions also coincides with discussions around administration costs throughout the digital asset administration sector. Grayscale’s Bitcoin Trust (GBTC) is famous for its slightly excessive administration fee of 1.5%, in stark disagreement to rivals admire BlackRock’s IBIT, which at demonstrate costs a fee of 0.12%—even despite the indisputable truth that plans are underway to plan greater this to 0.25% throughout the next three hundred and sixty five days.

The disparity in costs performs a truly valuable characteristic in investors’ choices, as lower costs in overall result in better procure returns over time.

Some commentators maintain linked the elevated outflows from Grayscale to the actions of Genesis, suggesting that the latter’s sale of GBTC for Bitcoin might be influencing market dynamics.

The perspective provides a much less bearish outlook on Grayscale’s future market affect, proposing that the results of these transactions might well additionally steadiness out attributable to the nature of the sales being in Bitcoin.

Following this valuable switch, Grayscale’s holdings now stand at 449,834 Bitcoin, valued at over $23 billion. The firm’s portfolio extends previous Bitcoin, with Ethereum (ETH) and Livepeer (LPT) as its 2nd and third-largest holdings, respectively.

Grayscale’s entire asset beneath administration exceeds $31 billion, encompassing other valuable tokens admire Uniswap (UNI), Chainlink (LINK), and Avalanche (AVAX).

Read extra: Grayscale CEO: Most rep 22 situation Bitcoin ETFs will no longer continue to exist