Whereas it remains a topic of debate when the FED will initiating lowering passion charges, there are heaps of diversified opinions on this topic.

Whereas the FED’s statements signaled that March would be impossible for the first passion price decrease and all eyes are on Would possibly per chance presumably well also for the first price decrease, Goldman Sachs thinks otherwise.

At this level, Goldman Sachs economists acknowledged in a most modern file that they achieve an snarl to there will likely be four passion price cuts in the United States in 2024 and that they estimate that the first will approach in June.

Goldman Sachs economists no longer too long ago up to this level their forecasts for when the Fed will decrease passion charges.

Economists, who expected 5 passion price cuts in 2024 of their preliminary forecasts, acknowledged that they achieve an snarl to the first passion price decrease to be made in June.

Economists bear that even even though the most modern inflation data for January is increased than expected, this also can amassed no longer be regarded as too noteworthy. Economists acknowledged that they predicted that core inflation would fall to 2.5% by the Would possibly per chance presumably well also FOMC meeting and to 2.2% in June.

At this level, Goldman Sachs economists’ most modern predictions are “We foresee passion price cuts in June, July, September and December of 2024, and 4 more passion price cuts in 2025.” acknowledged.

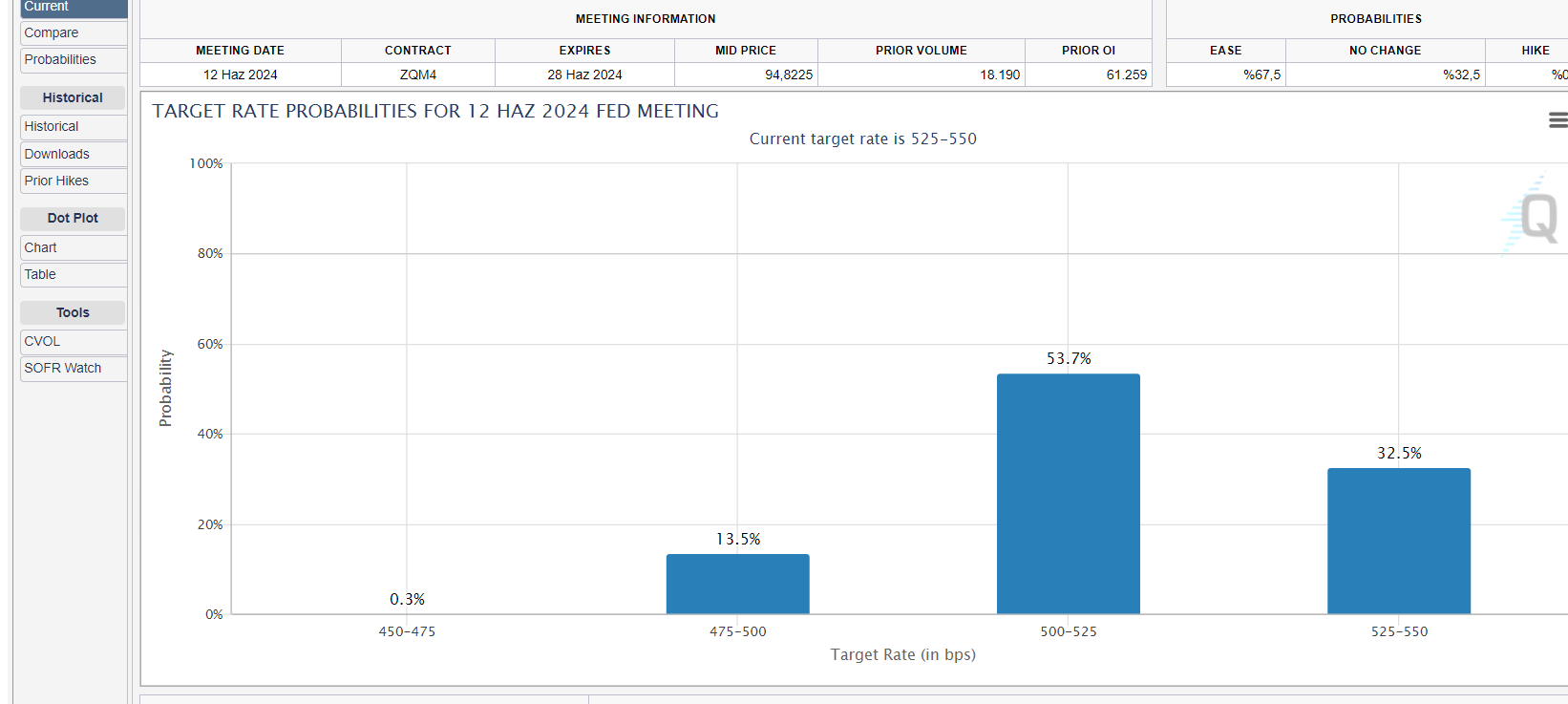

In line with CME Team’s FED Compile out about instrument, the likelihood of retaining passion charges constant in Would possibly per chance presumably well is also priced at 76%, whereas the likelihood of a 25 foundation level decrease is priced at 23%.

On the change hand, the likelihood of the FED retaining passion charges constant in June is priced at 32%, whereas the likelihood of a 25 foundation level decrease is priced at fifty three.7%.

As you would per chance presumably also take into accout, the FED saved its passion price option unchanged in January, constant with expectations, and saved passion charges constant in the fluctuate of 5.25-5.50 percent.

It is expected that there will likely be an enlarge in Bitcoin (BTC) and cryptocurrencies as the FED starts to diminish passion charges. Consequently of Bitcoin reached its top of $ 69,000 in November 2021, when the FED started increasing passion charges. Since the next endure market is straight connected to the FED’s passion price increases, it’s thought that BTC also can return to its historical days with a coverage exchange and passion price cuts.

At this level, consultants achieve an snarl to the BTC heed to expertise huge increases if passion price cuts approach straight after the Bitcoin Halving.

Experts acknowledged they predict that passion price cuts after April will push the BTC heed to a brand new high, as the halving is expected to push the Bitcoin heed above its all-time high of $69,000.

*That will not be any longer investment advice.