After over a decade of suspense, creditors of the defunct Mt. Gox Bitcoin (BTC) exchange get at final begun receiving long-awaited payouts this month. Knowledge from study firm Glassnode reveals that as of Tuesday, 59,000 of Mt. Gox’s 142,000 BTC had already been distributed to creditors by the Kraken and Bitstamp exchanges, with one more Seventy nine,600 BTC to prepare quickly.

Muted Promoting Tension Anticipated?

In keeping with a newest report by Glassnode, the overall recovered coin quantity amounts to over 141,686 BTC, with virtually 59,000 BTC already finding their plot to creditors and the final sum looking ahead to distribution.

Kraken and Bitstamp get been entrusted as one in all the 5 designated exchanges accountable for managing and disbursing these funds. Kraken has bought 49,000 BTC and Bitstamp the initial tranche of 10,000 BTC.

Severely, the firm notorious that the size of these distributions already surpasses newest indispensable transactions in the cryptocurrency condo, including crypto ETF inflows, issuance to miners, and the big selling stress skilled by the German authorities between June and July.

On the opposite hand, creditors opted to accumulate BTC barely than fiat currency, which changed into once a new possibility beneath the Eastern economic spoil law, suggesting that many of the creditors dwell keen in the Bitcoin condo, despite the in depth best assignment.

This keen participation could perhaps perhaps mask that easiest a subset of the distributed money will enter the marketplace for sale, per Glassnode’s prognosis, that can perhaps perhaps mask a long-time length holding approach amongst creditors. This in the spoil helps BTC’s mark barely than having an impact that can perhaps perhaps discontinue in extra mark declines for the very best cryptocurrency obtainable on the market.

Additionally, an prognosis of the living cumulative quantity delta (CVD) metric on Kraken and Bitstamp reveals easiest a marginal uptick in sell-aspect stress, suggesting creditors could perhaps perhaps very properly be more inclined to get onto their BTC for the long time length.

Lengthy-Term Bitcoin Holders Pile In

Additionally supporting Bitcoin’s mark over the past month, which has rebounded virtually 25% after hitting a 6-month low of $53,500 on July 5. Lengthy-time length holders of the very best cryptocurrency obtainable on the market get been on a attempting to search out spree, according to market knowledgeable Ali Martinez, who honest no longer too long ago revealed that these investors get added over 110,000 BTC to their portfolios.

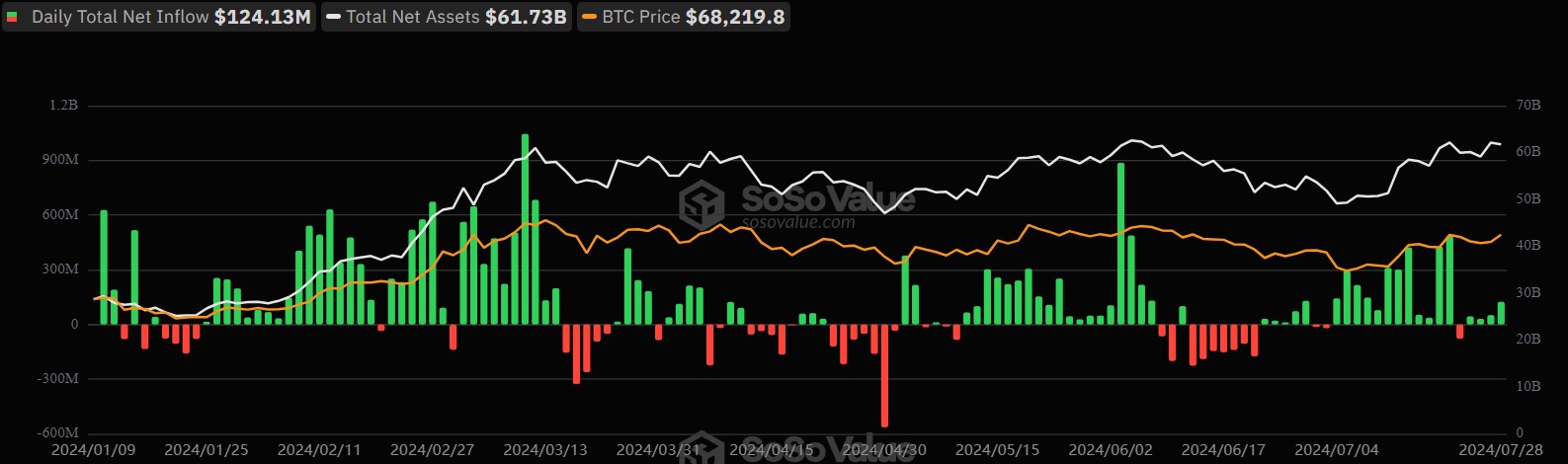

In an identical vogue, the Bitcoin ETF market has had its fragment of the newest recovery viewed in BTC’s mark over the past month, with the newest knowledge showing extra inflows into the regulated market in the US.

In keeping with SoSo Price knowledge, Bitcoin ETFs in the US noticed a total of $124 million in new inflows on Monday, though Grayscale’s GBTC ETF noticed outflows of about $54 million. BlackRock’s IBIT ETF had the most inflows for the day, with $206 million.

All this has contributed to BTC’s mark consolidation between $65,000 and $68,000 over the past few days, with an scrutinize on a doable retest of the all-time high of $73,500 reached in March this one year.

Currently, the very best cryptocurrency obtainable on the market is trading at $66,000, down 2.5% over the past 24 hours and 1.5% over the past week.

Featured image from DALL-E, chart from TradingView.com