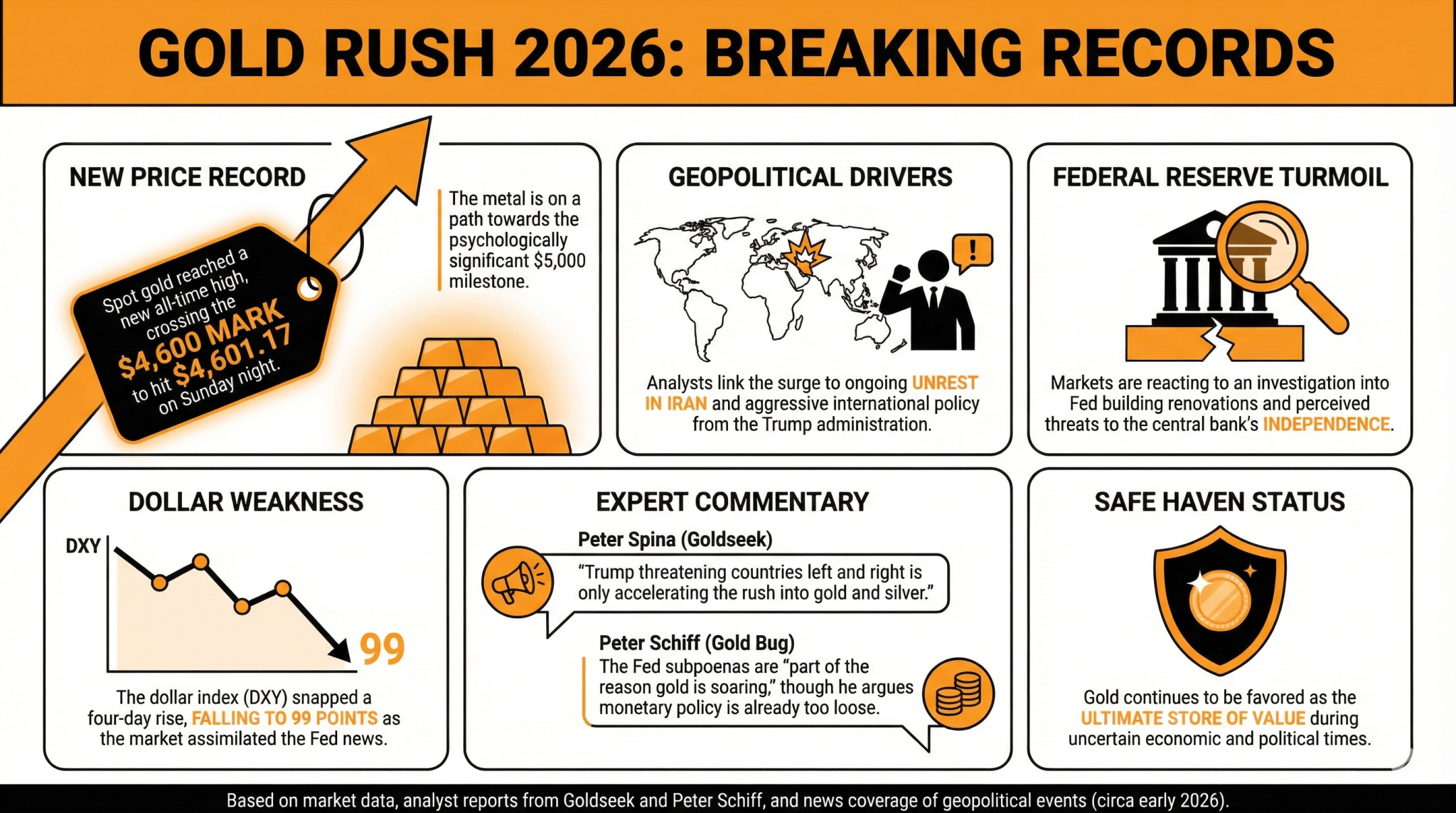

Analysts attributed these movements to developing geopolitical events in Venezuela and Iran, and to the DOJ probe into Fed Chair Jerome Powell, which changed into once interpreted as a blow to the establishment’s independence. Gold crossed the $4,600 mark, and the buck index fell to Ninety nine early Monday.

Markets Soar to Gold’s Safety as Fed Chair Jerome Powell Says Fed Independence Is at Stake

The dear steel rally has given no signs of stopping while geopolitical and economic factors attach propping up gold demand.

Gold, one among presumably the most favored commodities in 2025, reached but one other heed file, crossing the $4,600 mark on its course to $5,000. Field gold reached as excessive as $4,601.17 all over Sunday night hours, in a push that analysts accumulate linked to the unrest in Iran and the show of an ongoing investigation into the Federal Reserve’s ancient building renovations.

The buck index (DXY) furthermore fell after rising for four days, dropping to Ninety nine aspects because the market assimilated what Powell really appropriate a threat to the Federal Reserve’s independence from the Trump Administration.

Goldseek’s Peter Spina stated that this market transfer changed into once linked to Trump’s aggressive international coverage. “Trump threatening international locations left and interesting is highly most sensible accelerating the speed into gold and silver,” he wired. “Here’s furthermore including some gas to the fire… the Federal Reserve hit with subpoenas,” he added.

Gold bug Peter Schiff furthermore really appropriate this one among the causes for the gold heed’s acceleration all over unhurried Sunday hours. “Here’s share of the rationale gold is hovering to file highs this evening. Truly, Powell and Trump are atrocious: financial coverage is simply too loose, and pastime rates are too low,” he assessed.

Gold has been really appropriate one among the last shops of price in unsure cases, given its stable haven properties. The rally is in holding with what analysts had been predicting for the dear steel in 2026.

UBS these days raised its gold heed prediction, claiming that it will attain $5,000 in Q1. Within the equivalent manner, economist Jim Rickards believes that gold can upward thrust to $10,000 in 2026.

Read more: Federal Reserve Will get Probed by DOJ, Chair Powell Alleges Fed’s Independence Is at Stake

FAQ

-

What recent heed file did gold succeed in in 2025?

Gold surpassed $4,600, with role costs reaching a excessive of $4,601.17, as it strikes toward a purpose of $5,000. -

What geopolitical factors are influencing gold demand?

Analysts hyperlink the rally to unrest in Iran and an ongoing investigation into the Federal Reserve’s renovations, affecting market self perception. -

How has the buck index reacted to these traits?

The buck index (DXY) fell to Ninety nine aspects after a four-day upward thrust, reflecting market reactions to concerns about the Federal Reserve’s independence. -

What are analysts predicting for gold costs within the shut to future?

UBS predicts gold may perchance perhaps attain $5,000 in Q1, while economist Jim Rickards forecasts a upward thrust to $10,000 by 2026, reinforcing gold’s recognition as a stable haven.