FTW, the native token of a brand fresh memecoin mission Black Agnus, has emerged because the market’s high performer following its legit listing on CoinGecko.

At press time, Black Agnus (FTW) had skyrocketed by 112%, exchanging palms at $0.000034. In the same time body, the token’s day to day procuring and selling volume jumped 43.30% and used to be hovering around $7,883,560.

FTW’s most contemporary tag rally follows its most contemporary listing on the brand new crypto data aggregators CoinGecko and Coinmarketcap, which is taken into legend a obvious pattern for memecoin tasks esteem this which survey to reach exposure to the crypto community.

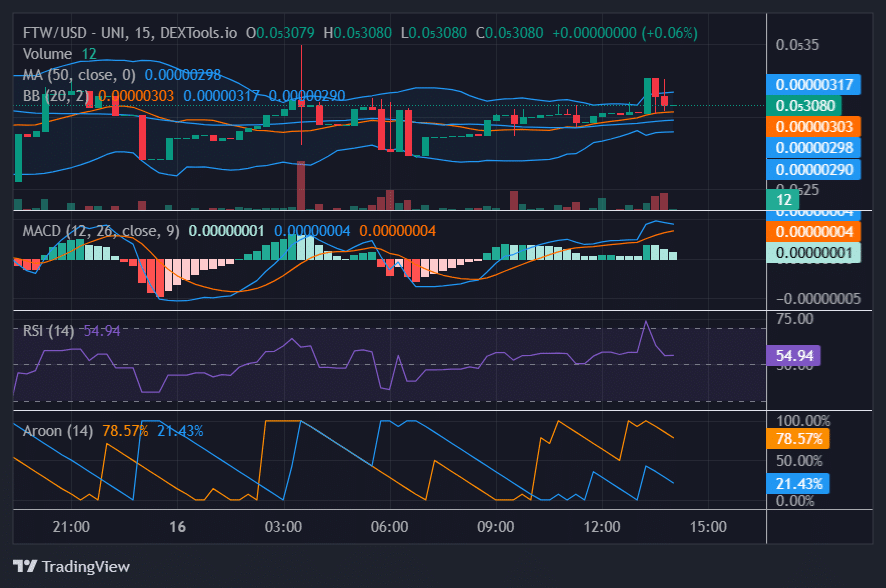

Technical indicators on the 15-min FTW/USDT chart recommend that the bulls are at the moment up to the mark, with FTW procuring and selling advance the upper limit of its Bollinger Bands, exhibiting sustained procuring hobby that would possibly presumably push the worth better.

The Interesting Practical Convergence Divergence supports this outlook, with the MACD line crossing above the brand line, pointing to continued upward momentum. Meanwhile, the Relative Strength Index is at 54.94, pretty above the just threshold of 50, indicating that there must be room for the rally to proceed.

Additionally, the Aroon indicator functions to a largely bullish style for the FTW/USD pair, with the Aroon Up at 78.57%, reflecting sturdy upward momentum. In distinction, the Aroon Down is lower at 21.43%, suggesting minimal downward motion. This divergence in general functions to bullish control in the instant duration of time.

Supporting this obvious outlook, FTW used to be positioned above both the 50-duration and 200-duration easy tantalizing averages, at $0.00000296 and $0.00000304, respectively on the time of writing. This setup forms a “golden substandard,” a pattern merchants on the total glance as a brand of doable continued tag enhance.

The upward style for FTW is extra confirmed by an ascending trendline around the $0.00000282 brand, which has been consistently tested and stays intact. As long as this trendline holds, the market is anticipated to set its bullish stance.