Cryptocurrency shopping and selling demonstrates clear regional and seasonal patterns influenced by regulatory environments, user preferences, and market dynamics, in response to an prognosis by Coin Metrics and its analyst Victor Ramirez.

Coin Metrics Characterize Examines World Cryptocurrency Procuring and selling Tendencies

The “Kimchi Top class” phenomenon, reflecting a disparity between cryptocurrency costs in South Korean markets and global weighted averages, is pushed by capital controls and localized query, Ramirez defined. Regulatory boundaries in South Korea limit arbitrage alternatives for worldwide investors. These restrictions purpose label volatility, exemplified by bitcoin (BTC) reaching nearly $115,000 for the length of political unrest in South Korea—a 20% top price when when put next with global costs.

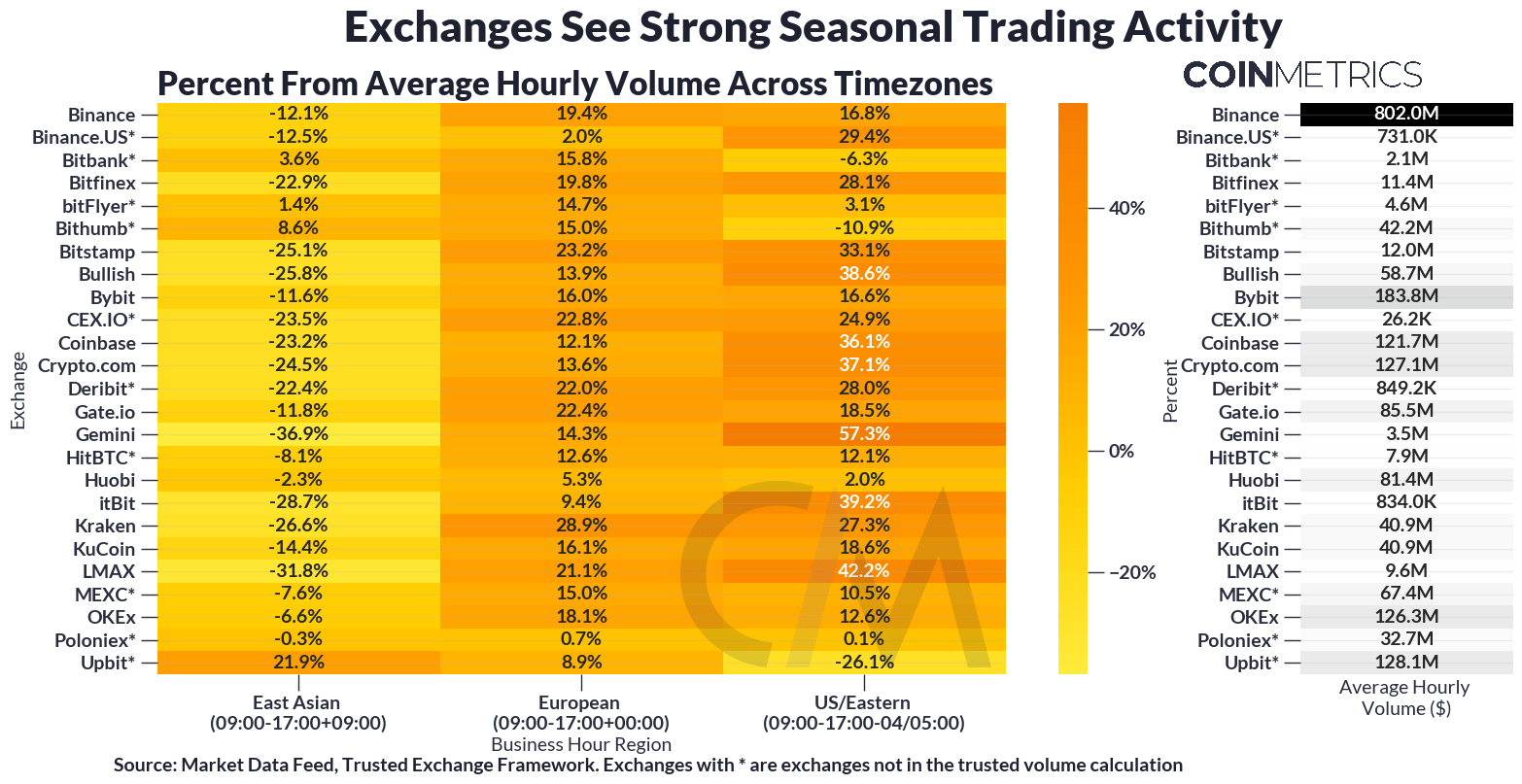

Coin Metrics’ findings expose that shopping and selling assert aligns with seasonal and regional patterns. Exchanges like Bithumb and Upbit expose high assert for the length of East Asian hours, while American platforms similar to Coinbase and Gemini resolve on U.S. time zones. Binance demonstrated a broader reach, showing increased assert in European hours.

“Binance sees –12.1% much less shopping and selling volume relative to its common volume of $802M for the length of East Asian hours, however 19.4% increased shopping and selling volume for the length of European hours,” the yarn minute print.

Additionally, obvious property expose regional preferences. Shall we say, xrp (XRP), stellar (XLM), and cardano (ADA) are more actively traded for the length of East Asian hours, whereas bitcoin (BTC) and ethereum (ETH) perceive greater assert for the length of European and U.S. time zones.

Coin Metrics’ onchain data highlights the worldwide nature of cryptocurrency utilize. Bitcoin and ethereum switch values align with their shopping and selling patterns, while stablecoins like tether (USDT) camouflage divergence; USDT sees significant onchain assert for the length of European hours. These patterns emphasize stablecoins‘ role in providing financial steadiness in regions like Latin The US.

Ramirez’s yarn also highlights the resurgence of 2017 and 2021-technology tokens like XRP, which saw a 278% label amplify alongside a upward thrust in onchain assert. This revival underscores regional and regulatory influences on asset efficiency.

Coin Metrics’ prognosis emphasizes the advanced interplay of regional regulations, user preferences, and market traits shaping global cryptocurrency assert. Understanding these dynamics is well-known as digital property proceed integrating into global financial programs, Ramirez concluded.