Mt. Gox trustees face a closing date on Oct. 31 to complete Substandard, Early lump-sum, and Intermediate repayments for Bitcoin creditors (BTC), with roughly 34,689 BTC unruffled sitting in Mt. Gox-linked wallets because the clock ticks down.

The Tokyo courtroom prolonged the fashioned cutoff date of Oct. 31, 2024, by twelve months after processing delays and lacking documentation stalled distributions that started in July 2024.

The trustee delivers Bitcoin and Bitcoin Cash by designated exchanges, equivalent to Bitstamp and Kraken, or in cash to creditors who did no longer inquire cryptocurrency.

Oct. 31 marks a completion date, no longer a single payout event, and the trustee reports that these phases are “largely accomplished” for creditors who possess submitted all required recordsdata.

The backdrop raises questions about whether exchanges will absorb a leisurely-month provide wave or creditors will route coins by custody and over-the-counter channels.

| Stage | What it does | Must haves / topic off | Asset compose & route | Timing window | A host of mechanics |

|---|---|---|---|---|---|

| Substandard Compensation | Indispensable first layer; comprises Small-Sum as a lot as ¥200,000; protects fiat claims; reduces post-Substandard steadiness. | Court docket time-confirmation; creditor KYC/portal complete; Company Receipt Agreement with alternate/custodian. | JPY by monetary institution/switch provider; BTC/BCH by designated exchanges or BitGo per creditor risk. | Crypto distributions since Jul 5, 2024; assemble-by Oct 31, 2025 (JST). | Can walk alongside Early; need to precede Intermediate. |

| Early Lump-Sum | No longer obligatory 21% of post-Substandard steadiness; irrevocable; on the final replaces Intermediate/Final (little risk-compensation exceptions). | Creditor elected Early in portal; checks complete; trustee operationally ready with venues. | Cash and/or BTC/BCH by the identical rails as Substandard. | Carried out alongside Substandard for electing creditors; assemble-by Oct 31, 2025 (JST). | Early recipients assuredly forgo Intermediate and Final. |

| Intermediate | No longer obligatory installment(s) for creditors who did no longer elect Early; between time-confirmation and Final. | Substandard accomplished; courtroom/operational clearance; funds designated by trustee. | JPY and/or BTC/BCH by identical rails (banks/switch providers, exchanges, BitGo). | Can also occur in batches as a lot as Oct 31, 2025 (JST). | Skilled-rata all over eligible claims; cannot precede Substandard. |

Likely pathways

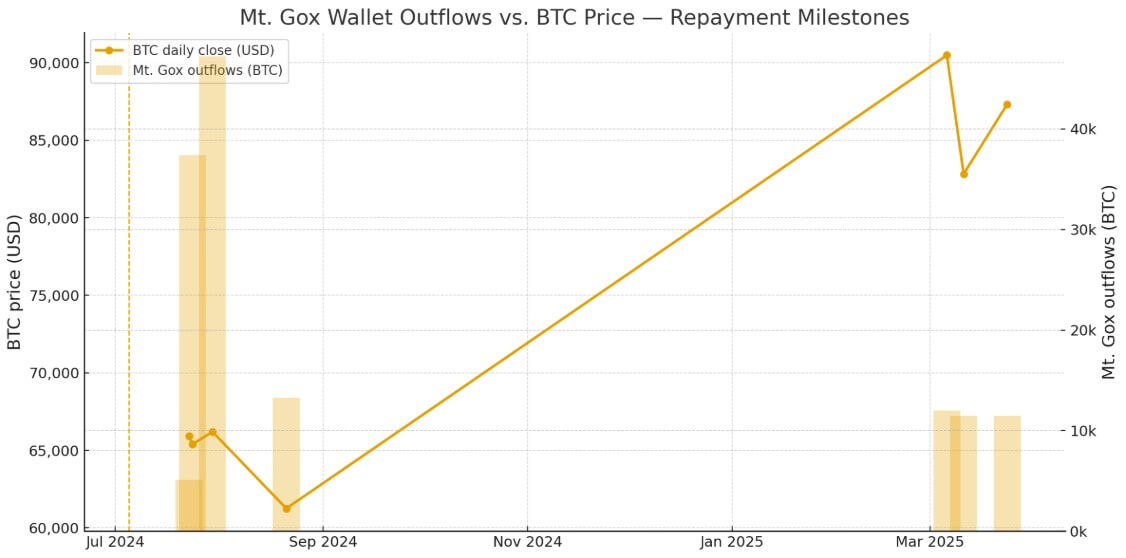

Of the fashioned 142,000 BTC within the pool, approximately 107,000 BTC had been transferred to finish recipients.

Glassnode reported 59,000 BTC reached exchanges by Jul. 29, 2024, whereas BitGo held roughly 33,023 BTC in tracked wallets by mid-August.

Extra batches followed by leisurely summer season, but the present split between alternate-skedaddle and custodial flows stays undisclosed.

Three capability pathways form how the final 34,689 BTC reaches markets earlier than the closing date.

In a staggered-distribution misfortune, creditors receive batches all over October but settle to preserve or switch coins into custody, thereby minimizing immediate promote stress.

Processing home windows at Kraken and Bitstamp are as a lot as 90 days and 60 days, respectively, which capability that individual credits are disbursed on varied dates even all over the identical repayment stage, spreading capability sales all over weeks in role of concentrating them.

A 2nd misfortune sees creditors routing coins into over-the-counter desks, thereby draining liquidity from institutional investors with out hitting public uncover books.

OTC transactions bypass alternate infrastructure completely, leaving role volumes and foundation trades unaffected whereas unruffled completing distributions earlier than Oct. 31.

The third misfortune introduces shock alternate inflows as batches of cleared custodial checks are added to Bitstamp or Kraken uncover books.

Concentrated inflows would be mirrored in role volumes, perchance compressing foundation spreads and affecting ETF arbitrage flows as market makers rebalance their hedges.

Change-skedaddle deliveries raise elevated visibility than custodial or OTC paths, making sudden pockets movements a key ticket for traders monitoring Mt. Gox addresses by the month-finish closing date.

What does history tell?

Out of the roughly 107,000 BTC distributed, reports are that approximately 59,000 BTC reached exchanges, whereas around 33,000 BTC had been processed by BitGo. The comfort is rarely any longer reported publicly. In consequence, out of the 92,000 BTC tracked, 64.1% had been sent to exchanges.

If utilized to the final Bitcoin steadiness to be distributed, the worst-case misfortune of a provide dump would be 22,253 BTC reaching the exchanges concurrently. Bitcoin traded at $106,795.03 as of press time, representing a capability $2.4 billion promote stress.

Nonetheless, what drove the costs down for the final crypto market last year on with regards to the identical date was the unwind of the yen raise alternate, which sent BTC from $58,315.08 to $49,351.27 on Aug. 4.

With regards to Mt. Gox-associated movements, Bitcoin’s payment remained current on Jul. 30, when 47,229 BTC had been moved to some wallets. On the time, the quantity represented $3.1 billion.

In consequence, even within the worst-case misfortune of $2.4 billion hitting exchanges, Bitcoin’s history means that the cost might well appropriate expertise microscopic fluctuations.