GRASS token, one in all the most in model DePIN initiatives, attracts vital attention from analysts and the investing public. As a Layer-2 platform on the Solana blockchain, the Grass platform enables users to share unused cyber net bandwidth to practice AI items the use of a browser extension. With its promising know-how, it’s no surprise that its token begin and airdrop closing October twenty eighth became extremely anticipated.

Whereas the airdrop became marred by a few points, including a three-hour outage, the token’s brand rally succeeded. Closing October Twenty ninth, the token peaked at October Twenty ninth, then made a huge rally from October thirty first till November 2nd, breaching the $1.50 level.

After hitting a excessive of $1.9175 on November 2nd, it has slowed down, settled under the $1.75 level, and now trades at the $1.forty five level. GRASS has rejected the $2 brand, with analysts seeing a deeper pullback—so, is this the impartial time to purchase?

A Rough Launch For GRASS

Trading for GRASS started on October twenty eighth, but a few points delayed the token’s airdrop and begin. The crew recorded technical points, including users being steer clear off from having access to their tokens on their Phantom wallets. Additionally, the frenzy to narrate the tokens became marred by the three-hour energy interruption. Moreover, some users reported flagged transactions, and a good deal of were disqualified from the airdrop.

WTF is this @getgrass_io @grassfdn I’m the use of it since Epoch 1 and after 10 months of the use of, it is miles asserting that your pockets is now not eligible?? In actuality?#grassairdrop #grassfoundation #grassSCAM pic.twitter.com/wt7BWPBI1R

— Phantom Soul (@PhantomSoulll) October 28, 2024

A entire of 1 billion GRASS tokens were circulated, and 10% were given to early supporters and contributors. It’s peaceable too early to uncover the total extent of these points’ secure on GRASS, however the token started neatly brand-wise.

Token Tries To Breach $2

It’s difficult to create sense of GRASS’s brand action because it completely launched a few days prior to now. Nonetheless, analysts uncover a bullish pattern on the chart’s lower timeframes. The token boasts above-moderate volume in the closing 24 hours.

Additionally, the token’s on-steadiness volume and price elevated starting October Thirtieth. In brief, there became buying for tension for the token, suggesting that brand positive aspects would possibly maybe occur quickly.

Nonetheless, GRASS rejected $2, making it the token’s non permanent psychological resistance. Analysts acknowledged the brand would possibly maybe dip to $1.75 for the reason that RSI reflects a bearish divergence.

Other Analysts Impress A Deeper Dive For GRASS

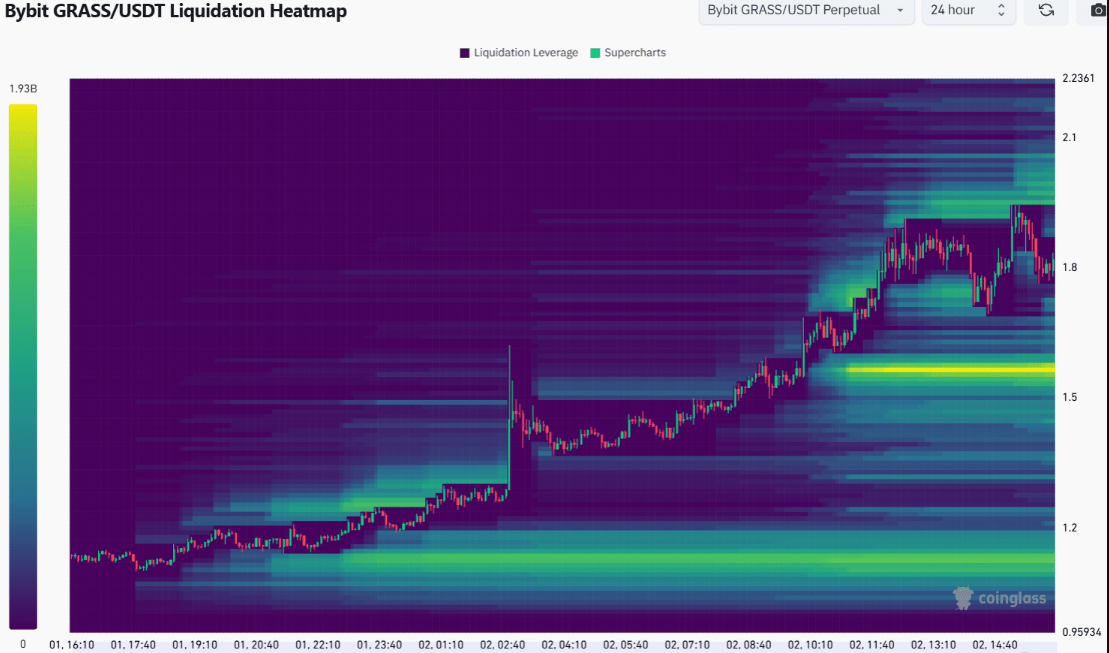

In step with the technical charts, the analysts chanced on two significant liquidity swimming pools at costs of $1.56 and $1.96. The hot brand is for the time being nearer to the liquidity pool at $1.56, with the token showing to reject the $1.96 level.

Since there’s a bearish momentum and a liquidity pool at $1.56, traders and holders can question a brand dip under $1,75. Swing traders and contemporary traders who are attempting to enter a job can depend upon the token’s retesting of $1.56 or even $1.4.

Featured image from Pexels, chart from TradingView