The Funding Escape of 2025: Gold Shines Brightest

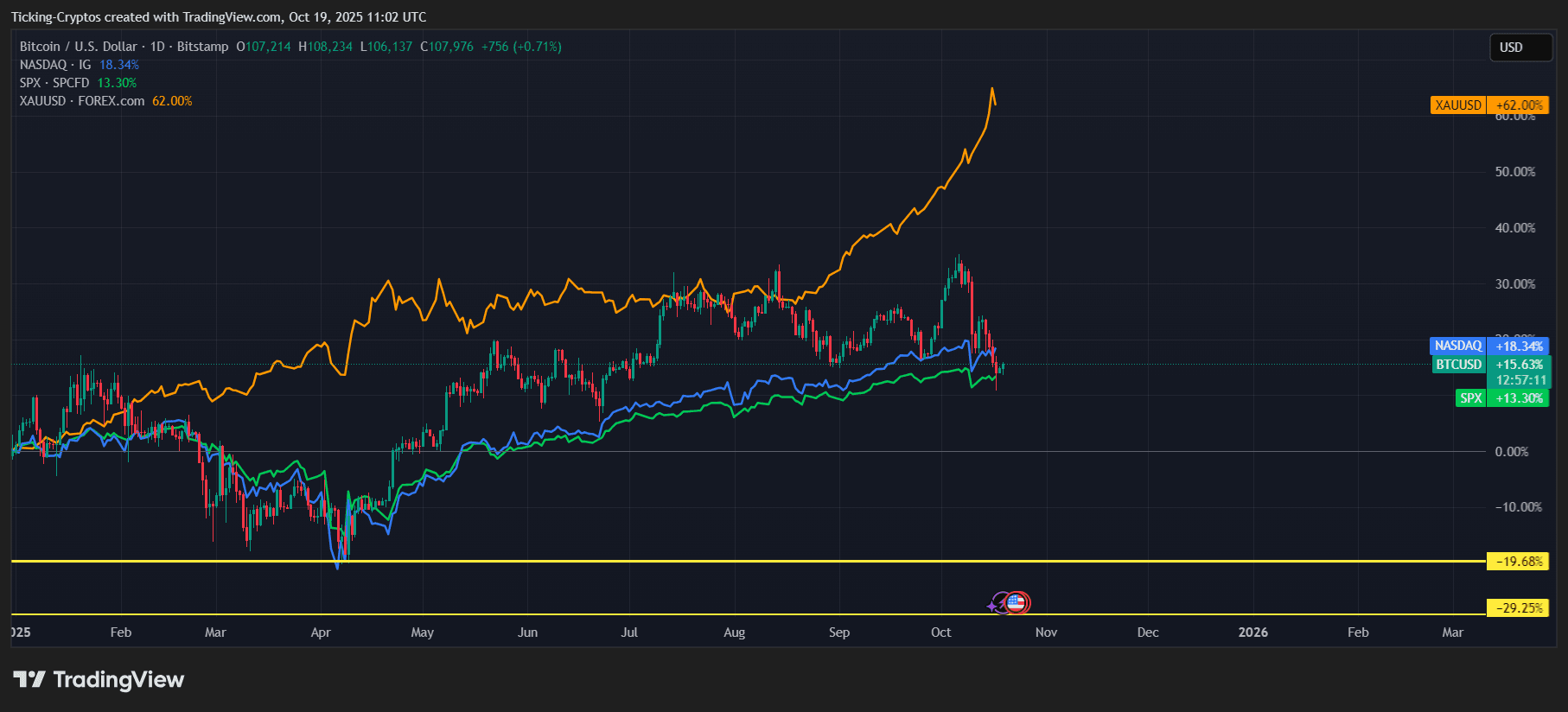

As we cease to the closing quarter of 2025, investors are taking a sight motivate on a volatile yet revealing one year for world markets. Essentially the most up-to-date comparative performance chart exhibits how assorted asset classes bear developed since January — and the consequences would possibly well well almost definitely surprise even seasoned traders.

In accordance with the data:

- Gold (XAU/USD) is up 62% since January.

- NASDAQ is up 18.34%.

- Bitcoin (BTC/USD) has obtained 15.58%.

- S&P 500 (SPX) follows carefully at 13.30%.

Whereas all four resources posted particular returns overall, the magnitude of the incompatibility unearths the deeper memoir — one about macro uncertainty, monetary coverage shifts, and the renewed significance of diversification.

Gold: The Comeback of the Final Trusty Haven

$Gold has been the one year’s standout performer, gaining over 60% and outperforming nearly every predominant index. The explanations are clear: with central banks throughout the globe decreasing curiosity charges, geopolitical tensions rising, and inflation tranquil lingering, investors bear was as soon as again to the metal that by no manner defaults.

The yellow line on the chart rises gradually, barely flinching even when assorted markets corrected. This consistency underscores gold’s dilapidated characteristic — a hedge towards systemic agonize and currency debasement.

Institutional investors, including central banks and sovereign funds, bear increased gold allocations seriously in 2025, with so much of Asian worldwide locations main purchases amid rising concerns over the U.S. buck’s lengthy-time interval steadiness.

Bitcoin: The Digital Hedge with Higher Volatility

$Bitcoin, no matter its reputation for volatility, tranquil managed a decent +15.58% one year-to-date performance. However, when when when put next with gold’s rally, it highlights a really well-known myth shift: crypto is maturing, but it stays tied to be concerned sentiment.

$BTC chart mirrors the NASDAQ carefully, reflecting how institutional adoption has built-in it into broader monetary systems. Bitcoin now moves extra in tandem with tech stocks than with dilapidated hedges enjoy gold.

However, every market dip in 2025 has viewed renewed accumulation, namely from company treasuries and lengthy-time interval holders. Bitcoin’s lengthy-time interval fundamentals — capped present, increasing shortage, and rising community usage — dwell intact. However its label tranquil reacts to liquidity flows, rate insurance policies, and investor agonize appetite.

NASDAQ and S&P: Ancient Markets Existing Resilience

No matter macro turbulence, U.S. equities bear maintained an everyday climb this one year. The NASDAQ’s 18% produce displays robust performance from AI, semiconductor, and draw sectors, while the S&P’s 13% prolong indicates broader economic resilience.

These positive aspects, alternatively, came with valuable volatility — namely proper thru midyear substitute tensions and fluctuating inflation data. Merchants who stayed assorted throughout equities and commodities were able to offset those swings and capture fixed returns.

The Case for Diversification in 2025

Essentially the most well-known takeaway from this chart is straightforward but extremely efficient: no single asset dominates every ambiance.

- Gold flourishes when dread rises.

- Bitcoin outperforms when liquidity expands and innovation narratives grow.

- Equities lead proper thru economic optimism and coverage easing.

By combining these resources, investors can minimize overall agonize while declaring upside publicity. A balanced allocation — to illustrate, 40% equities, 30% gold, 20% Bitcoin, and 10% cash or bonds — has historically outperformed single-asset portfolios proper thru volatile cycles.

Easiest Funding Technique: Balancing Chance and Reward

Heading into 2026, investors face every different and uncertainty. Charge insurance policies, political elections, and continued geopolitical instability will proceed shaping asset performance.

Gold would possibly well well also fair set leadership if inflation persists, while Bitcoin would possibly well well almost definitely leer renewed strength if world liquidity improves. Meanwhile, equities would possibly well well almost definitely scheme cease pleasure in easing credit score prerequisites and recovering company earnings.

The lesson is clear: in an unpredictable world, diversification isn’t appropriate strategy — it’s survival.