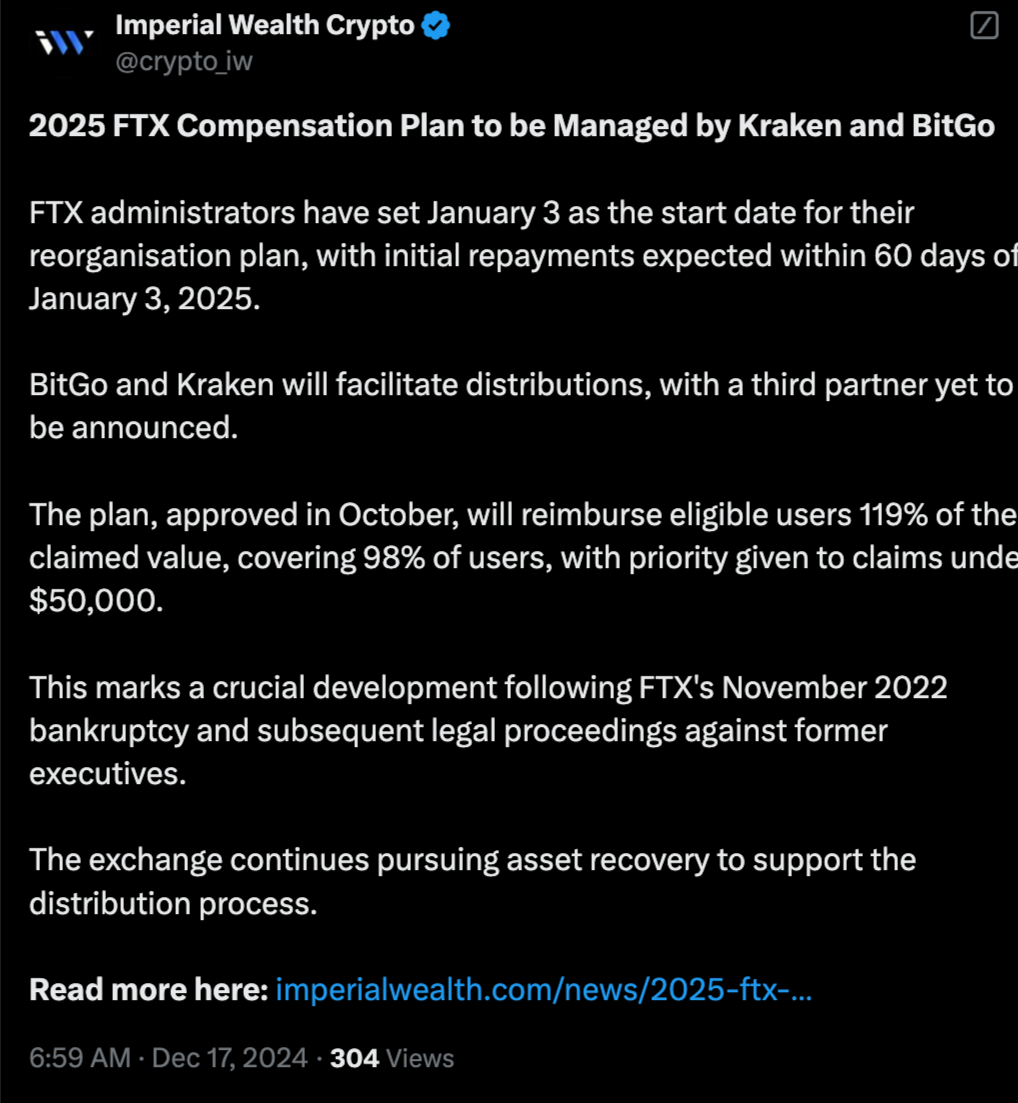

FTX is impending the best stages of its economic ruin direction of with an announcement of a new timeline for a necessary $16 billion repayment thought for its collectors. Position to start on January 3, 2025, this circulation marks a major milestone in resolving one of essentially the most dramatic collapses within the cryptocurrency enterprise.

The repayment technique comes after the Delaware economic ruin court docket’s endorsement of FTX’s Chapter 11 reorganization thought in October, a necessary step aimed at rectifying the financial turmoil following its public implosion in November 2022. Below the authorized thought, the estate will start the price direction of, starting with the preliminary distribution file date for holders categorized within the thought’s Convenience Lessons.

Partnership with Crypto Exchanges

To facilitate the efficient distribution of funds, FTX has engaged with renowned crypto exchanges, Kraken and BitGo. These platforms are tasked with overseeing the intricate direction of of fund distribution, making sure that eligible possibilities bag their dues seamlessly. This collaboration underscores the logistical challenges enthusiastic on disbursing enormous financial settlements all the scheme through a world creditor unsightly.

The direction of to qualify for repayment entails several serious steps. Collectors must first total a needed know-your-buyer (KYC) verification direction of on the FTX Claims platform. Furthermore, they are required to publish the needed tax kinds to ascertain their eligibility. Following these preliminary steps, customers must onboard onto both BitGo or Kraken forward of the January 3 efficient date.

As soon as these requirements are fulfilled, FTX plans to start the distribution within 60 days following the efficient date of the court docket-authorized reorganization thought. First and valuable, the principle target would possibly maybe be on collectors with claims below $50,000, which constitutes roughly 90% of all eligible collectors. This focused scheme goals to expedite reduction to a large majority of affected events efficiently.

Initial Rate Projections

While preliminary speculations instantaneous that collectors with smaller claims would possibly maybe per chance well also bag their reimbursements as early as the fourth quarter of 2024, the updated agenda now confirms that these payments would possibly maybe be processed within the first quarter of 2025. FTX has introduced that this would possibly maybe well also start separate recordsdata and price dates for other creditor classes at future dates, indicating a phased scheme to the repayment direction of.

The announcement of FTX’s repayment thought has elicited blended reactions from the cryptocurrency crew. Some patrons are inquisitive relating to the aptitude market impression attributable to FTX per chance having to liquidate a necessary half of its crypto holdings to take the needed funds. This action would possibly maybe per chance well also result in a non permanent dip in crypto costs attributable to the unexpected influx of resources within the marketplace.

Conversely, others are optimistic, suggesting that the redistribution of funds would possibly maybe per chance well if truth be told maintain a revitalizing originate within the marketplace. They argue that reimbursing collectors in stablecoins equivalent to USDT would possibly maybe per chance well also support reinvestment into the crypto market, per chance driving up ask and costs for diversified digital resources.

Attempting Forward

As FTX moves forward with its repayment thought, the broader implications for the cryptocurrency market remain a subject subject of worthy interest and speculation. The efficient management of this repayment direction of is now not going to most efficient resolve the instantaneous financial restoration for thousands of collectors however also map a precedent for how equal future crises would be dealt with within the crypto enterprise.

The crypto market, on the second experiencing a little uptick with a 0.96% magnify within the worldwide crypto market cap to $3.74 trillion, displays the resilience and unstable nature of this financial sector. With Bitcoin making up 56.6% of this valuation, the actions of primary avid gamers admire FTX continue to maintain a profound impression on the total market dynamics.

The FTX economic ruin saga highlights the challenges and attainable pathways to restoration following necessary disruptions within the cryptocurrency market. Because the January 3, 2025, efficient date approaches, all eyes would possibly maybe be on FTX and its companions to ship on their promises of restitution. This event will seemingly attend as a major case survey for regulatory frameworks and operational most efficient practices within the an increasing selection of scrutinized crypto enterprise.