Right here’s a segment from The Breakdown newsletter. To learn more editions, subscribe

“A hit. That’s my thought of fun.”

― Larry Ellison

Larry Ellison received’t ever be featured in a habits-of-billionaires listicle.

In the 2000s, whereas running surely one of a truly worthy corporations in the sector, he veritably strolled into the discipline of enterprise at 1:30 in the afternoon.

When he did come, he wasn’t repeatedly totally engaged. “He had a reputation for being without concerns bored by the intention of running a trade,” per his biographer.

He used to be veritably absent for long stretches, “leaving the shop to senior colleagues.”

On earnings calls, Wall Avenue analysts asked how remarkable time he’d exhaust on boats in the approaching quarter.

Briefly, he used to be the antithesis of the young tech founders profiled in The Wall Avenue Journal this morning — so dedicated to work they barely rob time to eat, let alone pursue an outside curiosity or inch on a date.

Ellison, by incompatibility, devoted years to competitive crusing, realized to pilot airplanes, supplied an island, designed Eastern-impressed properties, on a typical basis played tennis with Rafa Nadal and did enough dating to be married 5 times.

All whereas running surely one of the sector’s most important corporations.

When his first marriage resulted in divorce in 1978, Ellison’s ex-spouse idea so tiny of his prospects as a founder that she sold him her declare to the one-One year-used Oracle for $500.

(In three subsequent divorces, he any other time by some means managed to steer clear of surrendering any piece of Oracle.)

And but, Ellison handed Elon Musk to vary into the sector’s richest man this week — for the 2nd time.

The first time used to be in 2000, when he briefly handed Invoice Gates come the height of the dotcom bubble.

By then, Oracle’s ubiquitous databases had made the corporate surely one of the three major characters in the dotcom inform, alongside Cisco and Solar Microsystems.

Few tech merchants survived the subsequent bust: Solar Microsystems used to be sold for ingredients in 2009 (to Oracle), and Cisco is an afterthought in tech investing; its shares silent under their 2000 peak.

Nonetheless Oracle’s shares are if fact be told eight times above their 2000 peak. Larry Ellison is any other time vying for the title of world’s richest man, and the corporate he primarily based in 1977 is now, unexpectedly, more relevant than ever — all thanks to Oracle’s leer-popping $300 billion deal to present computing energy to OpenAI.

Many are skeptical.

OpenAI stays a long means from profitability, so it’s unclear where this $300 billion is supposed to come wait on from — merchants presumably received’t foot the invoice eternally.

Ellison gave wait on a couple of of his immense paper features as Oracle shares fell amid concerns over the plentiful investments required to present the records companies and products and buy the GPUs required to present $300 billion of computing energy.

If quiz for man made intelligence falls looking expectations, or this day’s files companies and products and GPUs change into ragged sooner than expected, Oracle risks becoming to the AI bubble what Cisco used to be to the dotcom one.

Nonetheless I’m optimistic Ellison — who says he’s handiest cheerful when each person thinks he’s scandalous — will welcome the doubters.

He proved doubters scandalous about relational databases in the Eighties, venture gadget in the Nineties and cloud computing in the 2010s.

Now, by going all in on files companies and products, Oracle has reinvented itself as soon as any other time — and change genuine into a first-rate personality in the unfolding drama of man made intelligence.

If Ellison’s genuine, merchants will any other time be winners — no longer genuine in Oracle, but in practically all the pieces.

Let’s test the charts.

Doubling down:

The US hyperscalers, Oracle included, get doubled capex in barely two years. If tech is going to continue to manual markets, they’ll get to cover that earnings will develop sooner than their files companies and products depreciate.

Sustainable?

Company profitability has decoupled from its usual tight relationship with GDP progress, but profit margins may per chance per chance also be inflated by hyperscalers depreciating their capex over too many years. How long will your total Nvidia chips Oracle is purchasing be significant to them?

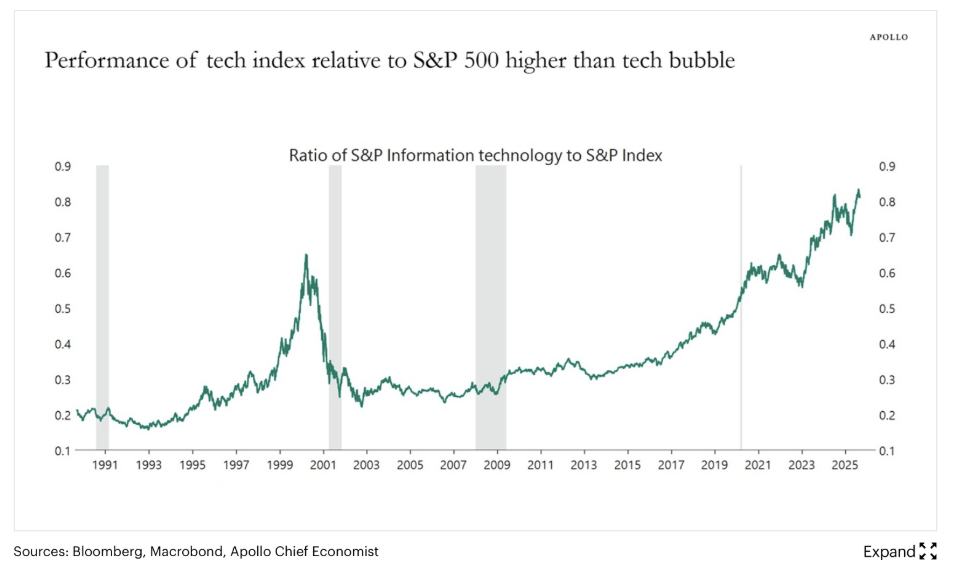

Hyper-outperformance:

The outperformance of US tech is now successfully in remarkable more than the dotcom peak. If it appears to be a bubble any other time this time, this may per chance occasionally seemingly be on account of corporations esteem Oracle built too many files companies and products.

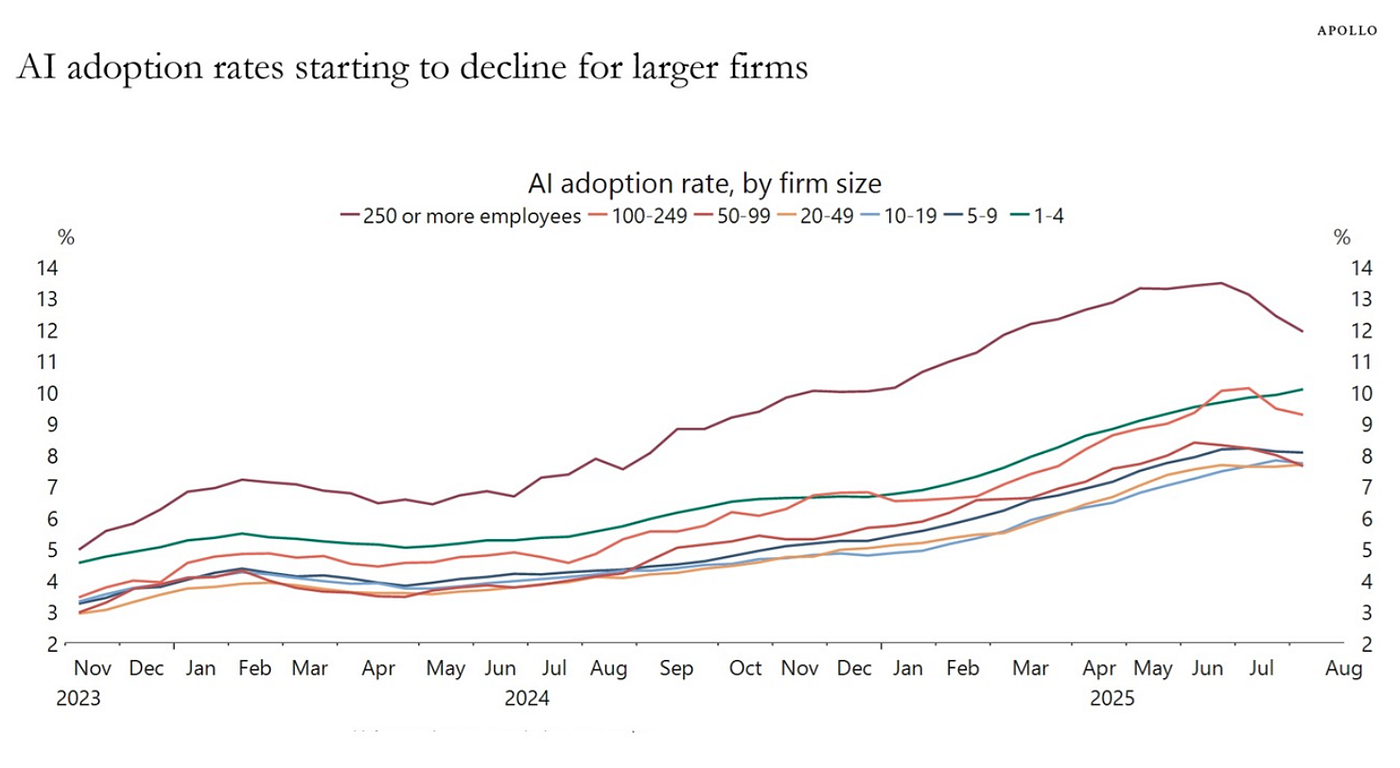

Warning signal?

Company utilize of AI will most in all probability be leveling off. If that is the case, OpenAI may per chance per chance fight to come wait on up with the $300 billion it’s promised Oracle and Oracle may per chance per chance fight to abet its files companies and products busy.

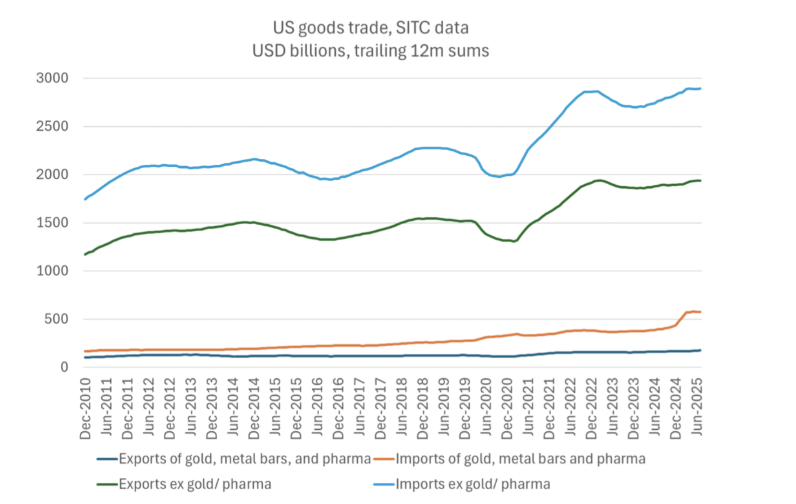

AI is saving global trade:

Brad Setser notes that no topic tariffs, US imports will expand this One year, with rising imports of tariff-exempt semiconductors offsetting a plunge in automobile imports.

Anyone’s paying the import tax:

The US tranquil a account $31.4 billion in tariffs in August — but total income silent fell $345 billion looking spending. The US is on the genuine song to mosey a budget deficit of over $2 trillion this One year.

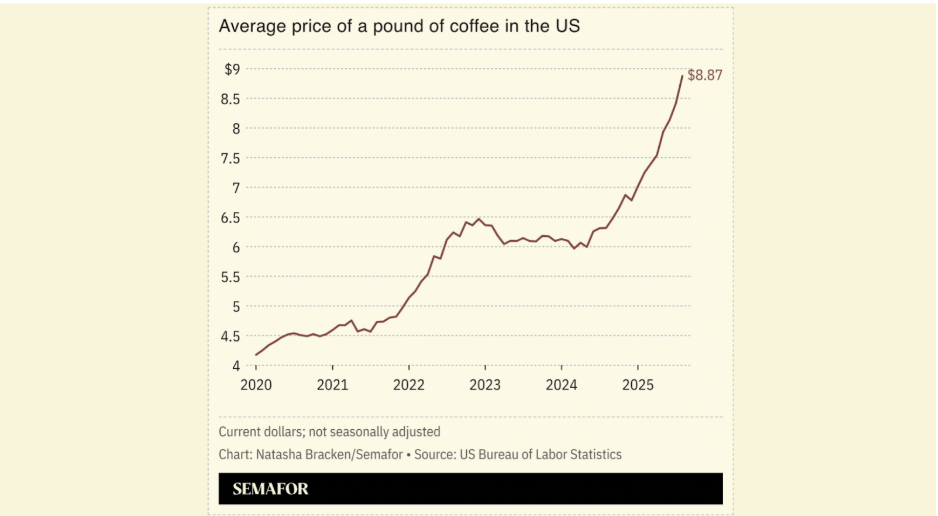

The coffee tax:

BLS files reveals coffee prices up greater than 20% on the One year, thanks in piece to the 50% tariff on items from Brazil. So, how long does it rob to develop a coffee tree (plant? bush?), and reach they develop in North Carolina?

It’s under no circumstances too tedious to build a couple of billion: